Litecoin, ETC, Neo Price Analysis: 07 January

With Bitcoin crossing the $37,000-mark a few hours before press time, many of the market’s altcoins recorded substantial spikes in their trading price. This was the case for popular alts like Litecoin, Ethereum Classic, and NEO, with hikes of up to 20% observed on the price charts.

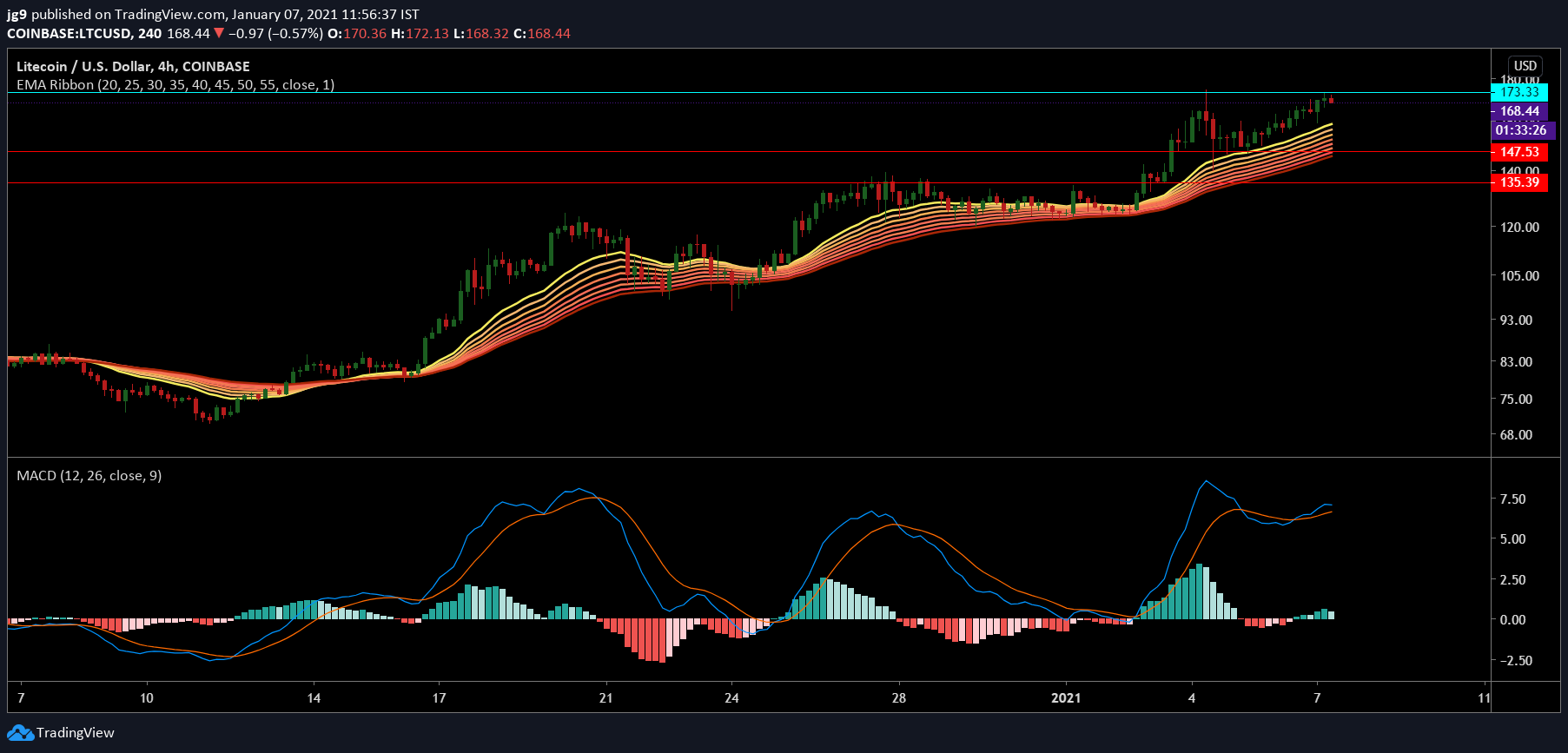

Litecoin [LTC]

Source: LTC/USD, TradingView

Litecoin’s price rose by close to 5 percent in 24 hours, with the crypto trading at $169.9, at press time, after having registered a market cap of around $11.3 billion. While there has been significant bullish momentum behind the coin’s price, the cryptocurrency was coming in contact with strong resistance around the $173-price range. However, if the bulls were to fail, then LTC’s price may need to rely on nearby supports at $147 and $135.

The EMA ribbons seemed likely to help the coin’s price since they had settled below its press time trading price and were likely to offer support. The MACD indicator also looked promising after having undergone a bullish crossover.

Ethereum Classic [ETC]

Source: ETC/USD, TradingView

Ethereum Classic has also been able to see its price appreciate by over 6 percent in 24 hours. The coin, at press time, was trading at $7.64 with a market cap of $893 million. The uptrend on the cryptocurrency’s chart came in contact with the resistance level at $7.7 and seemed to be on the verge of breaching it. However, there were also strong supports at $6.8 and $6.3, if a trend reversal were to take place.

The MACD indicator saw the Signal line go past the MACD line, forming a bullish crossover, while the RSI indicator remained well inside the overbought zone – a common sign of bullish momentum for the price.

NEO

Source: NEO/USD, TradingView

NEO registered a significant price hike on the charts, but it soon came in contact with a strong resistance level. At press time, NEO had a trading price of $20.1 and it was trying to breach its immediate resistance level again. However, if NEO is unable to propel itself above this level of resistance and endures a minor price correction, then, the support level at $18 may be extremely crucial in stabilizing the coin’s price.

The Bollinger Bands continued to remain quite wide, signaling the presence of substantial amounts of volatility in the price. Further, the RSI indicator was heading into the overbought zone, strengthening the chances of the price continuing to move north.