Litecoin falls below $90 and short sellers can smell opportunity here

- Litecoin’s fall beneath $90 could embolden the bears.

- The market structure on 4-hour as well as the daily timeframes favored the sellers.

Litecoin fell beneath a range it traded within since early February. In doing so it shifted the bias strongly in favor of the bears. The strong drop highlighted immense selling pressure a few days ago, and the volume was also enormous.

Read Litecoin’s [LTC] Price Prediction 2023-24

This happened at the same time when Bitcoin fell from $23.5k to $22k on Friday, 3 March. While BTC had some bullish hope, Litecoin showed further losses can be expected.

Partial fill of the fair value gap could offer short sellers a decent entry

Litecoin dropped dramatically from $95.4 to $88.8 within the space of a single 4-hour candle. The session closed below the range lows at $90.5 but was still within the bullish order block in that zone, highlighted in cyan.

This drop highlighted two things. One was that the bias was strongly in favor of the bears, which was reinforced upon an H4 close below the bullish order block.

Another was that a large imbalance was left on the charts. Not all imbalances might fill fully, but a 50% fill was a possibility. If this scenario played out for LTC, it would see the coin rise to the $92.8 resistance level before facing a rejection.

The RSI has been below neutral 50 since 2 March, to indicate a bearish trend in progress. Meanwhile, the OBV was at a support level from February and indicated selling pressure was dominant in March.

Realistic or not, here’s LTC’s market cap in BTC’s terms

Things were a bit tricky because even a partial fill of the FVG would break the structure and flip it to bullish.

Hence, buyers must exercise caution until a break above $95. Short sellers can attempt to enter the market upon a retest of the $89-$90 area, with a tight stop-loss above the recent lower highs at $91.9, and take-profit at the $85 support.

The falling prices saw a rise in Open Interest as bears assert themselves

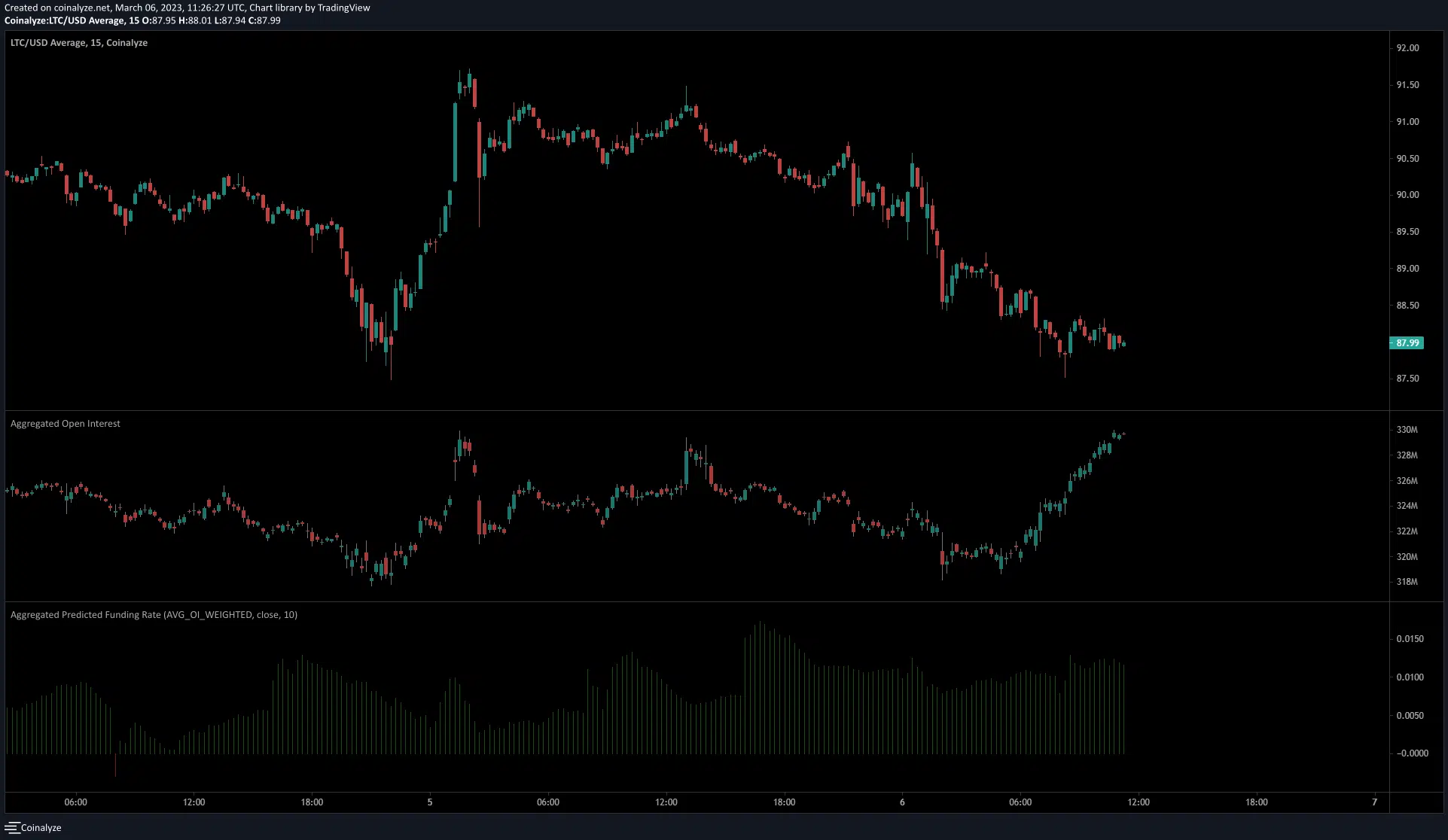

Source: Coinalyze

On the 15-minute chart, we can see falling prices over the past 24 hours.

The OI, which had been flat for a while, perked up and went on a strong uptrend in recent hours.

This indicated that short sellers were likely entering the market, and outlined strong bearish sentiment behind Litecoin. However, the predicted funding rate remained positive.

The findings from the futures market suggested a sharp move downward could occur in the coming hours.