Litecoin falls beneath a bullish order block, could $40 be next target

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the opinion of the writer.

Just a week ago, Litecoin [LTC] rallied to the $61 level but faced rejection there. This was a bearish development, especially for long-term investors. The market structure continued to remain bearish, and the psychological $50 level has been defended in the past few days. However, selling pressure began to climb once more.

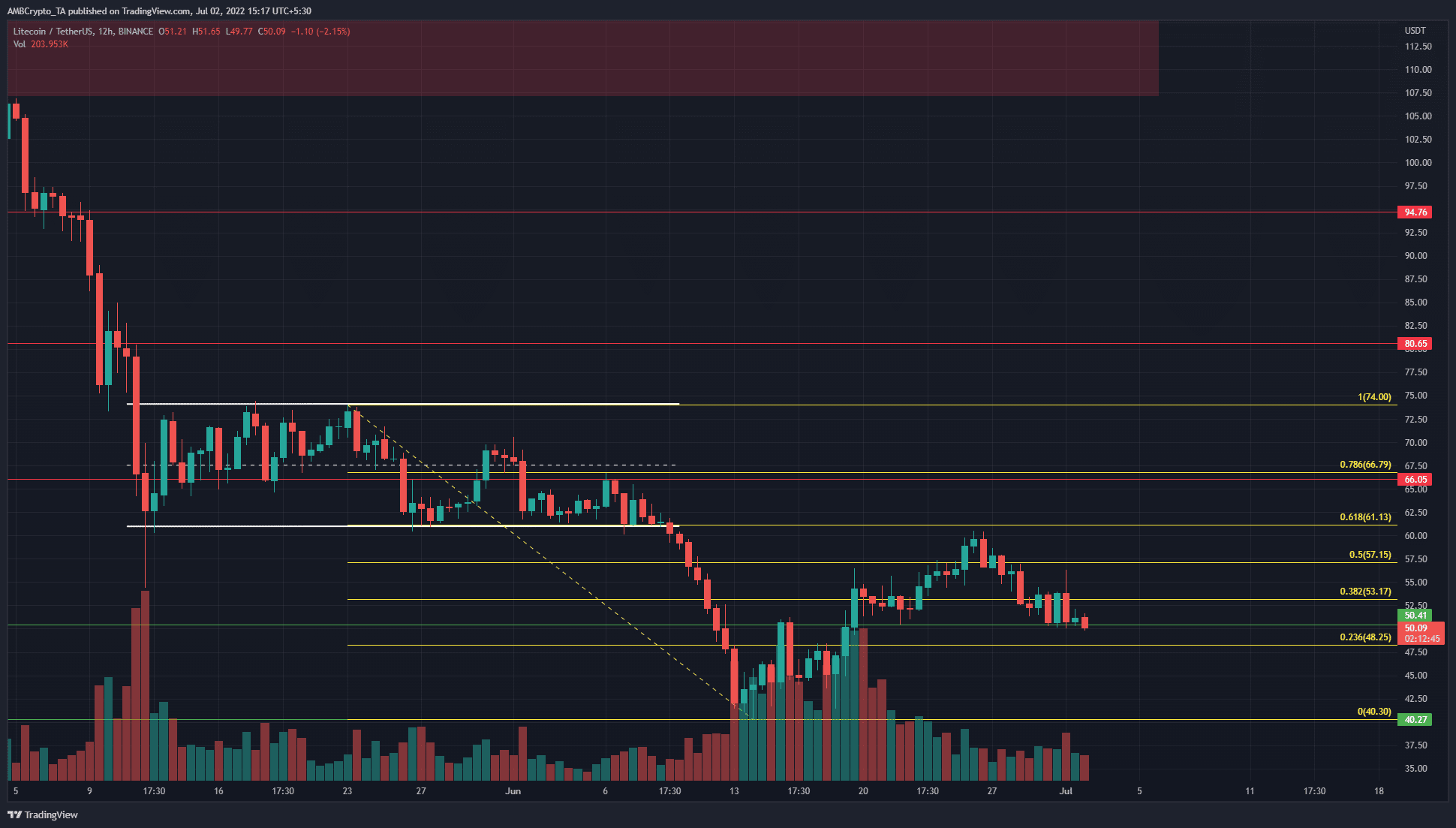

LTC- 12-Hour Chart

In May, LTC formed a range from $61 to $74 (white). One week into June, the lows of this range failed to hold. The wave of intense selling saw Litecoin drop as far south as $40.2. In the following weeks, the price saw a rally back to the $61 area.

The Fibonacci retracement levels (yellow) plotted showed the $61 mark to be the 61.8% retracement level of the move from $74 to $40.3.

Moreover, the $61 area was also the low of the range formed in May. The confluence of these two resistances was strong, and LTC faced rejection from the $61 zone.

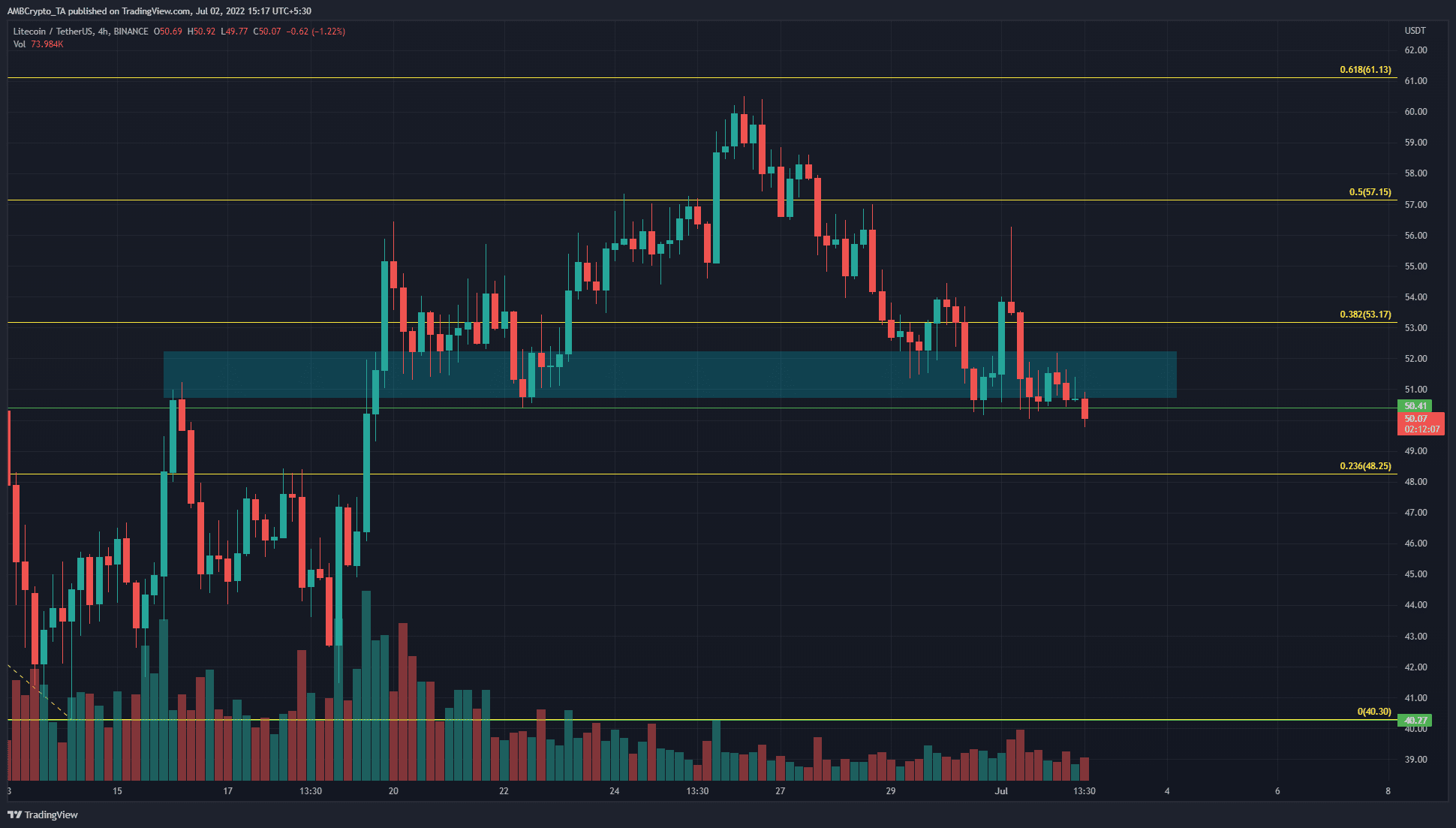

LTC- 4-Hour Chart

The rejection from the $61 area was expected to find some support in the $51-$52 area (cyan box). This was a zone of demand, and it also had a bullish order block on the four-hour chart. Moreover, this zone was just above the longer-term horizontal support level at $50.4.

Therefore, we have confluence once more between the bullish order block and a horizontal support level. Yet, the price bounce was only a weak one from this zone.

On two occasions in the past few days, a bounce was witnessed. Each of the bounces was unable to close a trading session above $54. At the time of writing, the price appeared to slip below both the $50.4 support level as well as the demand zone above it.

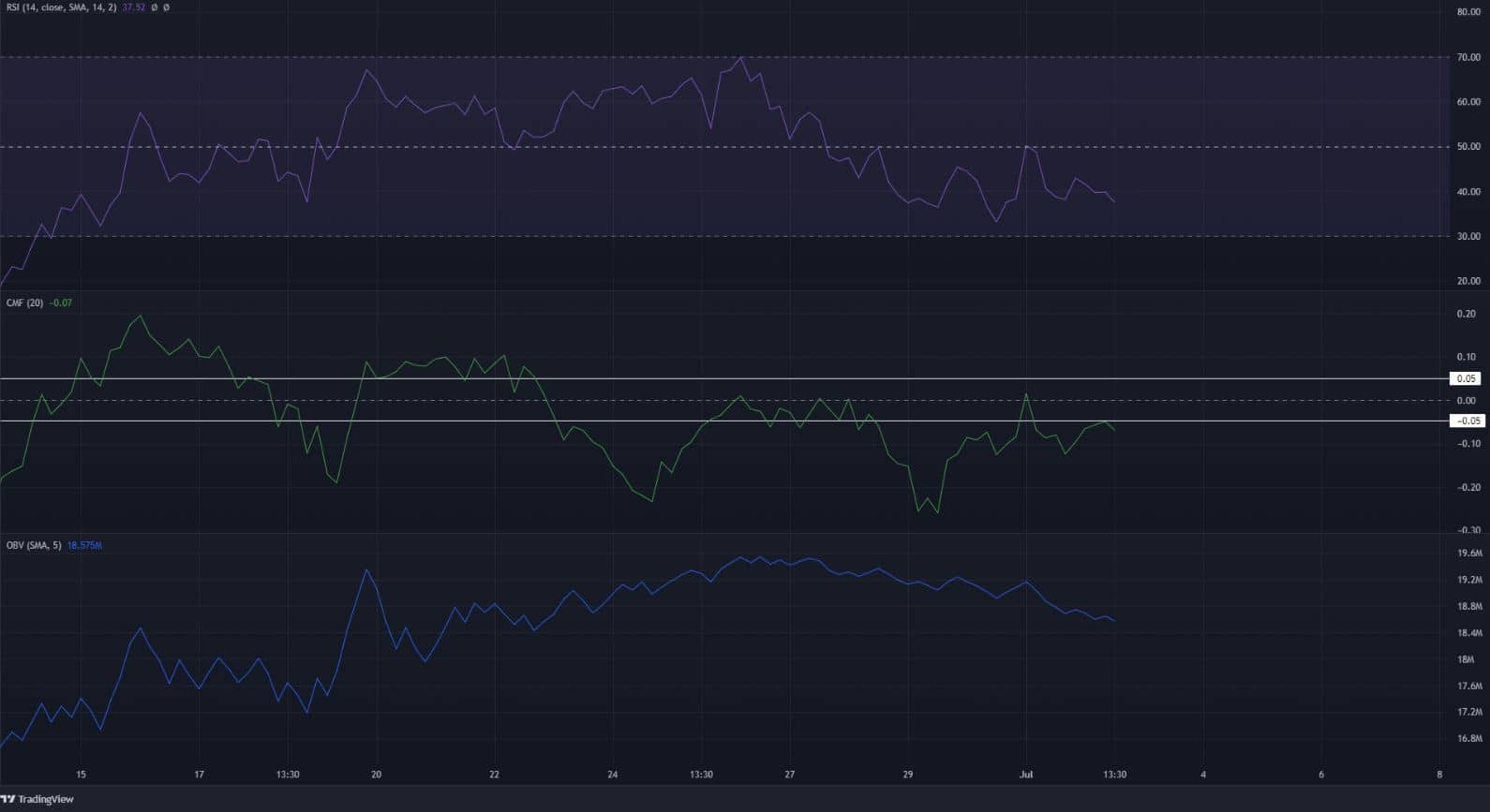

The four-hour Relative Strength Index (RSI) slipped below the neutral 50 line a few days ago and retested the same as resistance. This suggested that the momentum had swayed in favor of the bears. The Chaikin Money Flow (CMF) also agreed and showed that the past few days have seen significant capital flow out of the market.

On the other hand, the On Balance Volume (OBV) did not show heavy selling pressure. In fact, over the past week, it has been able to climb higher on the charts and saw only a minor dip over the past three days.

Conclusion

The price action of LTC in recent trading sessions showed that the $50-$52 area was a crucial area of support. If there was a session close beneath the psychologically important $50 level, it could see Litecoin begin to tumble much lower down the charts.

Therefore, aggressive sellers can look to enter short positions on a session close beneath $50, with a stop-loss just above $52. The Fibonacci retracement level at $48 could offer some weak support, but below it, the $40 area beckoned.