Litecoin investors on a buying spree as halving nears

- Apart from mid-tier holders, retail investors also showed interest in snapping up LTC.

- Litecoin’s social dominance shot up dramatically over the last few days.

Investors started to pack their bags with tons of Litecoin [LTC] as the altcoin braced for its most important event of 2023.

Is your portfolio green? Check out the Litecoin Profit Calculator

Bulls on the way?

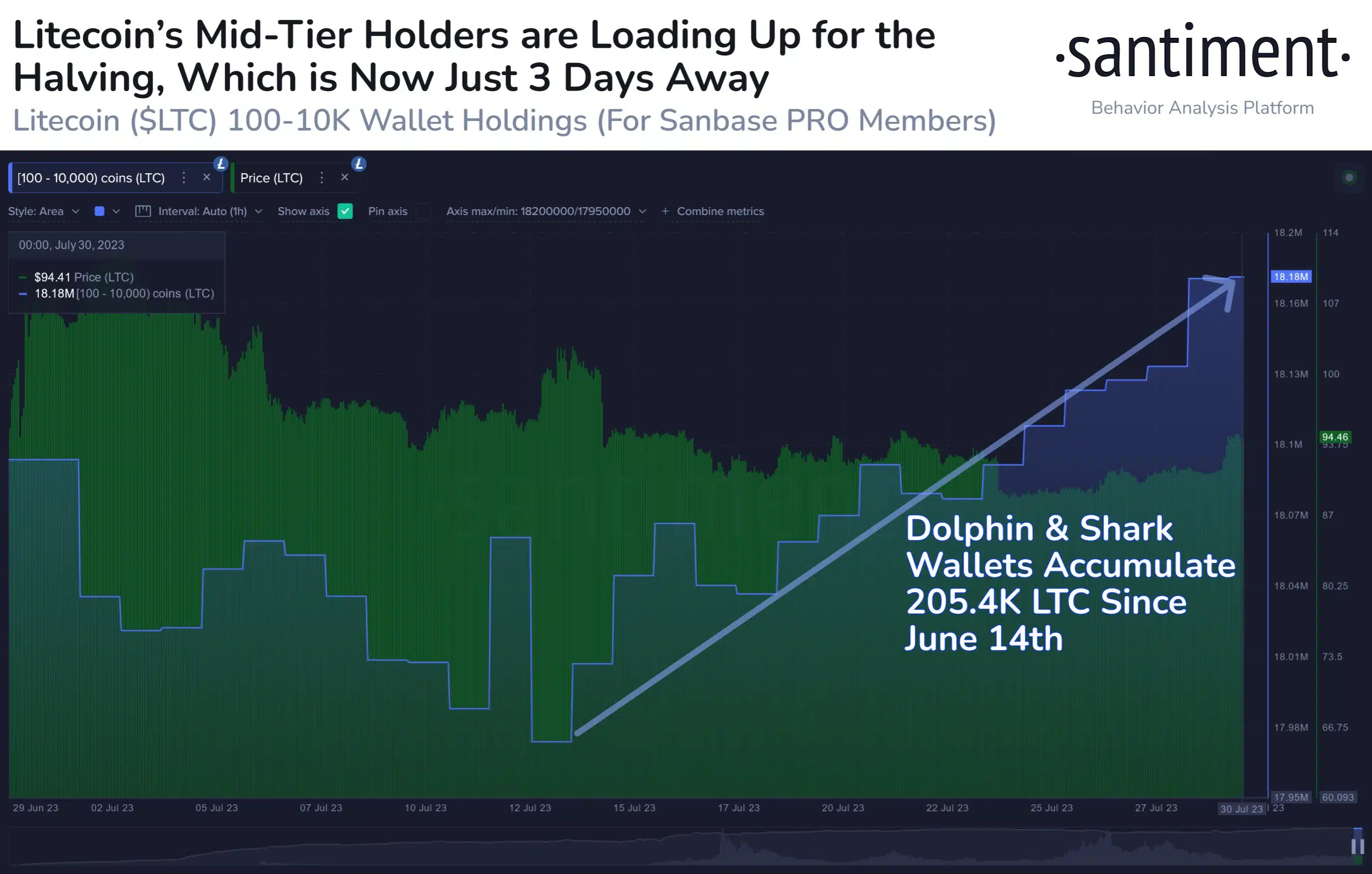

In a tweet dated 30 July, blockchain analytics firm Santiment called attention to the accumulation spree of mid-tier holders of the “Digital Silver”, who typically hold between 100 and 10k coins.

Referred to as dolphins and sharks by Santiment, this cohort has scooped a total of 205.4k LTCs since 14 June, underlining bullish expectations from the halving event in the coming week.

The favorable sentiment was based on the quadrennial occurrence that sees miners’ block rewards cut in half, hence lowering the number of tokens in circulation. Based on demand and supply fundamentals, traders anticipated a significant uptick in LTC prices.

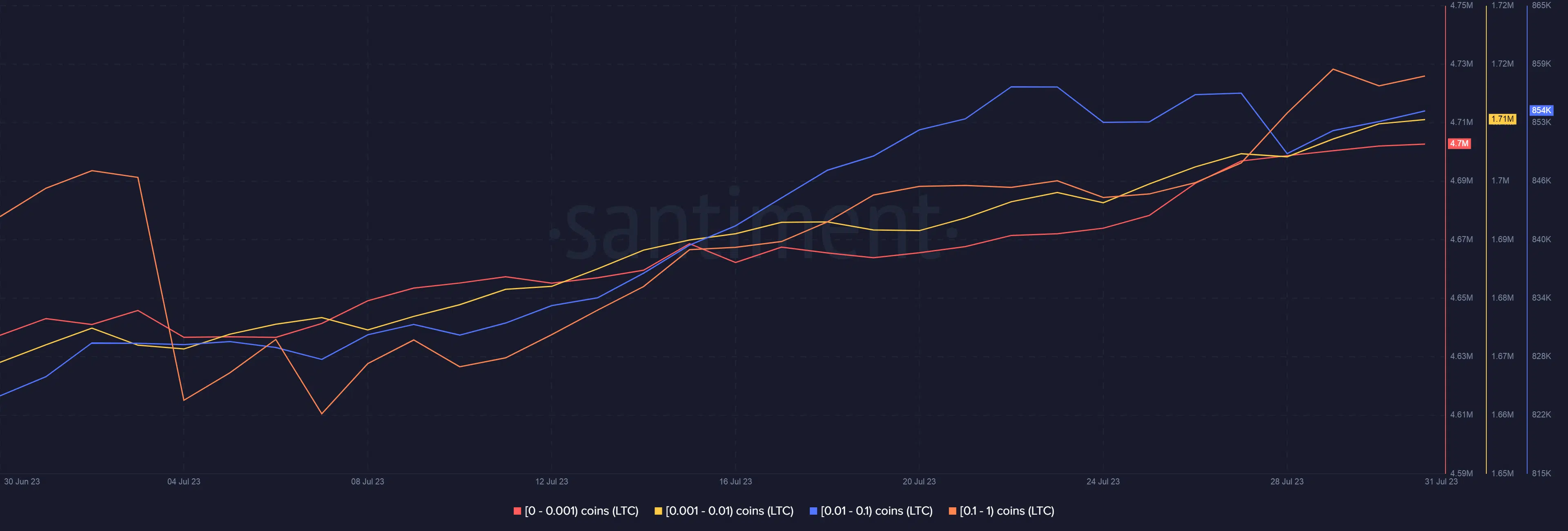

However, the demand was not only restricted to the mid-tier as highlighted earlier. LTC’s retail investors also jumped on the bandwagon. Wallets storing between 0-1 coins have been steadily adding to their portfolios over the past month.

Social buzz soars

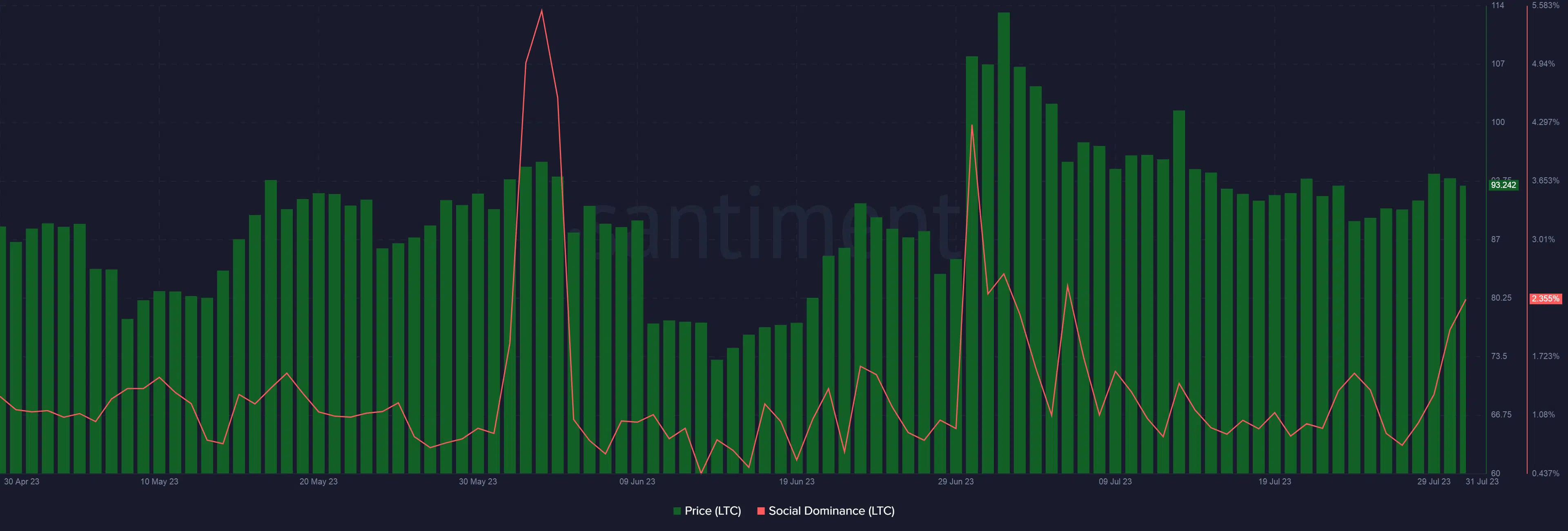

LTC started to pump almost a month before the marquee event, hitting its yearly peaks in the first week of July. Since then, prices have cooled off to an extent. However, on a year-to-date (YTD) basis, the younger sibling of Bitcoin [BTC] was up by 37%.

The halving event also sparked a flurry of LTC discussions on social platforms. In the last few days, the coin’s social dominance jumped to about 2.36%. Social dominance measures the share of a coin’s mentions on crypto-focused social media groups out of a pool of 50 most popular projects.

Litecoin in derivatives market

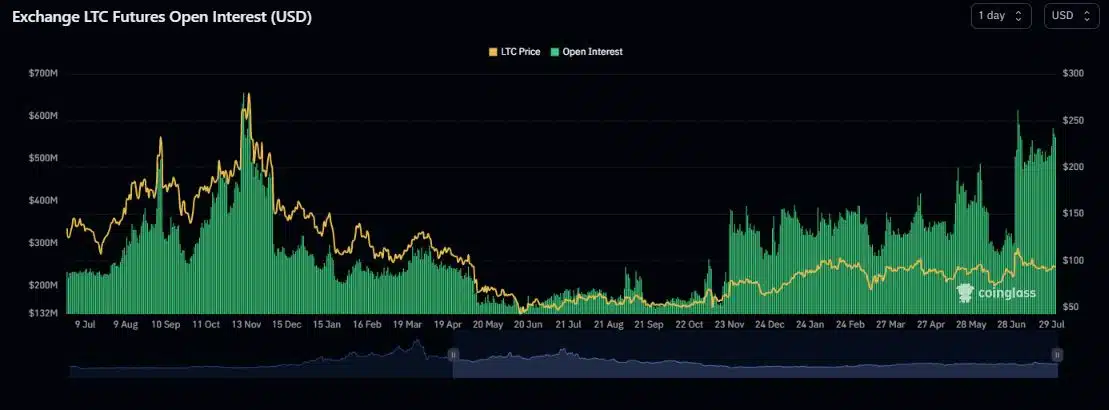

Speculative interest for LTC spiked, revealed by the sharp increase in Open Interest (OI) in July. At the time of publication, the dollar value locked in LTC futures was $550 million, a jump of 83% from a month ago, according to Coinglass.

How much are 1,10,100 LTCs worth today?

Most of these positions were gunning for price gains as underlined by the positive funding rates on the majority of the exchanges. Funding rates are the periodic payments made to either short or long traders in the crypto futures market.

When they are positive, it reflects the dominance of bullish long positions.