Litecoin is ‘cruising,’ but here’s why there’s so much more to it

Most market altcoins rallied on the back of decent on-chain activity over the past fortnight. While many of these cryptos hiked as anticipated, Litecoin took many in the market by surprise. It was not just the price gains, but the general growth from an on-chain perspective as well.

Ergo, the question – Can there be anything more to that?

These numbers paint a bullish picture

Price-wise, at the time of writing, Litecoin was holding up well with weekly gains of almost 6%. Curiously, LTC was down by 66% in three months following its last ATH. And yet, it seemed to register a one-month ROI of +5.74% and a yearly ROI of +146.05%.

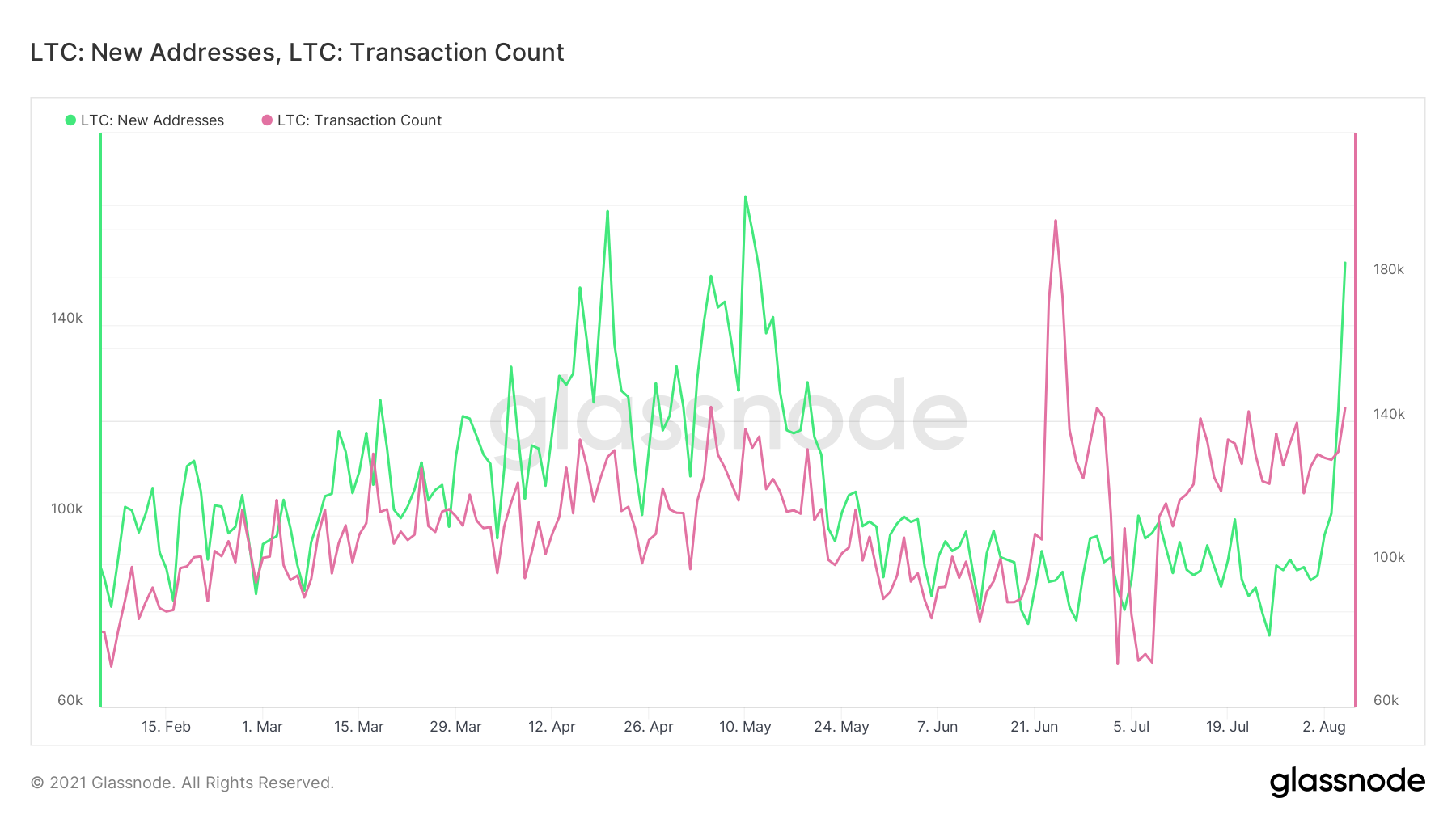

That being said, an interesting spike in new addresses for Litecoin on 5 August really stirred up the network. New addresses have almost doubled in a span of just five days. Such high numbers were last seen on 11 May, around the time of LTC’s high of $410.05.

Source: Glassnode

Moreover, a high transaction count supported the high number of new addresses, the former hitting a monthly high. But, what was the reason behind the surge in new addresses?

One possible reason could be the anticipation around the MimbleWimble Extension Blocks (MWEB) upgrade that was in the news recently. The update will be up by the end of this year, according to developer David Burkett. Nonetheless, the developer’s latest update and anticipated changes might have woken up the community.

Litecoin Hodlers showing strength

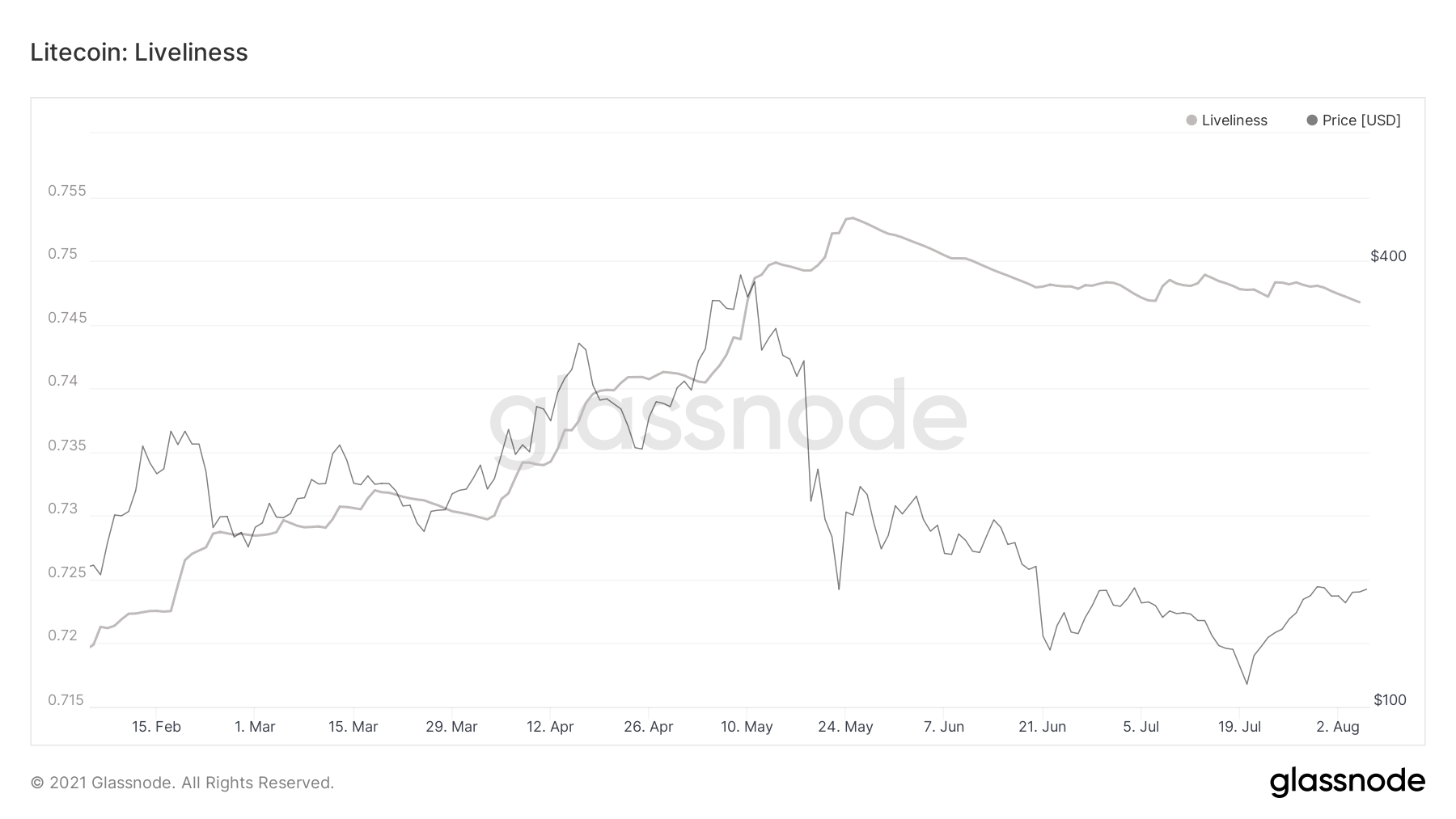

Holders play a very important role when it comes to sustaining rallies. In the case of LTC, the alt was unable to sustain its rally, at least over the last three months. However, this rally was different because this time there was a steep decline in LTC’s Liveliness, pushing the 5 August levels to levels last seen on 10 May (the day of LTC’s price ATH).

This decrease in Liveliness suggested that long-term holders are continuing to accumulate and HODL. This also implied that strong hands are getting stronger. But, are they?

Source: Glassnode

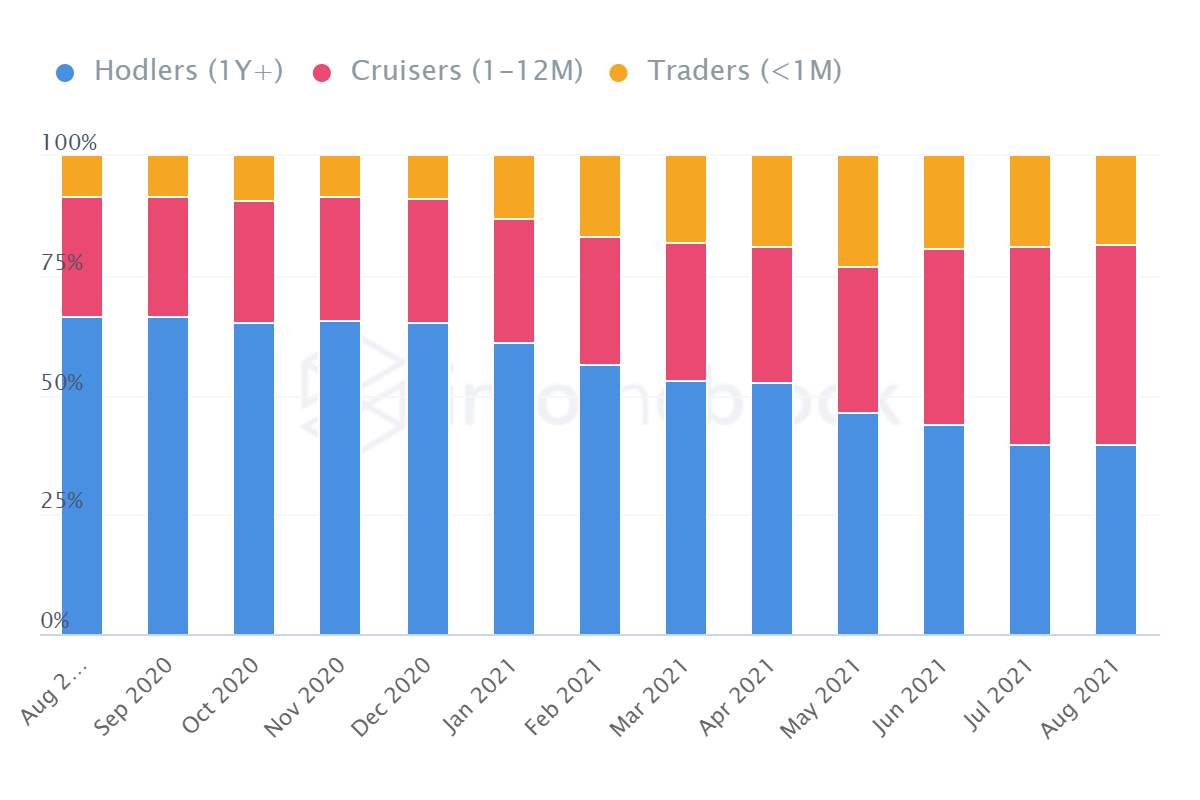

By the looks of it, LTC and its Hodlers are showing strength. However, long-term holders did not contribute to its ATH in metrics. Instead, short-term cruisers (addresses holding from one month to a year) are the ones that have been accumulating.

A slow but steady rise in cruisers from May to August highlights the role of these investors in this rally.

Source: IntoTheBlock

So, is LTC on a path to recovery?

While a good outlook on metrics along with price tops might seem like a pleasing scenario for Litecoin, as highlighted by a previous article, there aren’t any drastic hikes at the moment. Further, the fact that metrics like Liveliness and New Addresses are seeing their tops (equivalent to the May tops) at a price level that is 65% down from its ATH is a slightly worrying factor.

By extension, this might mean that LTC’s price high of this rally has been reached and going forward, corrections will ensue. On the upside, however, if these levels are held and followed by more price gains, who knows where LTC ends up at.