Litecoin [LTC]: A decline in Open Interest does not mean that buyers are done

![Litecoin [LTC]: A decline in Open Interest does not mean that buyers are done](https://ambcrypto.com/wp-content/uploads/2023/01/1672374537870-62b817f9-f6a7-49e4-a669-006b119a515e.jpg)

- LTC’s Open Interest fell by 9% in the last week.

- Regardless, investors remained bullish.

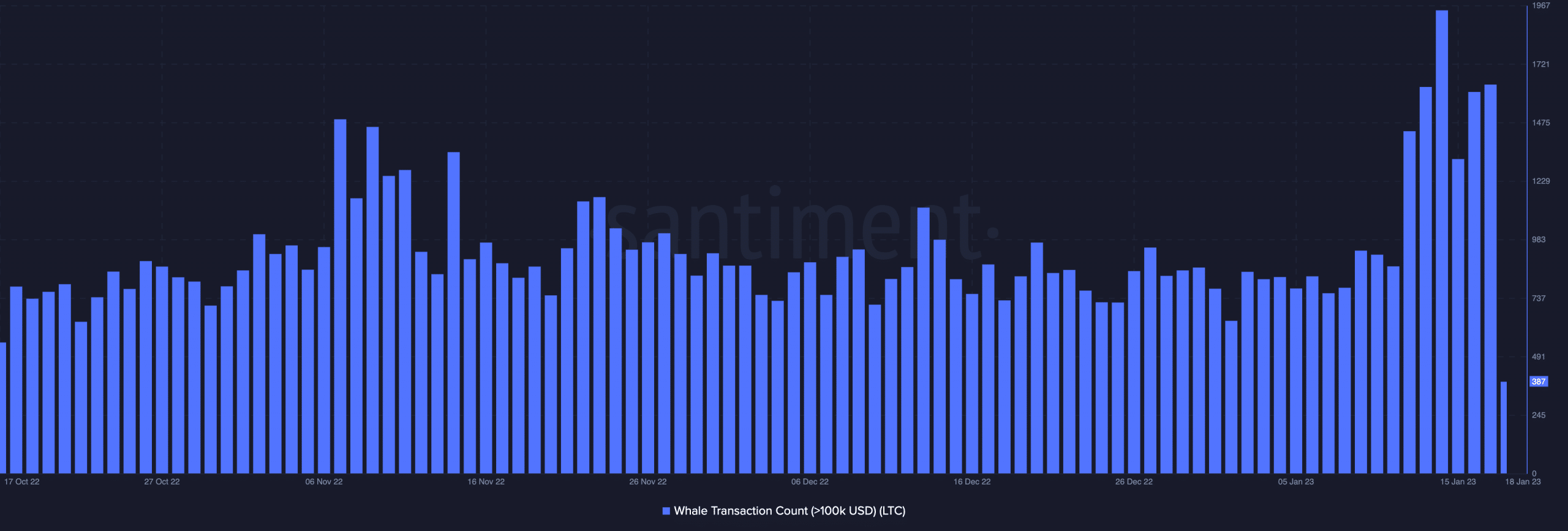

Despite the rally in the count of Litecoin [LTC] transactions above $100,000 since the year began, the steady fall in the alt’s Open Interest in the last week indicated that bearish sentiment was returning to the market.

Read Litecoin’s [LTC] Price Prediction 2023-24

According to data from on-chain analytics platform Santiment, the count of LTC transactions above $100,000 executed since the commencement of the 2023 trading year has increased by 75%.

Sharing a statistically significant positive correlation with leading coin Bitcoin [BTC], LTC’s price went up by 23% since 1 January, data from CoinMarketCap revealed.

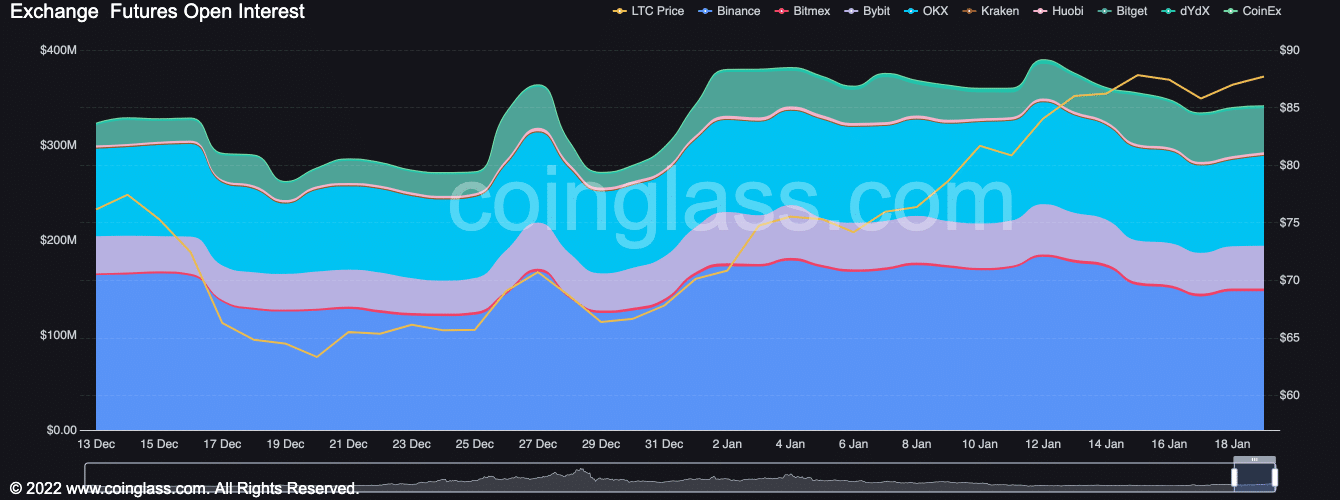

Between 1 January and 12 January, LTC’s Open Interest rose by 8%. When the Open Interest for crypto assets increases, it means that more people are entering into contracts or positions to buy or sell the cryptocurrency. This can indicate increased trading activity and market interest in the cryptocurrency.

However, in the last week, LTC’s Open Interest embarked on a decline to be pegged at the level it closed at 2022 as of this writing. According to Coinglass, LTC’s Open Interest stood at $341.27 million.

Holders are rooting for Litecoin

Despite a gradual decline in LTC’s Open Interest, a few on-chain metrics suggested that bullish conviction still lingered in the LTC market.

According to data from Santiment, LTC’s funding rates on leading cryptocurrency exchanges Binance and DyDx have been positive in the last week.

A crypto asset logs positive funding rates when the interest rate paid to those holding short positions in the asset is higher than the interest rate earned by those holding long positions.

This happens when demand is high. A positive funding rate indicates the market is optimistic about the cryptocurrency’s potential and continued price growth.

Further, LTC’s weighted sentiment has been significantly positive since the year started, data from Santiment showed. So far this year, whenever market sentiment turned negative, it was quickly replaced by positive investor sentiment, indicating that bullish conviction exceeded bearish conviction. At press time, LTC’s weighted sentiment stood at 0.79.

Realistic or not, here’s LTCs market cap in BTC’s terms

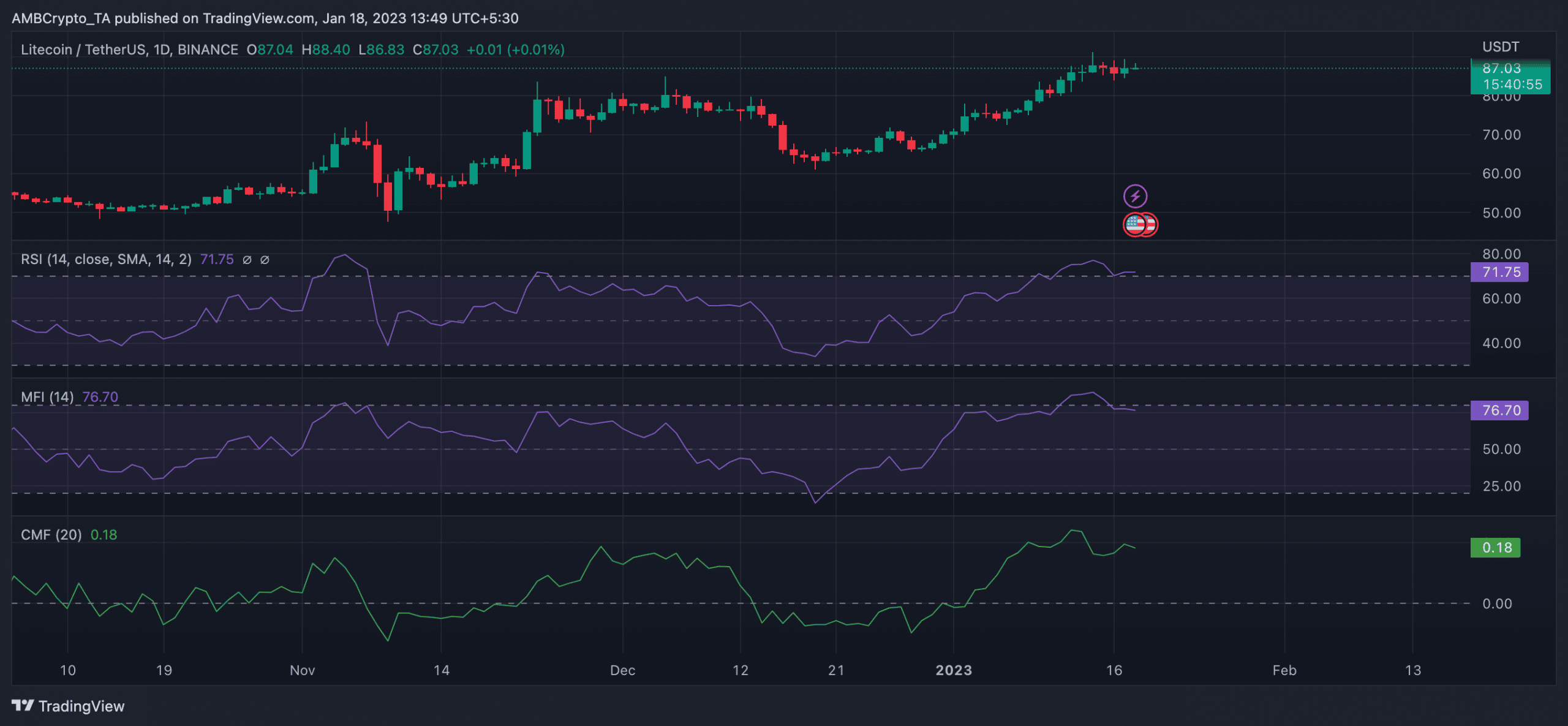

Movements on the price chart revealed that buying momentum remained strong. Oversold at press time, the alt’s Relative Strength Index (RSI) laid at 71.75. Similarly, its Money Flow Index (MFI) was spotted at 76.70.

Lastly, the dynamic line (green) of LTC’s Chaikin Money Flow (CMF) was positioned far from its center line in the positive zone. At press time, the CMF was 0.19. When an asset’s CMF indicator is positive, it suggests that money is flowing into the asset, indicating bullish sentiment and an uptrend in the market.