Litecoin [LTC] on the way to $110? Not yet, as this can delay the bulls

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LTC was bullish at press time.

- LTC open interest rate declined in the past few days.

Litecoin’s [LTC] value increased by over 40% in January 2023, rising from $68 to $102. However, a short-term price consolidation in the past few days has seen the asset lose some value.

Read Litecoin’s [LTC] Price Prediction 2023-24

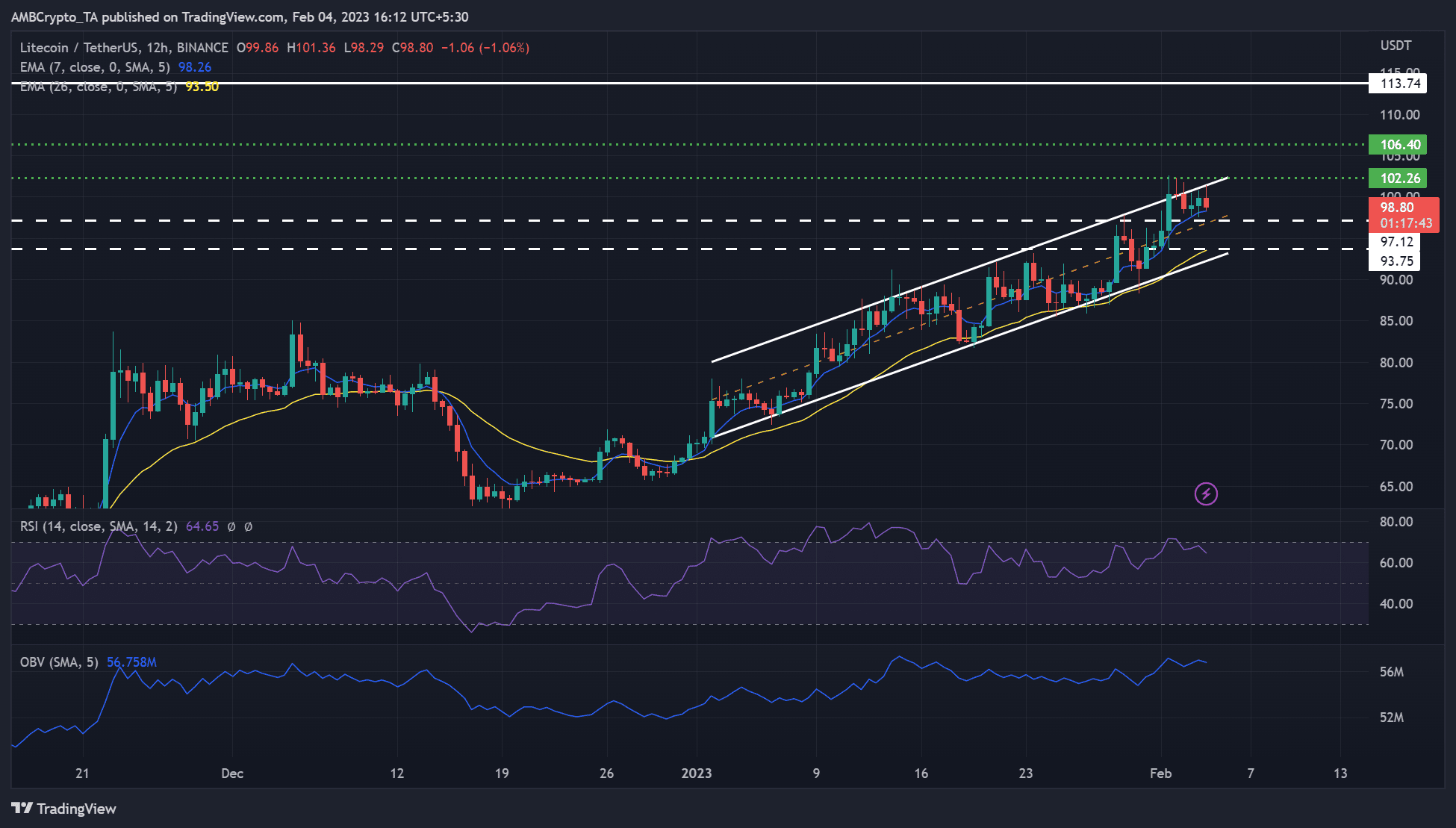

At press time, LTC traded at $98.80 and was strongly bullish on the price charts. However, a strong bullish momentum could be delayed because of declining open interest rates in the futures market.

LTC price action fluctuated between $97.12 and $102 over the past few days. Notably, the overhead resistance was only retested twice. Key price technicals suggested a possible retest, and breach of the $102 resistance level seemed likely.

The Relative Strength Index (RSI) value was 65, thus bullish. In addition, the On Balance Volume exhibited an uptick after an extended fluctuation in January, showing rising trading volumes and demand.

Therefore, LTC could maintain its price action on the upper range of the rising channel and aim at the resistance levels of $102.26 and $106.40.

However, a break below $97.12 would invalidate the above bullish bias. The drop could be kept in check by $93.75 or the 26-period EMA.

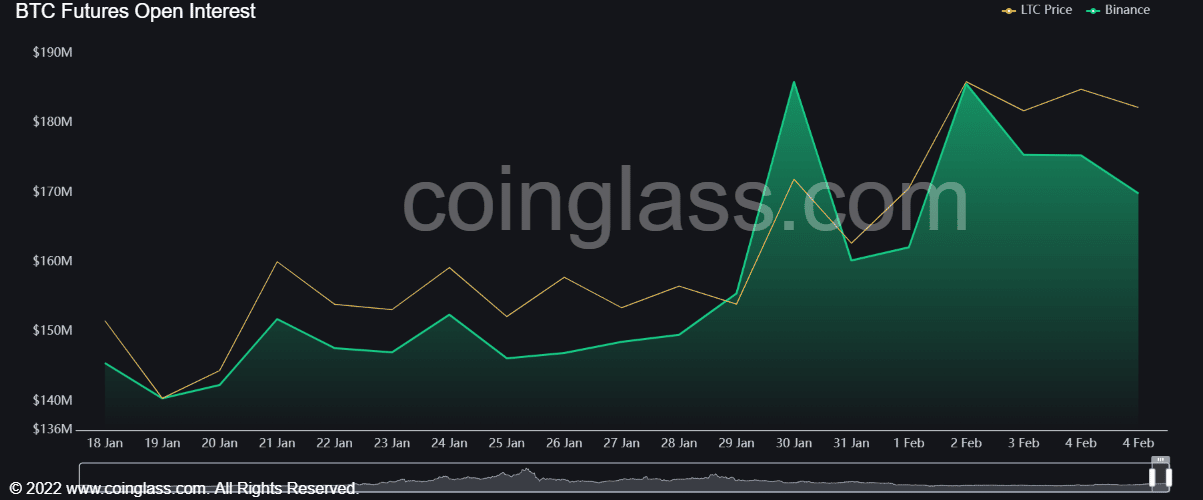

LTC’s open interest rate declined

As per Coinglass, LTC’s open interest (OI) rates declined, which could undermine its uptrend momentum. Notably, the OI fluctuated during the second half of January 2023 before peaking on 30 January.

Is your portfolio green? Check out the LTC Profit Calculator

At press time, the OI reduced, indicating more money flowed out of LTC’s futures markets. It denoted a bearish sentiment, which could undermine a strong bullish momentum targeting the overhead resistance at $102.26.

At the same time, betting against LTC may not be prudent because more short positions were liquidated than long ones, as per Coinalyze’s data. Short liquidations were twice as much as long ones. Therefore, investors should be cautious and track BTC price movements before acting.