Litecoin [LTC] rejects the itch to go to ground with the market- Here’s how

![Litecoin [LTC] rejects the itch to go to ground with the market- Here’s how](https://ambcrypto.com/wp-content/uploads/2022/11/po-2022-11-22T072800.733.png.webp)

- Litecoin’s social metrics increased, neglecting the downturn recorded by most assets in the market

- The hikes could not produce enough profits for LTC holders. Although it was likely that investors might not have to deal with massive a price fall in the short-term

Gloom-ridden! That might be the perfect description of the crypto market sentiment in the last few days. However, not every asset seemed to have joined the bandwagon as Litecoin [LTC] progressed in the opposite direction.

According to LunarCrush, Litecoin maintained a positive position as per its social engagement and mentions. Although it was ranked 98 among the altcoins, the crypto social intelligence platform noted that the excellent social levels had impacted LTC’s market reaction.

Read AMBCrypto’s Price Prediction for Litecoin 2023-2024

At press time, the influence was obvious. This was due to the 3.15% increase registered by the decentralized payment cryptocurrency.

Here’s where the advantage is for LTC

Despite the upturn, LTC’s price was far from being a premium buy at $62.15. This was indicated by the Network Value to Transaction (NVT) signal displayed by Glassnode.

According to the on-chain data shown, Litecoin’s NVT signal was 2.21. This level is considered low. Hence, investors accumulating LTC could do so at a discount. Moreso, it indicated that the transfer volume outpaced the market cap growth. So, LTC, regardless of the uptick, might reflect a close to the market bottom.

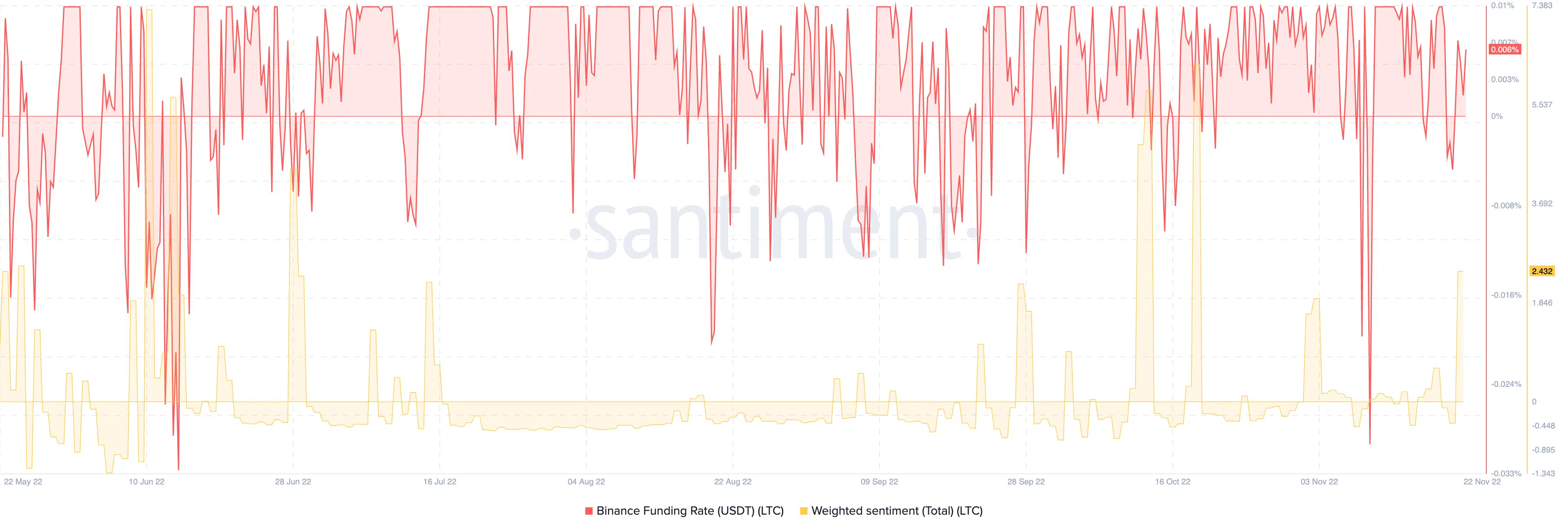

The rebellious attitude of Litecoin seemed to have helped it win the hearts of traders. According to Santiment, the funding rate on Binance, which dropped heavily on 10 November, had recovered substantially.

As of this writing, the Binance funding rate was 0.006%. This meant that LTC had attracted traders, and they, in response, turned up the volume pumped into the derivatives market.

Interestingly, the total weighted sentiment also drew a positive reaction. At press time, Santiment data revealed that the total weighted sentiment for LTC was 2.432.

As this was a recovery from the drop on 20 November, it implied that investors’ attitude towards LTC was worthwhile. In addition, it indicated a possible sentiment for the coin to significantly increase in the long term.

Gain some, lose some

However, the uptick recorded by LTC could not produce much profit for its holders. This stance could also be because of the decline a few days back. According to Santiment, LTC’s daily on-chain transaction volume in profits was 153,000. On the opposing end, the daily on-chain transaction volume in the loss was 163,000.

Although slight, the difference meant that the transactions that recently went through the Litecoin network initiated more losses than gains. So, Bitcoin investors might require more than slight price increases for the social hikes to be beneficial.