Litecoin repeating history will have this effect on its price action

Even though Litecoin may not be one of the topmost cryptocurrencies by market cap, it still holds a lot of value for investors. However, with the active downtrend that interest might begin fading away soon.

Litecoin in the dark

Litecoin has a significantly higher rate of adoption when compared to most of the other altcoins. However, it is failing as a reliable vehicle of investment at the moment.

Stuck under a downtrend, still, even after seven months, the altcoin could not keep the rally from continuing further despite hovering over it for almost a month. It fell back under the trend line and is presently trading at $151.

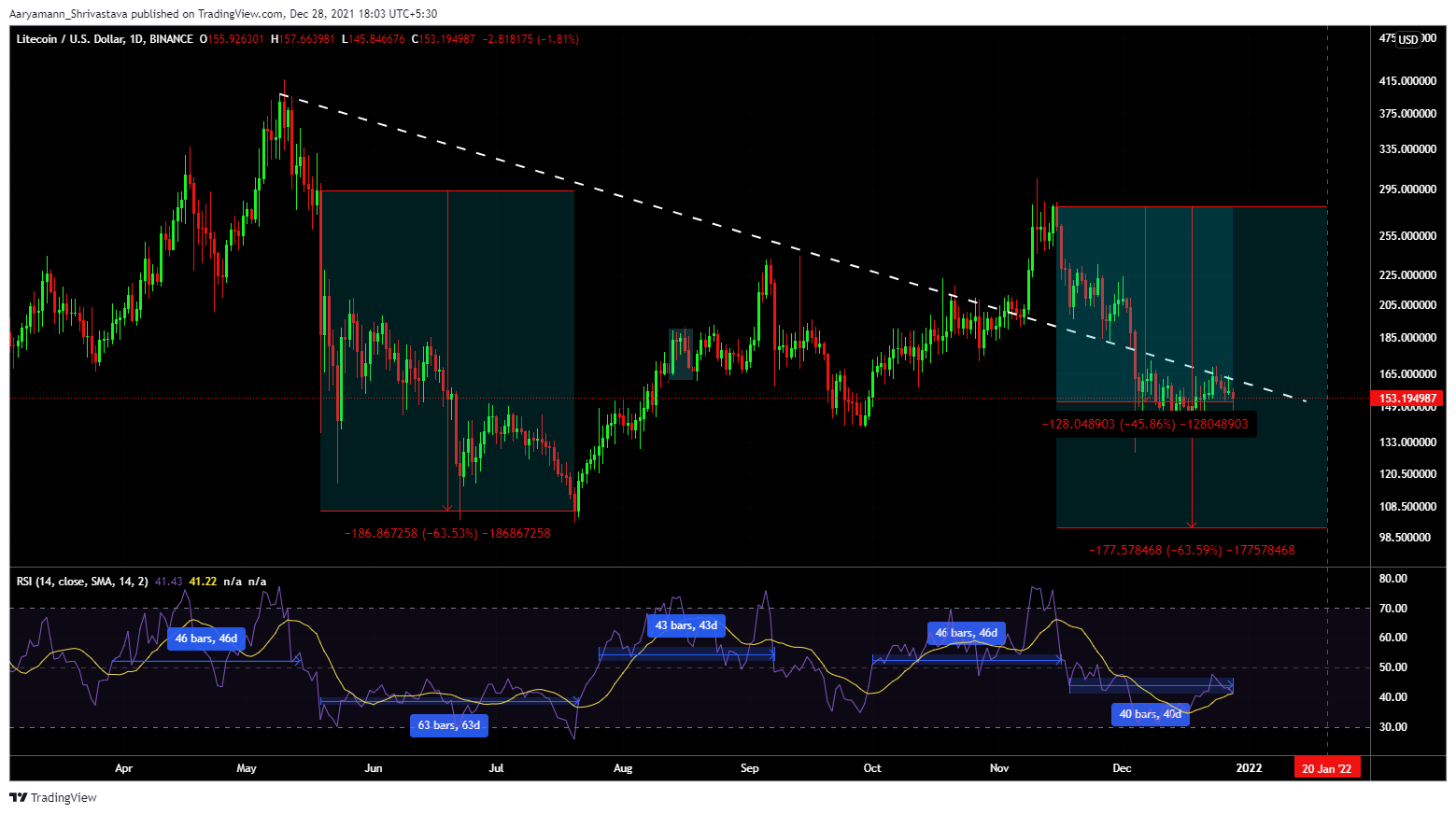

But as it began tumbling, it triggered the RSI to exhibit a pattern observed once before. On a macro scale, the fall of LTC into the bearish-neutral zone this prolonged, was last seen only in June when LTC fell by 63.5%.

This pattern isn’t random co-incidence considering there have been solid instances of this pattern recurring. The rally of April kept the RSI in the bullish zone for about 46 days, the next rally of August lasted for 43 days too and the most recent rally of November kept on going for 46 days as well.

Litecoin price action | Source: TradingView – AMBCrypto

Thus if we consider the same for a bearish market, right now RSI is only 40 days into the bearish-neutral zone and down by 45.86%. Should it last for 63 days and fall by 63.5%, LTC will end up at $101.6 by January 20, 2022.

In any case…

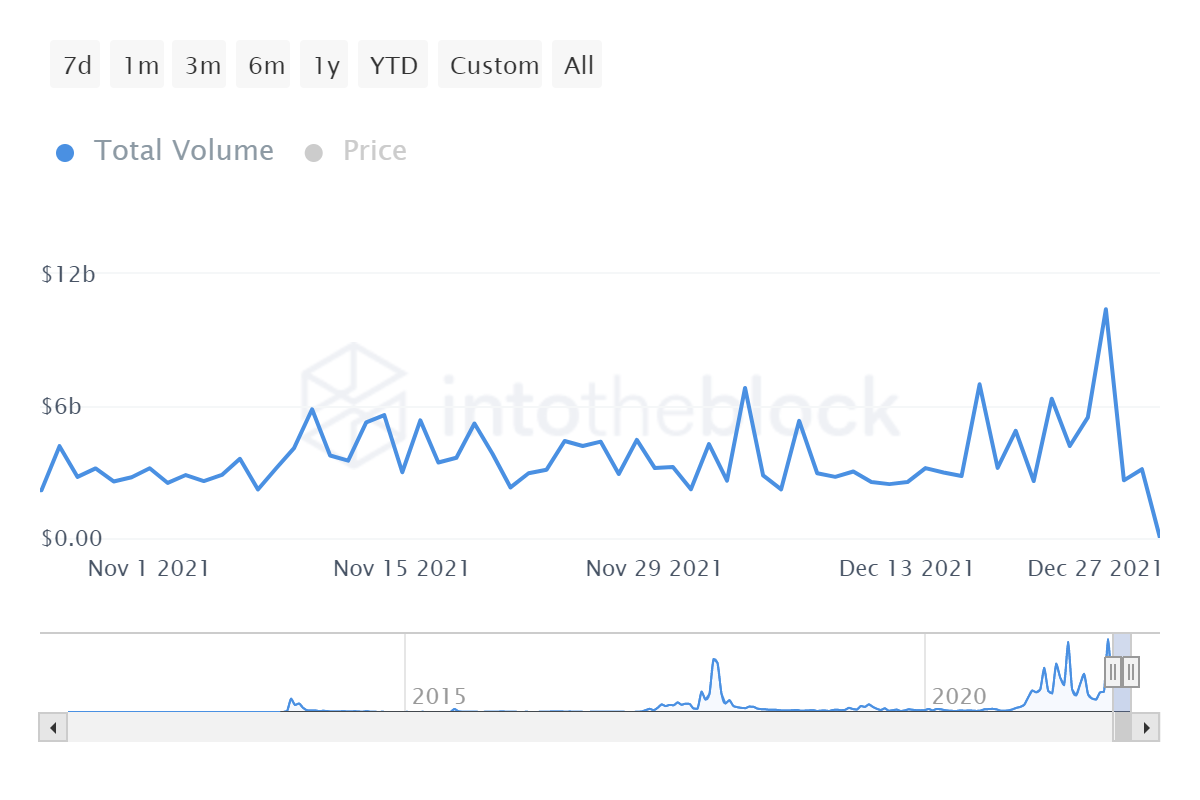

Litecoin investors have already turned cautious as soon as they observed the first red candle on December 24. Volumes suddenly shot up to $10.4 billion and interestingly the highest contributing cohort to these volumes were the whales. Transactions worth more than $100k on 24 December came up to $9.89 billion in a single day.

Litecoin large transactions | Source: Intotheblock – AMBCrypto

Thus going forward, the market can expect further reductions in volume and token movement and until LTC flips the downtrend into support, it won’t gain its investors’ confidence.