Litecoin stalls near $90 level: Will this group swoop in to save LTC?

- Whales accumulated almost $230 million worth of LTC.

- The LTC price trend remained relatively flat.

In the past month, Litecoin [LTC] has yet to experience an impressive price trend, with significant declines following its test of the $100 price range between March and April.

Despite these drops, large wallets have viewed this as an accumulation opportunity, amassing millions of LTC over the last 30 days. However, Open Interest in Litecoin has remained relatively flat during this period.

Litecoin sees massive 30-day accumulation

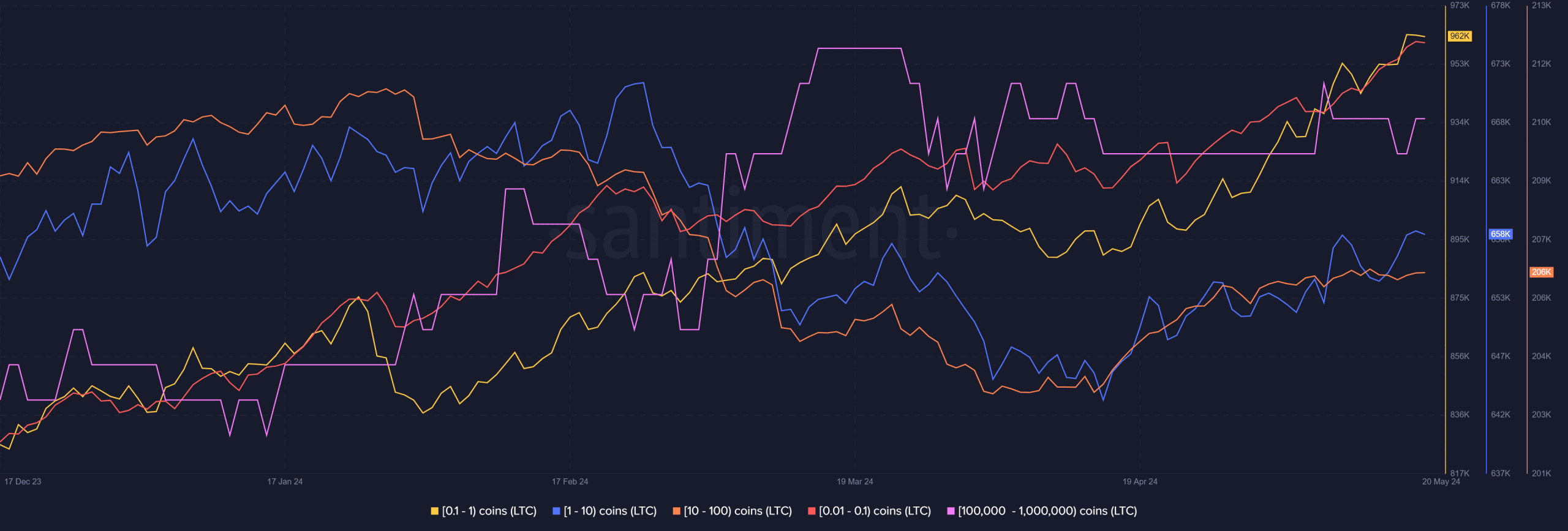

Recent data from IntoTheBlock revealed significant whale accumulation in the past 30 days, with large wallets accumulating over 2.751 million LTC.

At press time prices, this accumulation was worth over $229.7 million. On the 10th of May, these addresses saw a netflow of around 900,000 LTC, the highest since February.

Analysis of the supply distribution showed that smaller addresses have also been accumulating LTC in recent months, but the larger addresses have accumulated more LTC.

Interestingly, this accumulation trend has continued despite the declining price trend of LTC.

Litecoin hangs on to its bull trend

AMBCrypto’s look at Litecoin’s price trend on a daily time frame showed that its short Moving Average (yellow line) has remained a resistance level between $86 and $90.

At the time of this writing, LTC was trading at around $83.5, reflecting an increase of over 1%, according to AMBCrypto’s analysis.

The long Moving Average (blue line) appeared to be a solid support level at around $77 to $78.

After a near fall below the neutral line, the recent uptrend in price has pushed LTC above it again.

The analysis of the RSI indicated that it was above the neutral line at the time of this writing, suggesting a bullish trend, albeit weak.

LTC sees flat interest

AMBCrypto’s analysis of Litecoin’s Open Interest on Coinglass showed that it rose to over $600 million around March but dropped to around $500 million in April.

It then declined significantly and went flat towards the end of April, settling at around $330 million.

At the time of this writing, Open Interest remained flat at about $340 million. This indicated that the inflow of money into LTC has reduced in the past few weeks.

Is your portfolio green? Check out the LTC Profit Calculator

AMBCrypto’s examination of LTC’s Funding Rate showed that it remained positive, staying above zero.

However, it was low, suggesting that while there were more buyers than sellers, their numbers were not substantial. These metrics indicate that the overall sentiment around Litecoin was low.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)