Will Litecoin break $180 soon? Key metrics point to yes!

- Rising accumulation could validate LTC’s move northward.

- Most holders refrained from selling, indicating a possible rise above $180.

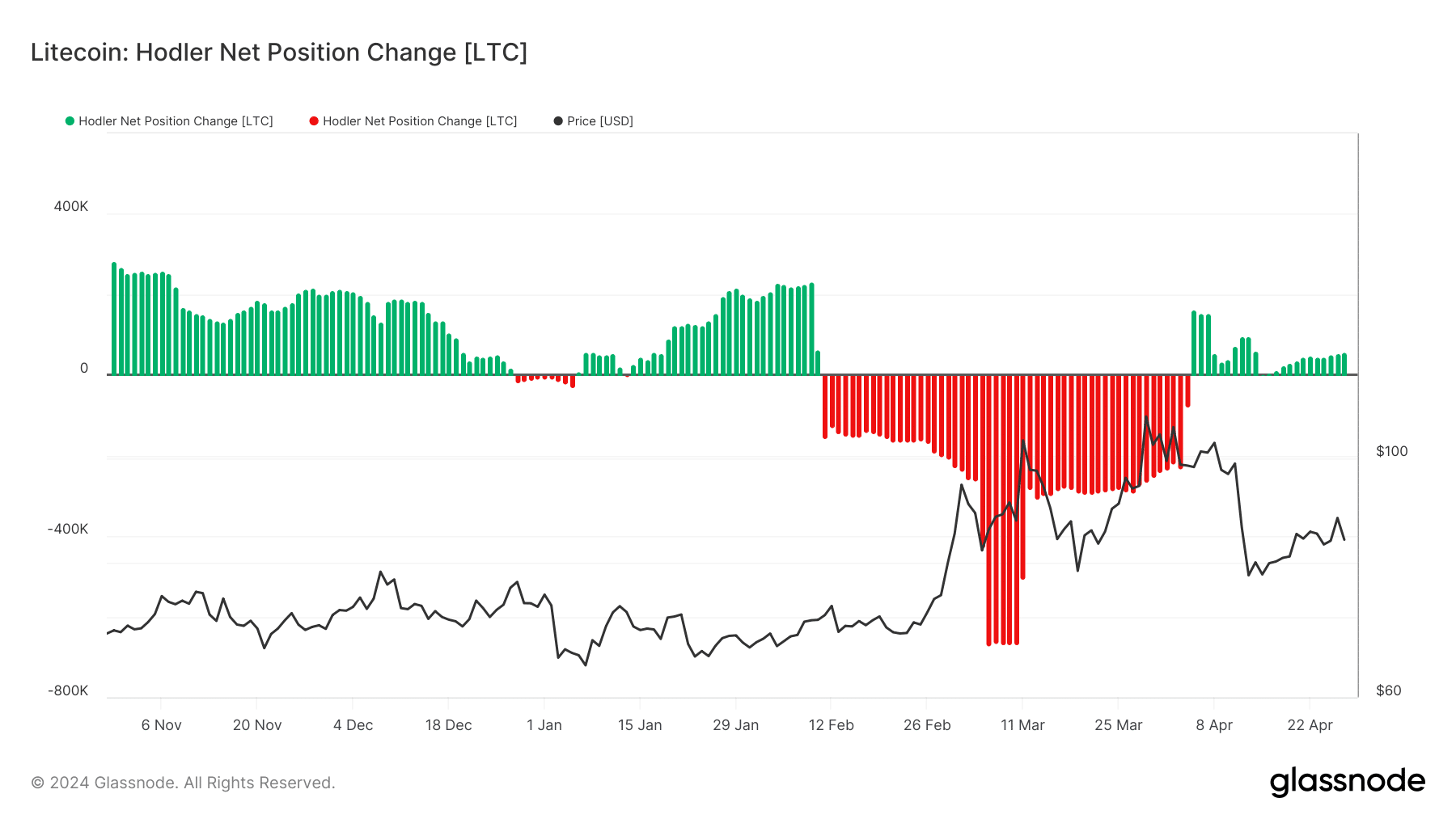

For most of April, things changed for a large part of the crypto market, and Litecoin [LTC] was not exempted. However, this is not about the price performance. Instead, the notable rotation happened with the Hodler Net Position Change.

If this metric is negative, it means investors are cashing out. But a positive reading suggests accumulation. According to AMBCrypto’s analysis of Glassnode data, the Hodler Net Position Change was positive, indicating that long-term holders bought 57,095 coins on 27th April.

No more cash-out

From the second week in February to the whole of March, this metric was negative. This led to speculation that LTC might be out of the league of altcoins expected to blow minds in the coming months.

However, that might no longer be the case as the net position change has been consistent since 5th April. Should we see more accumulation than cash out, then Litecoin might defy bearish expectations, and tilt toward the bullish end.

At press time, Litecoin changed hands at $18.37, representing an 18.42% decrease in the last seven days. While AMBCrypto discussed a possible increase to $110 in the short term, LTC might climb higher than that in the coming months.

The bulls are preparing

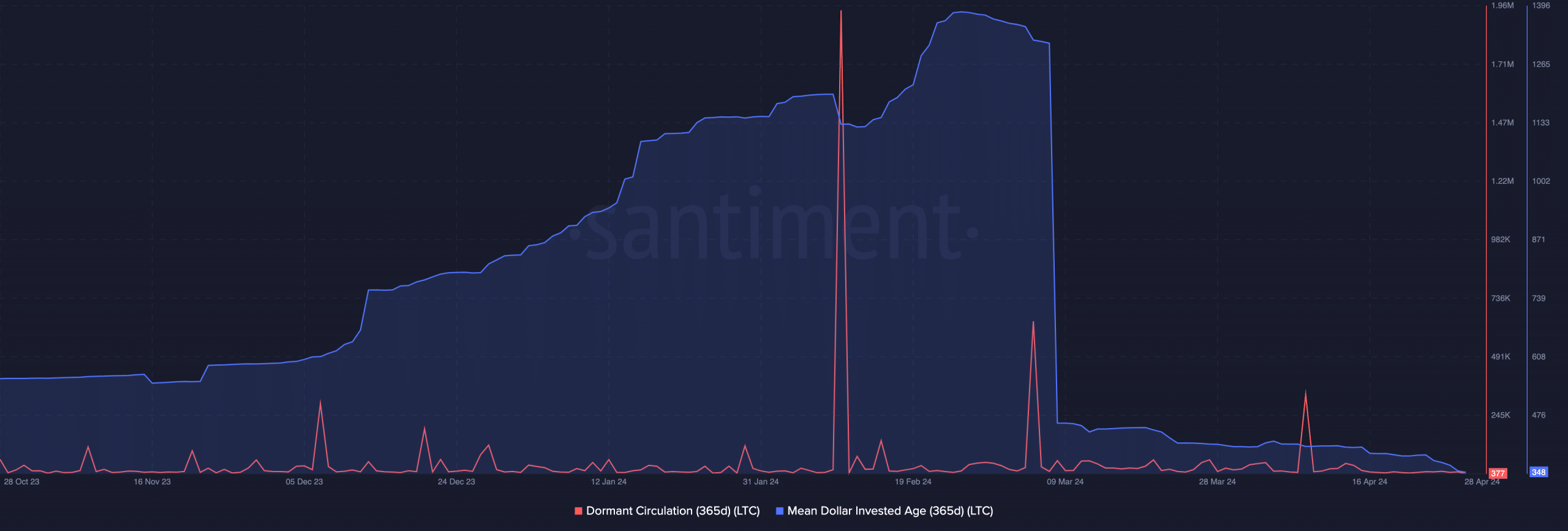

To put it into context, we analyzed some other metrics that could impact the coin in the long term. First off, we considered the dormant circulation.

This on-chain metric tracks the number of unique coins which have been idle for a long while but were transacted in a day. Most time, spikes in dormant circulation cause prices to decrease.

However, the 365-day dormant circulation on the Litecoin network was its lowest since 9 April. With this figure, one can assume that most long-term holder would rather keep their coins than sell them for cheap.

Furthermore, the Mean Dollar Invested Age (MDIA) fell to a low of 348. The MDIA is the average age of all coins gauged by the purchase price.

If the average age of investments in Litecoin had increased, it would have implied that the coin is close to a local top. But since it decreased, it indicated a bull run could be around the corner.

The projected bull run is no guarantee that LTC will rise to the $400 region. But seeing the coin change hands between $180 and $250 cannot be ignored.

Read Litecoin’s [LTC] Price Prediction 2024-2025

Still, it is important to note that the potential rise might appear linear. If LTC jumps, it might undergo a correction at a different point.

As such, a decrease below $84 might be possible before the coin tries to double or triple its value.