Litecoin user count grows amidst a freefall in prices – What now?

- Litecoin saw the daily active addresses count rise spectacularly.

- The massive market wide bloodbath wiped out LTC’s gains from the second half of December.

Litecoin [LTC] has witnessed another surge in its daily active addresses. A Santiment post on X (formerly Twitter) highlighted this development.

The post noted that such a rise could lead to an increased market cap, which is another way to say that prices would appreciate.

? #Litecoin, #Maker, and #LidoDao are all seeing rapidly rising address activity. Typically, this gradually rising utility is accompanied by market cap growth. While $MKR and $LDO have seen this come to fruition, $LTC has yet to see a similar rise. https://t.co/hOwwknnP98 pic.twitter.com/rbmswUrx82

— Santiment (@santimentfeed) January 4, 2024

This is because of the increased utility of the token and the uptick in demand for it. Litecoin has seen a surge in this metric twice in December, and each was followed by a sustained rally. Could history repeat itself?

Examining the swell in daily active addresses

Generally, a single metric does not give a good picture of the state of the market. A combination of metrics do a better job.

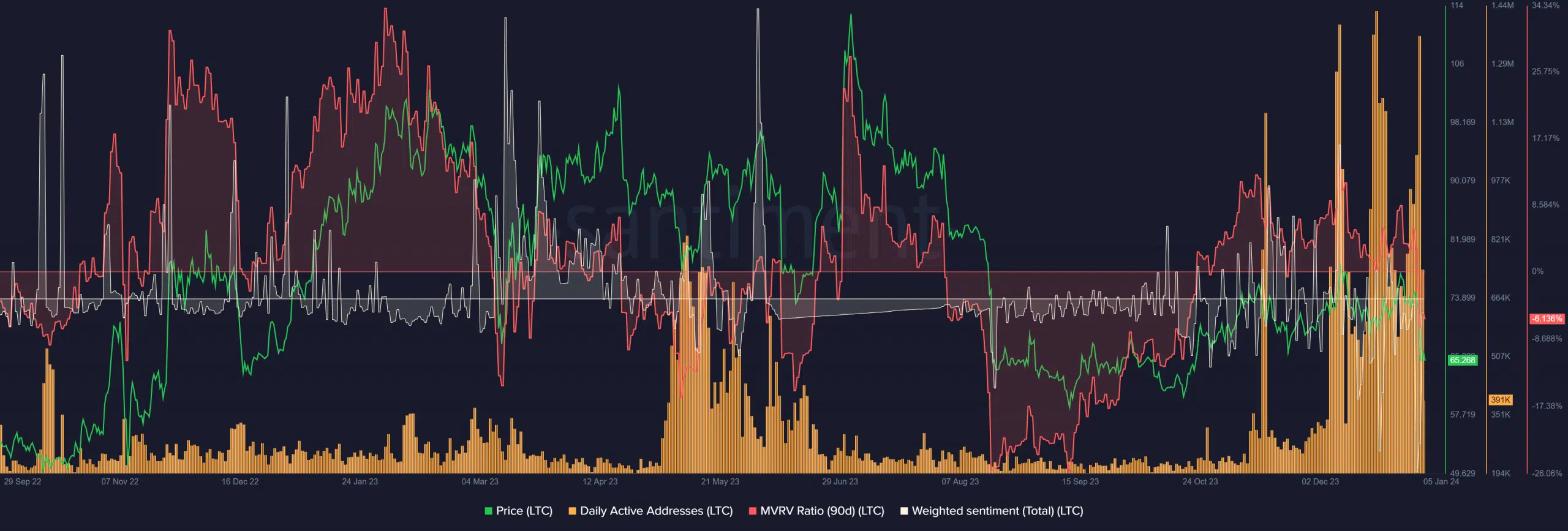

Therefore, AMBCrypto looked at the social sentiment and the MVRV ratio alongside the active addresses.

Before drawing inferences from the metrics, the prior active user count spikes must be examined. The first occurred on 14th November, but this was after LTC reached a local top at the $76.8 mark.

The next two surges of the metric occurred on 6th December and 20th December. The former saw a 9% price increase within three days, and the latter witnessed a similar return over a week.

When the metric climbed again in January, it was met with a massive tumble in Litecoin prices.

Source: Santiment

The MVRV ratio fell below 0 on 3rd January after the large price dump. The weighted sentiment has also largely been in the negative territory since mid-December.

This suggested a general lack of faith in the idea of a Litecoin rally. Yet, it is also possible that Litecoin prices could form a range and accumulate before pushing higher.

Where are LTC prices headed next

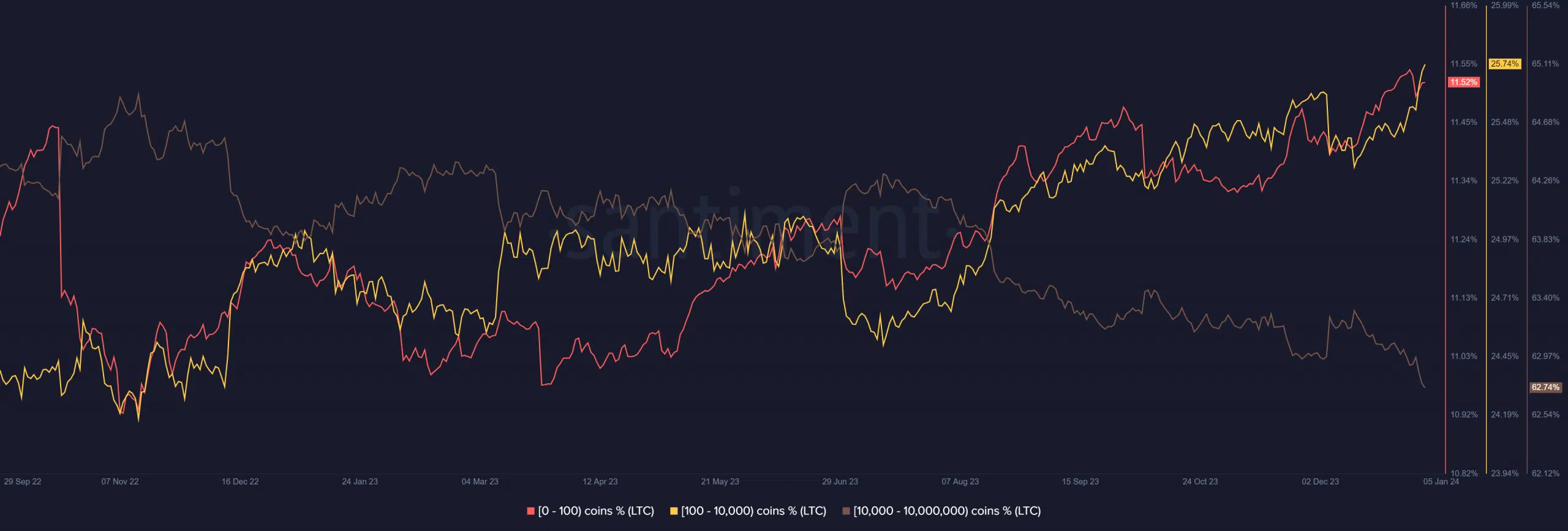

AMBCrypto noted this in the supply distribution by balance of addresses chart. The chart showed a strong uptrend in the balances of addresses holding less than 10k LTC.

Source: Santiment

On the contrary, the number of addresses with 10k or greater LTC was in decline. This was an interesting finding. The downtrend has been prevalent since 2022.

However the August 2023 halving saw isolated periods of accumulation from January 2023 to March 2023. Another period of whale accumulation occurred in June of that year.

Therefore, this whale downtrend suggested that the price action of Litecoin might not be explosively bullish in the coming months.

The 12-hour price chart showed a bearish market structure after the drop below $71.41. Moreover, the H4 bullish order block (cyan box) below the $68 area has been breached. The bulls have some faint hope despite this.

Read Litecoin’s [LTC] Price Prediction 2023-24

The 78.6% Fibonacci retracement level saw a candlewick go to $58 but not a 12-hour trading session close below it. Until such a session close occurs on the H12 or H4 charts, the bulls could have a say in the fight.