Litecoin whale activity indicates price reversal: Are your investments in jeopardy

- LTC whales have started selling off their holdings.

- Open interest has been on a decline in the past two weeks.

On 23 January, on-chain data provider Santiment warned investors that Litecoin’s [LTC] price may drop in the coming days due to an increase in selling activity among whales.

According to the report, the coin distribution among this cohort of LTC holders in the past few days was a profit-taking move, as demand for the altcoin had surged, thereby creating an artificial pump that the whales worried might not last.

Read Litecoin’s [LTC] Price Prediction 2023-24

Per data from Santiment, in the last two weeks, the count of whale addresses that held between 100 and 1,000,000 LTC tokens fell by 0.2%. Whereas, on a year-to-date basis, LTC’s price rallied by 29%. At press time, the alt exchanged hands for $90.92, data from CoinMarketcap showed.

Maybe you should worry if you hold LTC

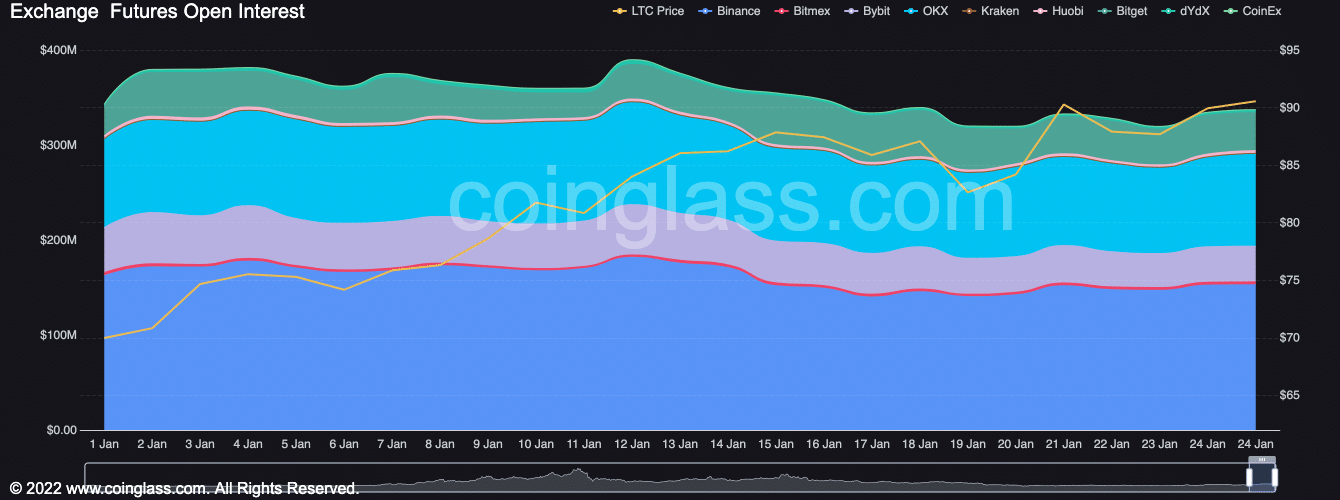

Mirroring the growth in the general cryptocurrency market in the last few weeks, LTC’s Open Interest rose by 14% between 1 – 12 January.

An increasing open interest in the crypto market meant that more traders were opening new positions in derivatives such as futures or options. It typically indicated an increased activity and interest in the market. It also suggested that more traders were becoming confident in the market and were looking to take advantage of potential price movements.

However, as profit-taking began, and many traders closed off their LTC trade positions, the alt’s Open Interest soon fell. At $337 million at press time, LTC’s Open Interest fell by 13% since 12 January, data from CoinGlass showed.

A decline in an asset’s Open Interest is often taken as a bearish signal. It indicates that traders are closing out their positions, which could signal a lack of confidence in the current direction of the market or a decrease in overall activity.

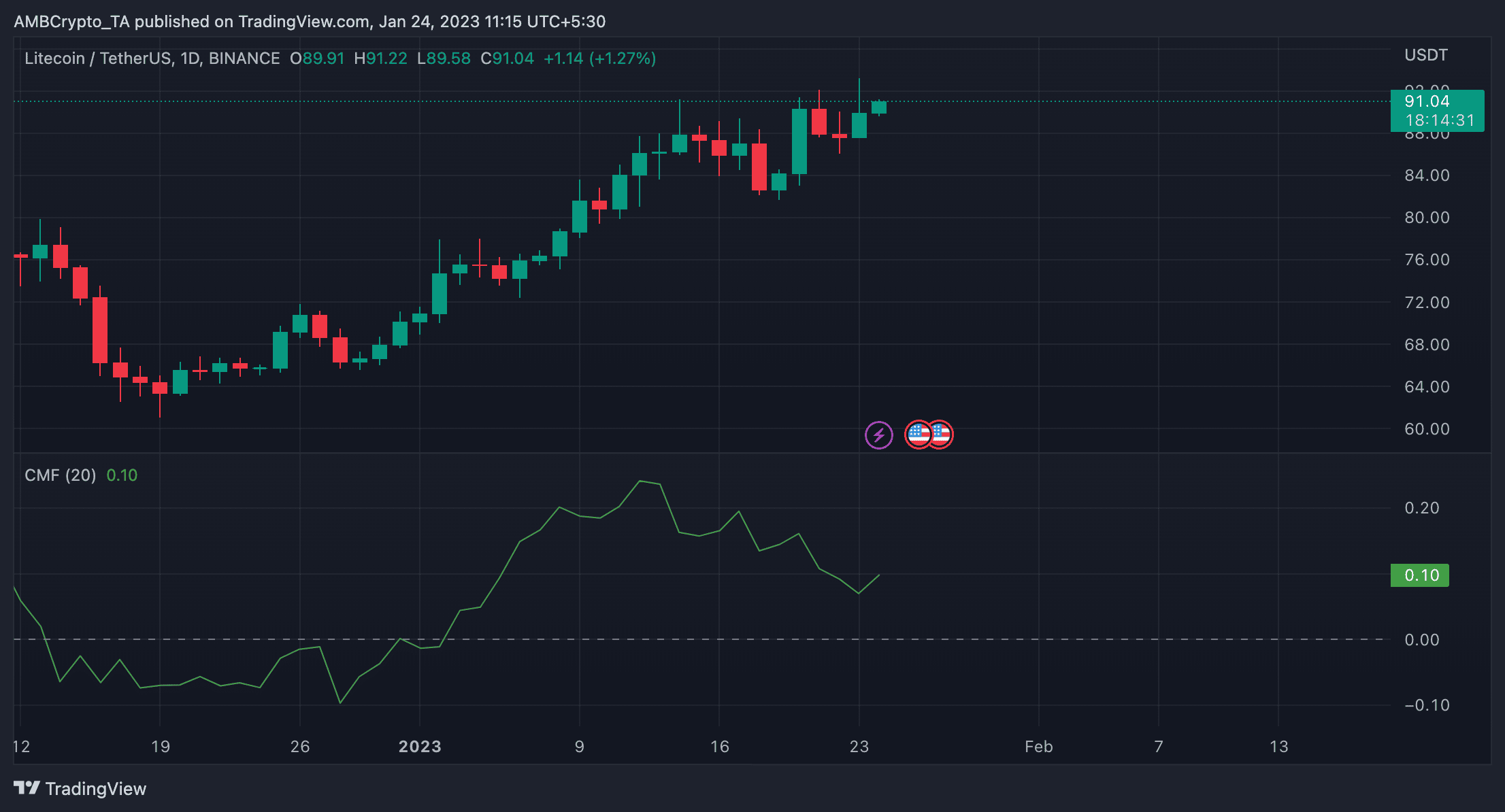

A further assessment of LTC’s price movement on a daily chart revealed the formation of a bearish divergence between the alt’s price and its Chaikin Money Flow (CMF). Although still positioned above the center line, LTC’s CMF had embarked on a downtrend since 13 January, while its price chased new highs.

Realistic or not, here’s LTCs market cap in BTC’s terms

A possibility of Litecoin’s price reversal?

A decreasing CMF value, combined with a high price, can indicate that the market is overbought and that there may be potential for a price correction. This could mean that although Litecoin’s price was high, the buying pressure behind it is decreasing, which could suggest that the market is becoming more bearish and that traders are becoming more hesitant to buy at such high prices.

This situation could be a sign that traders should consider taking profits or reducing their exposure to the market.