Litecoin’s [LTC] near-term trajectory could depend on this factor

The recent market growth rekindled the hopes of Litecoin [LTC] buyers over the last month.

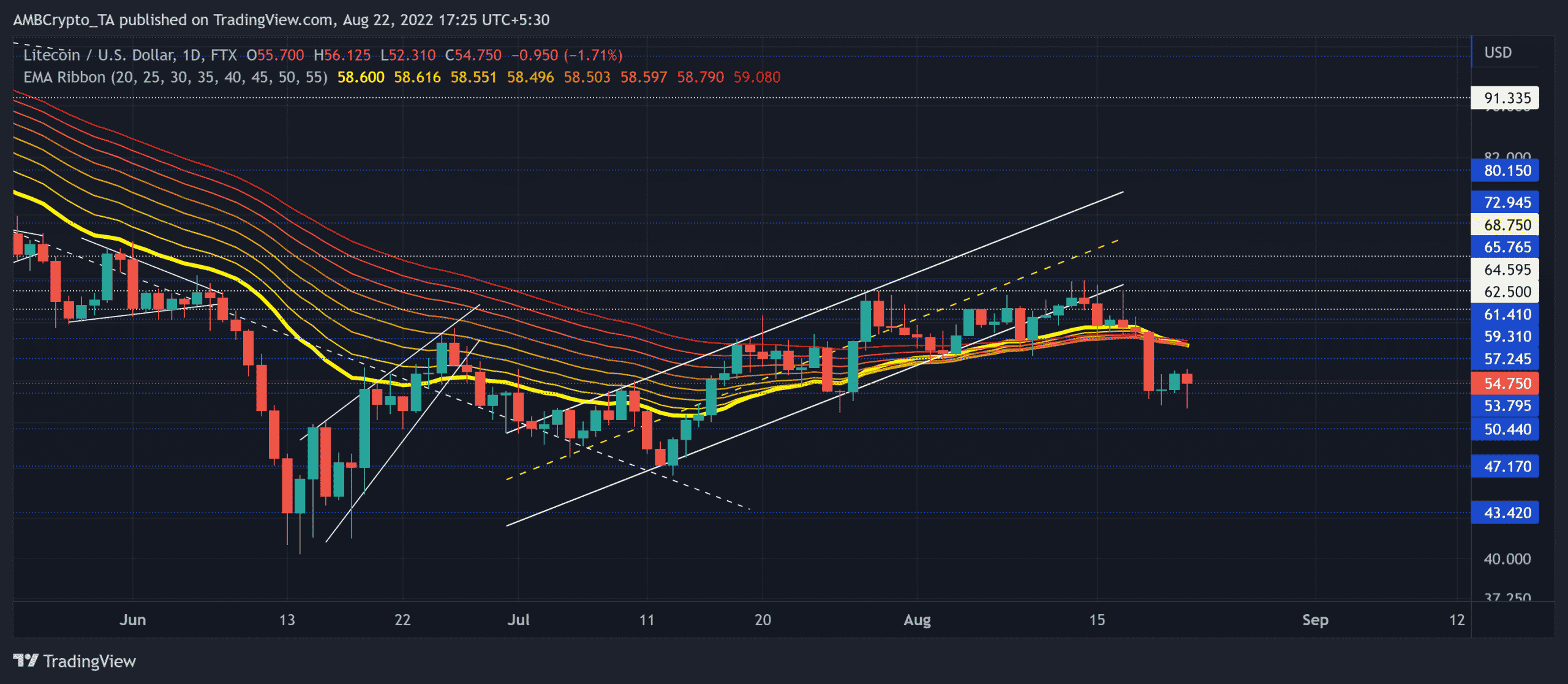

But the $62-$64 range has been shunning the bullish efforts while preventing a swift buying rally. As a result, the altcoin quickly dropped below the EMA ribbons to project strong selling momentum.

Furthermore, the recent bearish engulfing candlestick reflected a solid uptick in selling pressure. Sustained rejection of higher prices near the 20 EMA could inflict a near-term pullback before any revival chances. At press time, Litecoin was trading at $54.75.

LTC Daily Chart

The altcoin’s buying resurgence led it to test higher peaks over the last month. While the bears ensured the $64-ceiling, LTC saw an ascending channel movement in this timeframe.

After a brief compression phase near the boundary of the EMA ribbons, the crypto finally saw a bearish breakout below the ribbons. Now, LTC has found immediate support around the $53.7-zone.

While the EMA ribbons looked south, the bears aimed to steer the near-term trend. A compelling bearish flip con the ribbons would only reinforce the selling pressure.

An immediate rebound from the $53-mark can help buyers provoke a slow-moving phase near the EMAs. Any close below this support could expose the alt to an extended pullback. In this case, LTC could head toward the $50-zone before the bulls step in to stimulate the buying pressure.

Rationale

The southbound Relative Strength Index (RSI) revealed a robust selling edge. A continued pullback would only favor the sellers in the days to come.

However, the OBV’s higher troughs highlighted a somewhat mild bullish divergence. An eventual uptick in its support level could aid the buyers in stopping the near-term bleeding. Nonetheless, the altcoin’s directional trend [ADX] still struggled to improve its weak position.

Conclusion

Owing to the bearish breakdown below the south-looking EMA ribbons, the sellers would aim to continue the selling spree. While the broader sentiment still was not conducive for buyers, the buyers must step up to defend $53-support to prevent fallout. The targets would remain the same as discussed.

Finally, LTC shares a 96% 30-day correlation with BTC. Thus, a look at Bitcoin’s movement would be crucial in making a profitable move.