LTC’s 20% surge charms investors but is a correction on the way?

- Litecoin made its way to the top 10 cryptocurrencies as of 23 June.

- Despite a positive price action, LTC’s metrics didn’t favor the altcoin to a great extent.

Now that the end of Q2 2023 is near, the cryptocurrency market was seen making progress in full swing. Most cryptocurrencies stood in the green and were witnessed making bullish strides. One such cryptocurrency was Litecoin [LTC].

As of 23 June, the Litecoin Foundation announced the launch of Litecoin Space which will help the blockchain focus on memepool visualization. Furthermore, the block explorer would also benefit developers in a number of ways.

How much are 1,10,100 LTCs worth today?

In addition to the aforementioned information, Litecoin also posted another promising update. As of 10.53 AM PDT, Litecoin entered the list of top 10 cryptocurrencies on CoinMarketCap. This could be some good news for LTC holders as these updates could be an indication of a recovering altcoin.

Was recovery en route?

A look at LTC’s daily price chart painted an extremely positive picture for the altcoin. At press time, the alt was exchanging hands at $91.65 and was up by 5% as compared to its opening price for the day.

Furthermore, a look at the Relative Strength Index (RSI) also favored a bullish narrative. The RSI stood in an ascending direction at 63.05. This indicated the presence of significant buying pressure around LTC. The Awesome Oscillator (AO) too flashed green, although below the zero line.

In addition to the aforementioned indicators, LTC’s Moving Average Convergence Divergence (MACD) favored the bulls. At the time of writing, the MACD line (blue) was moving upwards and was seen midway of an attempt to cross the zero line. On the other hand, the signal line (red) hovered below the MACD line.

This was a strong bull signal.

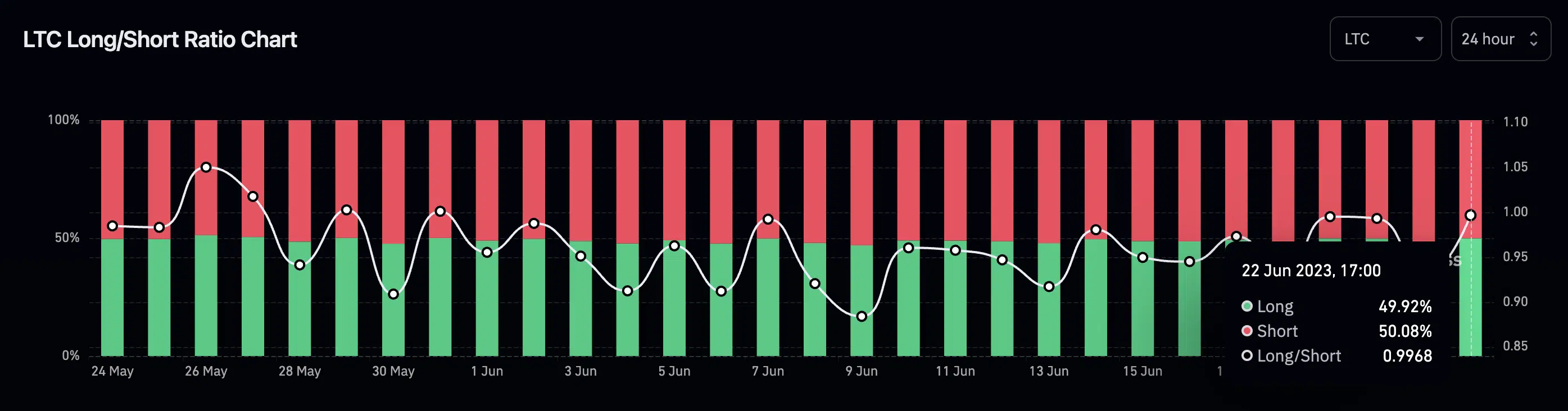

Despite the aforementioned bullish strides, data from coinglass indicated that LTC holders held higher short positions as compared to longer positions. In the event that traders short LTC, the ongoing price action could change its course.

This could lead to LTC undergoing a price correction. At press time, LTC’s long/short ratio stood at 0.9968.

Caution could be key

As per data from CoinMarketCap, LTC was exchanging hands 6.67% higher in the last 24 hours and almost 20% higher over the last seven days. However, data from the intelligence platform Santiment painted a slightly different picture.

Although the total amount of holders stood at a high of 8.73 million, its weighted sentiment stood at -0.446. This wasn’t a very great indicator for the altcoin as it showed that traders didn’t have a positive outlook towards the altcoin.

Realistic or not, here’s LTC’s market cap in BTC’s terms

Additionally, LTC’s social dominance also dropped after reaching a peak just a few days ago. This was evidence that LTC wasn’t doing great on the social front either.

Despite a not-so-appealing front put forth by the metrics, LTC’s price action stood tall. However, traders may want to look out for any price correction over the weekend incase short traders begin walking the profit taking path.