LUNA: Identifying the right opportunity before probable 45% rally

A look at LUNA’s price, at press time, indicated that a short-term pullback would be necessary before a massive leg-up. This fact can be supported by technical and on-chain metrics and will serve as an opportunity for sidelined buyers to accumulate LUNA.

A perfect concoction of technicals and on-chain metrics

The altcoin’s price set up a range, extending from $43.34 to $87.92 as it crashed by roughly 50% between 15 and 22 January. After establishing a stable base, LUNA rallied by 74% and pierced the four-hour demand zone, stretching from $75.57 to $79.40. Due to the blockade, the alt’s price set a swing high of $79.52.

Interestingly, between 15 January and 26 February, LUNA set up lower highs while the Relative Strength Index (RSI) created a higher high. This setup is a bearish divergence and forecasts that a retracement is likely. Due to the blockade and the bearish divergence, the resulting price action will be a retracement that drags LUNA down to another stable support level.

The contenders of such a barrier include the 50% retracement level at $65.63 and the 70.5% retracement level at $56.49. Although the crypto might slide lower, the bullish thesis will stay intact as long as the altcoin stays with the formed range.

A reversal at the levels mentioned above will lead to a strong uptrend, one that slices through the said demand zone and tag the range high at $87.92.

Here’s the support system

Supporting the short-term retracement is the recent decline in the funding rate of Terra from 0.01% to -0.04%. This sudden dip indicates that investors are booking profits and that the majority of the traders are betting for a retracement.

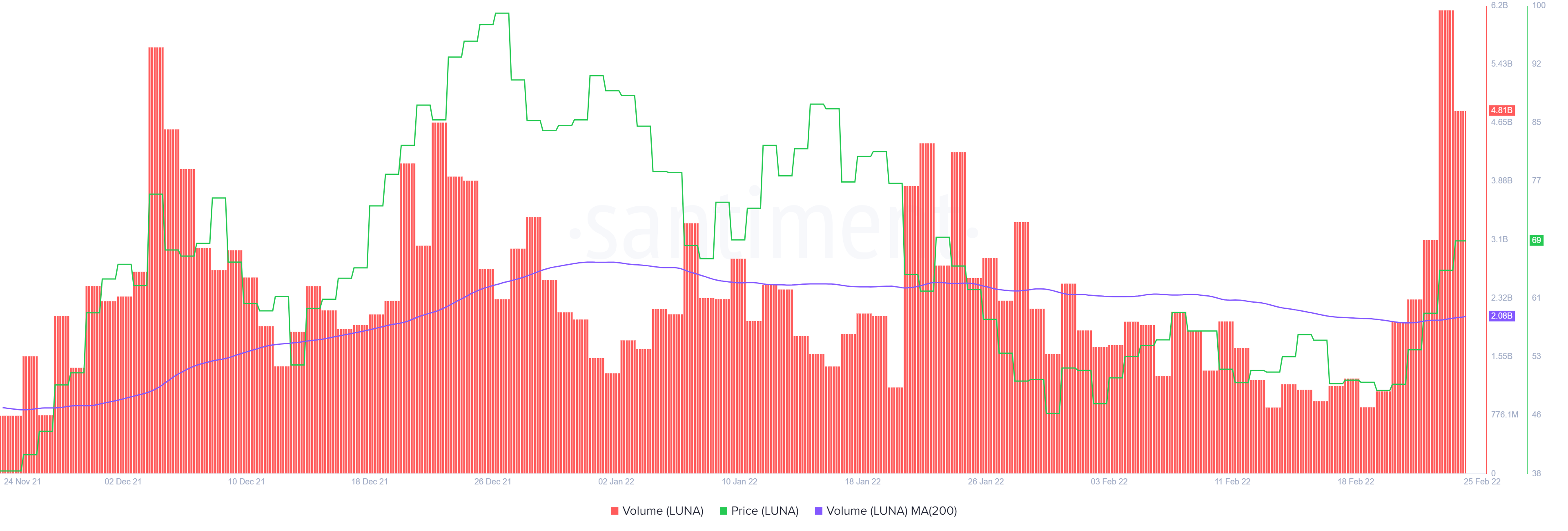

While the short-term outlook might seem bearish, it is an opportunity for sidelined buyers to accumulate since the overall trend is still bullish. Implying a similar outlook for the altcoin is the recent spike in on-chain volume from 881.73 million to 6.14 billion from 19 to 24 February. This massive upsurge has pushed way past the 200-day moving average, indicating that high net worth investors are interested in LUNA at the current price levels.

While the situation is looking optimistic for LUNA, market participants need to pay close attention to the ongoing retracement. If this retracement breaks below the 79% retracement level at $52.7, it will reveal that the bulls are weakening. However, a swing low below $43.34 will invalidate the bullish thesis.