LUNC’s 1.2% tax burn may lead to a brighter future, what about the present

The much-awaited 1.2% tax burn was implemented on the Terra Classic [LUNC] blockchain recently. Thus, giving massive hope to investors for the token’s revival. Though the protocol received much support from multiple crypto exchange platforms, including KuCoin, LUNC’s price did not correspond accordingly.

Moreover, just a day after the roll out, it was announced that LUNC’s 1.2% tax burn protocol was facing issues.

BREAKING :

A couple major CEX's like @binance ran into issues implementing the onchain. That's why #LUNC volume has dropped off. Deposits and withdraws have been suspended.

Once the issue has been resolved, especially on Binance, burning and volume will explode ⚡️?

— LUNC Community ? (@lunaclassic_co) September 23, 2022

However, investors and enthusiasts still remained confident despite the setback. LUNC HODLers believed that LUNC would continue surging and reclaim its past glory in the months and years to come. However, let’s look at what’s happening in the ecosystem to better understand what to expect.

Facts vs Rumors

The information regarding some issues with the protocol when revealed, was followed by information that stated developers were working on fixing the problem. No matter the issue, the good news was that more than four billion LUNC tokens were burnt after the roll out, with a daily burn rate of over 243 million.

This was definitely a positive development, as burning such large amounts would limit LUNC’s supply in the future. Thus, driving the price of LUNC higher in the long run.

?Total Burned $LUNC TODAY

?Daily Rate burned 243,589,240

✅RETWEET IF YOU WANT MORE BURN TO HAPPEN #LUNCBURNING #LUNCBURN #LUNC

???????????????? pic.twitter.com/gGMgxvypLb

— LunaClassic HQ ? ™ ? (@LunaClassicHQ) September 22, 2022

Interestingly, amid all these developments, some misinformation also surfaced on social media. For instance, people on Twitter did not have much clarity on the Binance episode.

A popular crypto influencer, Classy, via Twitter mentioned the actual scenario, which helped in clearing the cloud regarding Binance’s position. He mentioned that LUNC’s network burns are supported by Binance, and if added, the burn will significantly increase.

If you've been asking whether or not @binance WILL be supporting the 1.2% On-Chain $LUNC tax here's your PROOF!

Some are spreading MISINFORMATION on this topic.

Binance IS supporting network burns & the burn WILL increase drastically once added.RETWEET TO SPREAD THE MESSAGE!? pic.twitter.com/f01if2G3J5

— Classy ? (@ClassyCrypto_) September 22, 2022

Here is what to expect

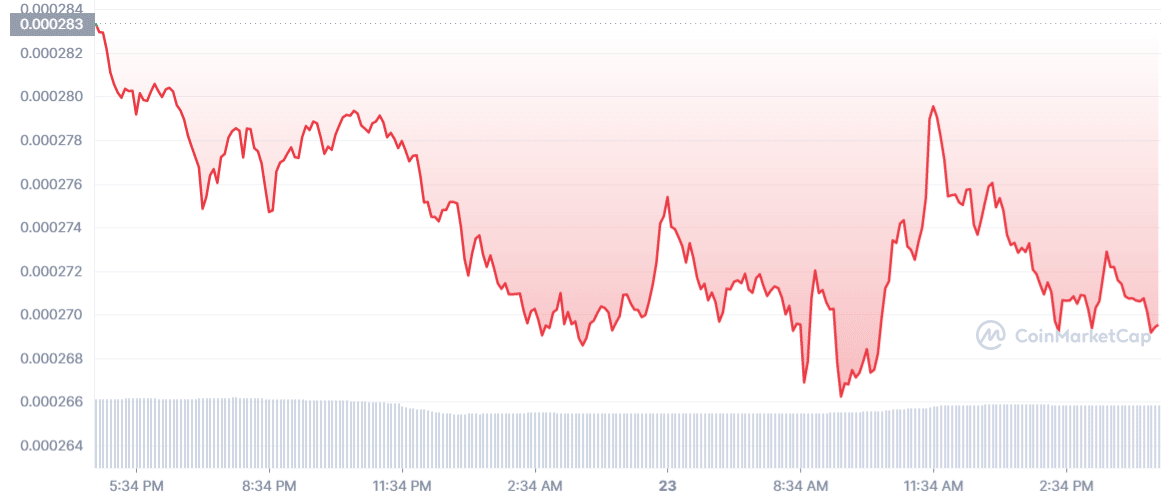

LUNC, which registered massive upticks in the last month, failed to meet the expectations of investors after the tax burn. At the time of writing, LUNC registered negative 3.40% 24-hour gains and was trading at $0.0002573 with a market capitalization of $1,585,327,915.

Furthermore, data from Santiment also revealed a few reasons that might have played a role in this decline. For instance, LUNC’s trading volume decreased considerably over the last few days. Additionally, the blockchain’s network activity also followed a similar route of steep decline.

As of 23 September, LUNC’s four-hour chart also painted a similar picture, as most of the market indicators suggested a bearish market.

For instance, the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF), both registered downticks. This suggested a sellers’ advantage in the market.

Moreover, the 20-day Exponential Moving Average (EMA) was below the 55-day EMA, which was also bearish. Therefore, what’s in store for the recently revived token is yet to be seen.