Maker: As MKR sees ‘Cup-and-Handle’, watch out for THESE resistance levels

- MKR broke a long-term downtrend, with analysts forecasting a $5K target.

- 62% of holders profit as MKR aligned with Ethereum growth.

Maker [MKR] is drawing attention as Ethereum [ETH] climbs to new heights, with analysts suggesting MKR could target $5,000 in 2025. A breakout from a prolonged downtrend and bullish chart patterns support predictions of a potential rally.

MKR was trading at $1,727.42, at press time, after experiencing a slight decline of 0.69% in the last 24 hours a weekly drop of 15.47%. However, its market cap stands at $1.54 billion, supported by a circulating supply of 890,000 MKR tokens.

A rise in Ethereum prices, coupled with MKR’s recent technical patterns, suggests that the token could gain momentum in the coming months.

Analysts have identified critical support levels and highlighted the influence of ETH’s performance on MKR’s price trajectory.

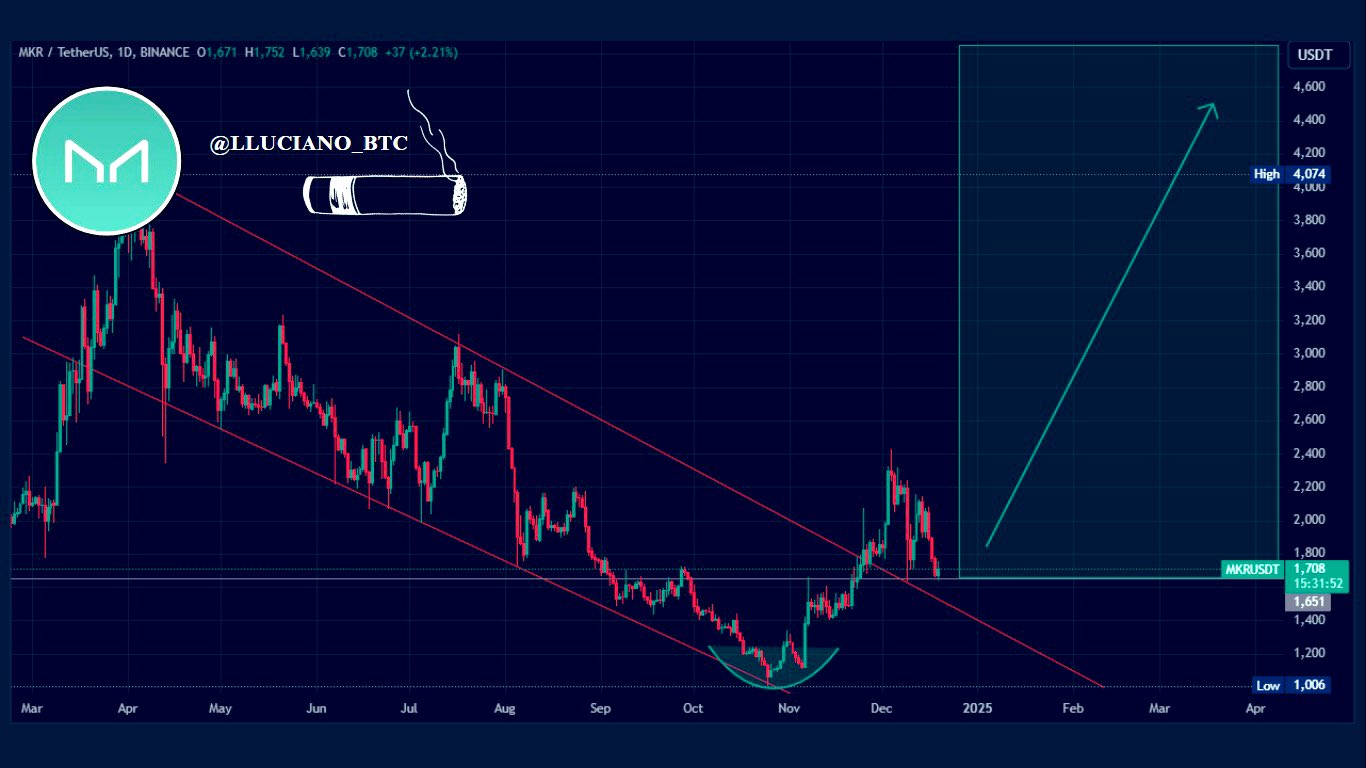

Breakout from a prolonged downtrend

Between March and November 2024, MKR experienced a prolonged downtrend, trading within a descending channel characterized by lower highs and lower lows.

However, the price successfully broke out of the channel in late November, signaling a potential reversal.

Additionally, a bullish cup-and-handle pattern, visible between September and November, adds to the positive outlook.

The pattern is associated with rallies, with the “cup” reflecting gradual accumulation and the “handle” representing brief consolidation before an upward breakout.

These technical indicators suggest potential upward price movement in the medium term.

Key technical levels to watch

The price currently hovers around $1,746, with support levels at $1,760 and $1,440. Resistance levels include $2,200, $3,800, and a potential high of $4,400.

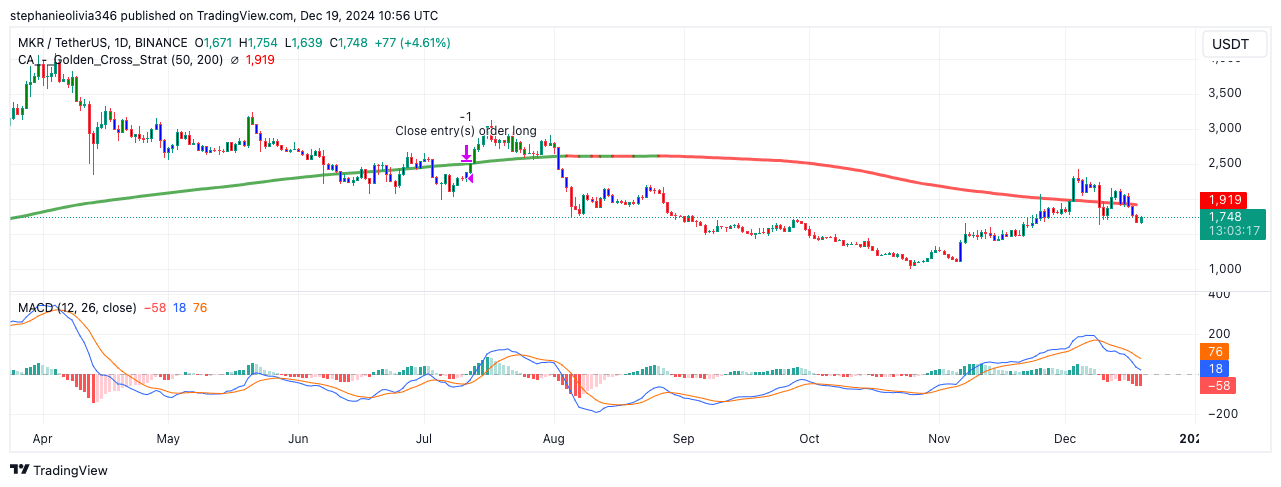

The 50-day Moving Average(MA) recently crossed above the 200-day MA in a golden cross formation, signaling bullish momentum.

However, MKR is now trading below the 200-day moving average ($1,919), indicating that this level may act as resistance.

To sustain bullish momentum, the price must reclaim this critical level. If MKR fails to hold above $1,700, it may test support near $1,500.

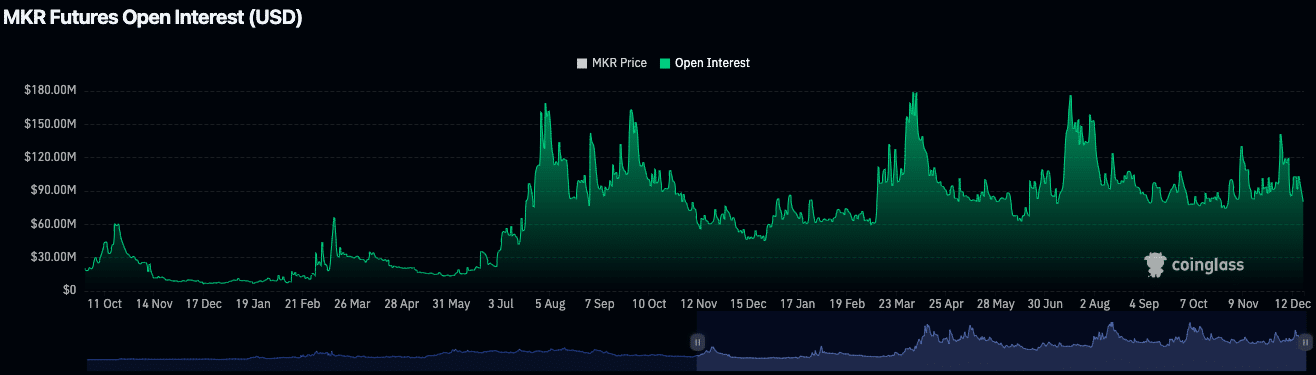

Reduced futures market activity for MKR

Data from Coinglass shows MKR’s futures market Open Interest(OI) declined by -8.67% to $78.83 million, indicating reduced activity. Despite this, trading volume has increased by 41.59% over the same period, reaching $184.94 million.

The decrease in OI may reflect waning speculative activity or a reduction in leveraged positions.

Source: Coinglass

Historically, OI has shown spikes during periods of heightened volatility. The recent dip suggests a pause in speculative momentum but does not negate the possibility of renewed activity as bullish sentiment builds around Ethereum’s growth.

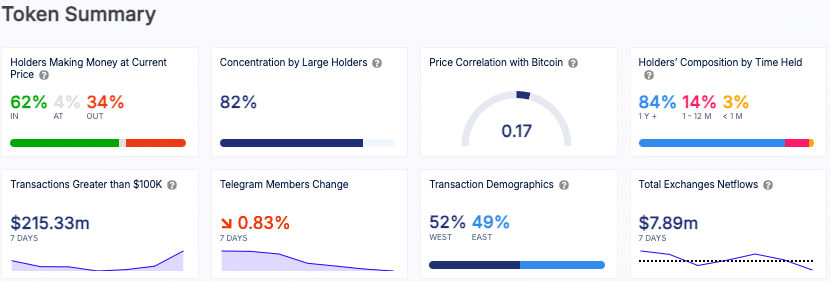

Long-term holder confidence in MKR remains high

On-chain data showed that 62% of MKR holders remain in profit at the current price, with 84% classified as long-term investors holding for over a year.

Large holders control 82% of the supply, reflecting high concentration but also long-term confidence in the token’s potential.

As Ethereum achieves new highs, MKR’s performance appears tied to the broader crypto market’s trajectory.