Maker eyes 35% rally to $3,200 as THESE metrics fuel bullish sentiment

- MKR’s open interest has skyrocketed by 37% in the past 24 hours indicating traders’ strong participation.

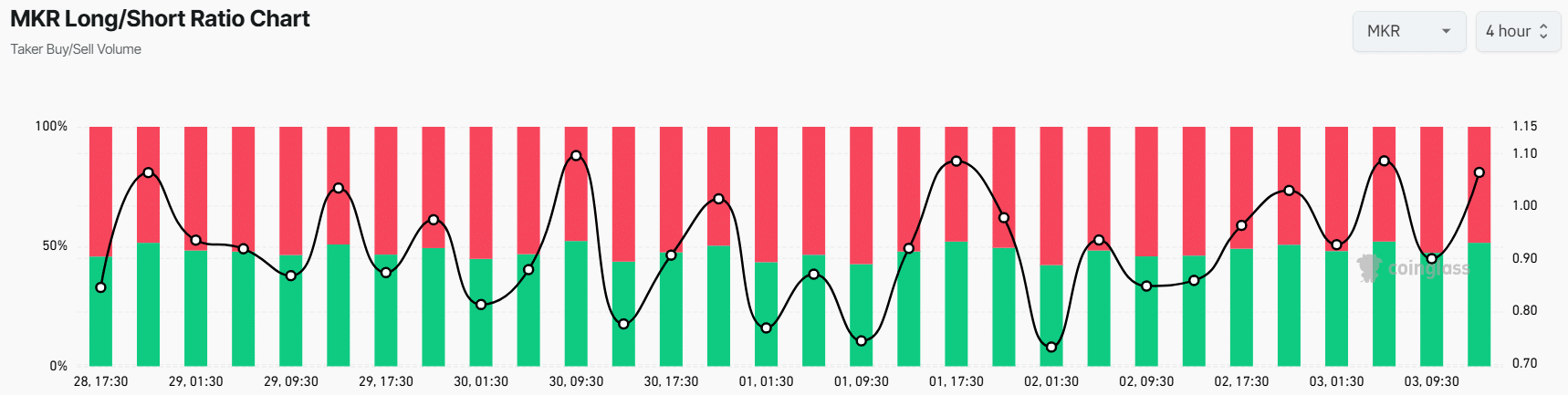

- MKR’s Long/Short ratio indicates a strong bullish sentiment among traders.

MKR, the native token of MakerDAO is poised for a notable upside rally as it has formed a bullish price action pattern on a daily time frame.

However, it appears that whales and traders have shown a strong confidence and interest in the token as reported by on-chain analytics firm Coinglass.

MKR’s rising open interest

This notable interest and confidence in the altcoin follow its breakout from a prolonged descending trendline. Data shows that MKR’s open interest has skyrocketed by 37% in the past 24 hours and 16% in the past four hours.

This growing OI indicates strong trader participation in the altcoin, leading to a significant increase in new open positions.

In addition to rising OI, MKR’s Long/Short ratio currently stands at 1.08, indicating a strong bullish sentiment among traders. According to the data, at press time 53% of MKR’s top traders hold long positions, while 47% hold short positions.

The combination of on-chain metrics suggests that investors and traders are currently dominating the asset and could support it in an upcoming rally.

Maker technical analysis and key levels

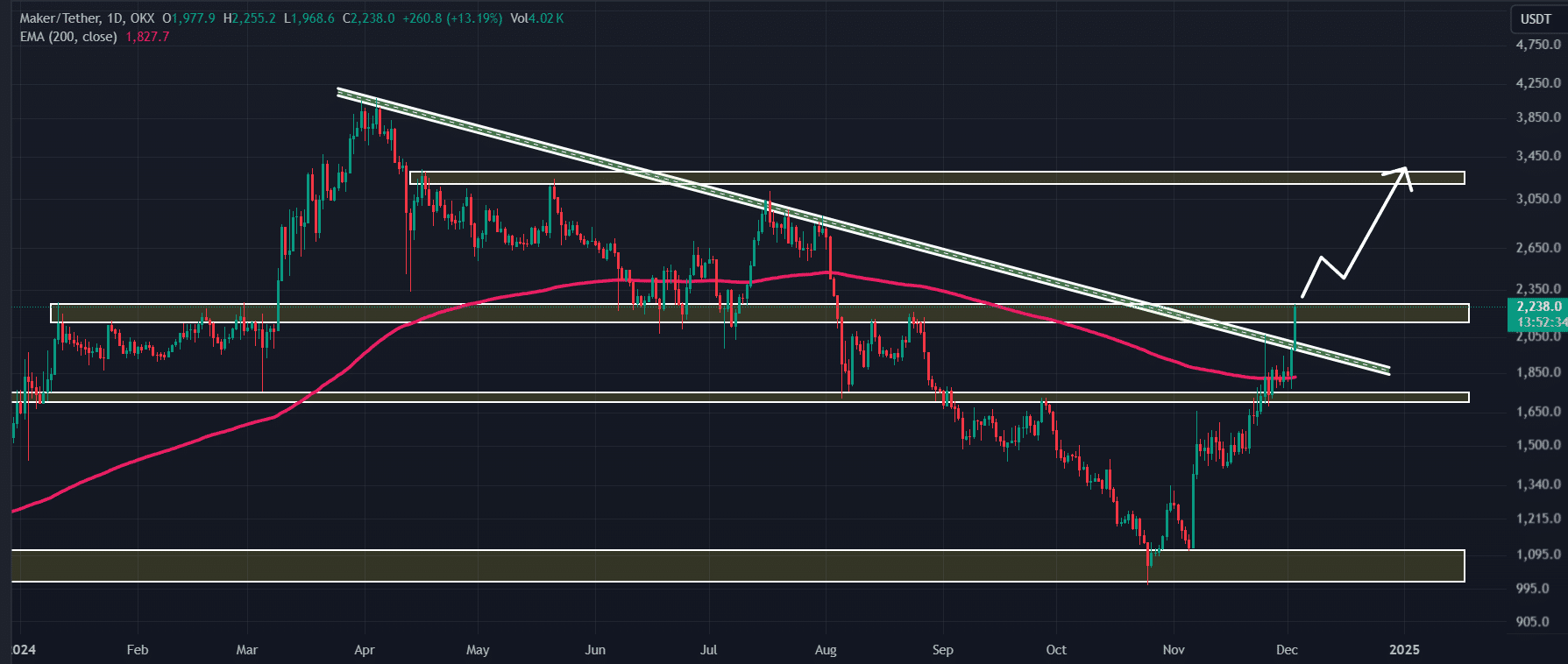

According to AMBCrypto’s technical analysis, MKR, after breaching a prolonged descending trendline, is currently struggling near a strong resistance level of $2,220 but is poised to break through.

Based on recent price action and historical momentum, if MKR breaches and closes a daily candle above the $2,230 level, there is a strong possibility it could soar by 35% to reach the $3,200 level in the coming days.

MKR was trading above the 200-day Exponential Moving Average (EMA) on the daily timeframe at press time, indicating an uptrend. However, its Relative Strength Index (RSI) suggests a potential price correction, as the RSI value is in overbought territory.

Read Maker’s [MKR] Price Prediction 2024–2025

The RSI is a technical indicator that traders and investors use to determine whether an asset is in an overbought or oversold area, helping them decide when to build positions.

At press time, MKR was trading near the $2,220 level and has registered a price gain of over 24% in the past 24 hours. During the same period, its trading volume surged by 180%, indicating heightened participation from traders and investors amid a bullish outlook.