Maker: How MKR defies market trends and targets a 50% rally

- iCryptoai reported that MKR was in the SDT accumulation zone.

- Traders were over-leveraged at $1,062 on the lower side and $1,144 on the upper side.

At the time of writing, Maker [MKR] was defying the bearish trend with a 14% price hike.

The key reasons behind this rally are the consistent increase in investor and trader interest, along with its bullish price action forming on the daily timeframe.

Maker’s price action and upcoming level

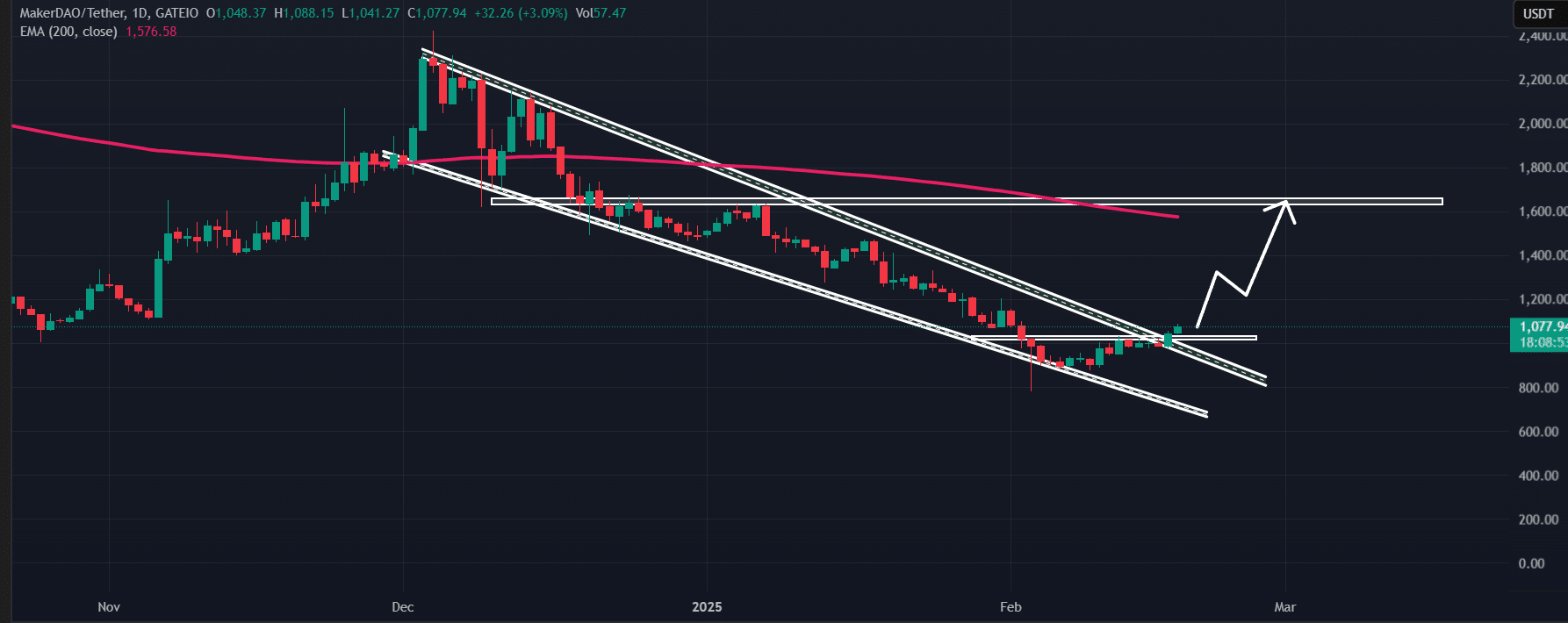

According to AMBCrypto’s technical analysis, MKR has broken out of a descending channel pattern on the daily timeframe. Following the breakout, MKR seems to be reversing its prolonged bearish trend into a bullish phase.

Based on the recent price pattern, it is possible that MKR could soar by 50% to reach the $1,600 level in the future.

Investors’ rising interest

Recently, the blockchain-based crypto intelligence firm iCryptoai made a post on X (formerly Twitter).

They stated that smart DEX traders and whales have consistently accumulated MKR tokens over the past few days. The post noted that on DEX trades, the buy volume from whales and traders continues to dominate the selling volume, making it more bullish.

However, the intelligence firm also noted that MKR is currently in the SDT accumulation zone. This might be the reason behind the consistent accumulation, ultimately leading to a price surge.

$2.81 million worth of MKR inflow

Despite this bullish outlook from investors and traders, some long-term holders have been cashing out their holdings, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow revealed that exchanges across the crypto landscape have witnessed an inflow of $2.81 million worth of MKR tokens in the past 24 hours, potentially signaling a sell-off.

Rising Open interest and bulls’ bet

The intraday traders appear more confident, increasing their open positions in the past 24 hours. Data shows Maker’s Open Interest (OI) jumped by 20.5%.

At press time, traders betting on the long side dominate, encouraging holders to maintain their bullish stance on the token. This might be the reason for the jump in Maker’s OI.

Currently, $1,062 is where traders holding long positions are over-leveraged, with $2.20 million in long positions.

Meanwhile, $1,144 is another level where short sellers are over-leveraged, currently holding $970K in short positions.

When combining these on-chain data points, it appears that bulls are back to support MKR tokens. They drive a price rebound after its earlier decline.

At press time, MKR was trading near $1,115 after surging over 14% in the past 24 hours.

Despite all these bullish on-chain metrics, MKR’s current price action suggests trader interest and whale accumulation will continue in the coming days.