Maker [MKR] hit a key resistance level- Will shorting yield profit?

![Maker [MKR] hit a key resistance level- Will shorting yield profit?](https://ambcrypto.com/wp-content/uploads/2023/03/jared-schwitzke-GqaXA9m_0IY-unsplash-scaled-e1677680527520.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- MKR reclaimed November’s pre-FTX level.

- The coin saw short-term sell pressure, which could undermine the uptrend momentum.

Maker’s [MKR] rally could slow down as it faces key obstacles on its upward trajectory. The token hiked by 16% and 20% in the past 24 hours and seven days, respectively, according to CoinMarketCap.

However, it has reached a crucial resistance level of $915, which could derail the momentum of the uptrend.

Read Maker’s [MKR] Price Prediction 2023-24

In another new development, MakerDAO has approved Aave’s Direct Deposit Module with a debt ceiling of 5 million DAI units. The move is aimed at stabilizing the borrowing rate of DAI at 2%. The liquidity provision will also extend to Aave’s rival, Compound Finance.

D3M with debt ceiling of 5 million DAI deployed to @AaveAave protocol.

5 million of fresh DAI generated and supplied to @AaveAave protocol's DAI market.

??? pic.twitter.com/prTVJI9i4O

— Maker (@MakerDAO) February 28, 2023

The $915 obstacle – Can bulls bypass it?

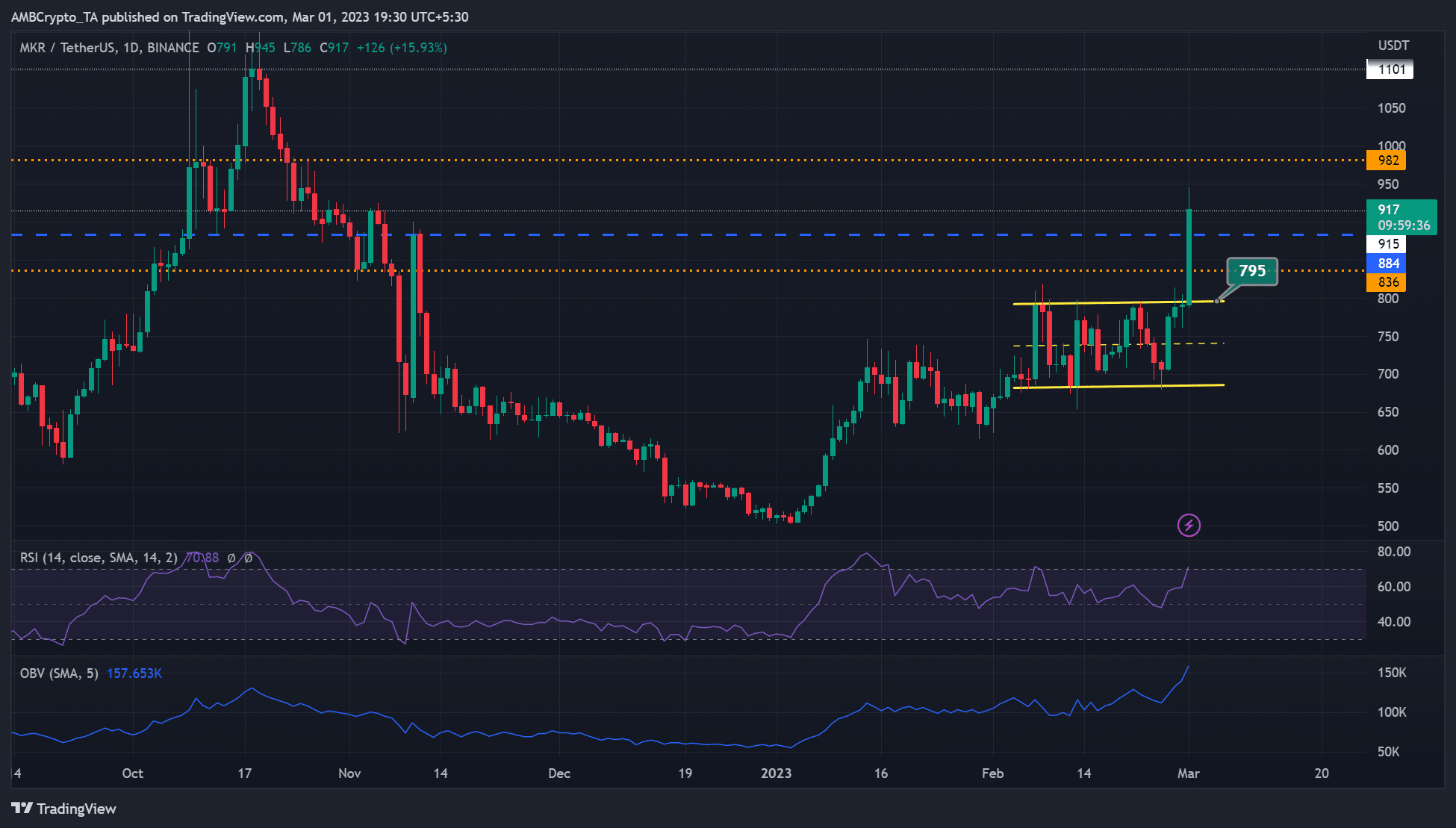

MKR consolidated within the $682 – $795 (orange parallel channel pattern) throughout February. However, it started March on a high note after inflicting a bullish breakout. It hit the $900 zone, reclaiming its pre-FTX levels and offering over 10% gains.

However, $915 is a crucial resistance level, which could slow down the uptrend momentum. Notably, the RSI also hit the overbought zone, which could further fuel the probability of price reversal.

A correction could see MKR settle at $884, $836, or the channel’s upper boundary of $795. These levels could offer shorting opportunities if the correction is confirmed. Short-sellers should only make moves if MKR fails to close above $915.

A break above the $915 obstacle will invalidate the above bearish thesis. Such an upswing could push bulls to target $982 and $1100 – a 20% potential hike.

Is your portfolio green? Check out the MKR Profit Calculator

MKR saw short-term selling pressure alongside a negative sentiment

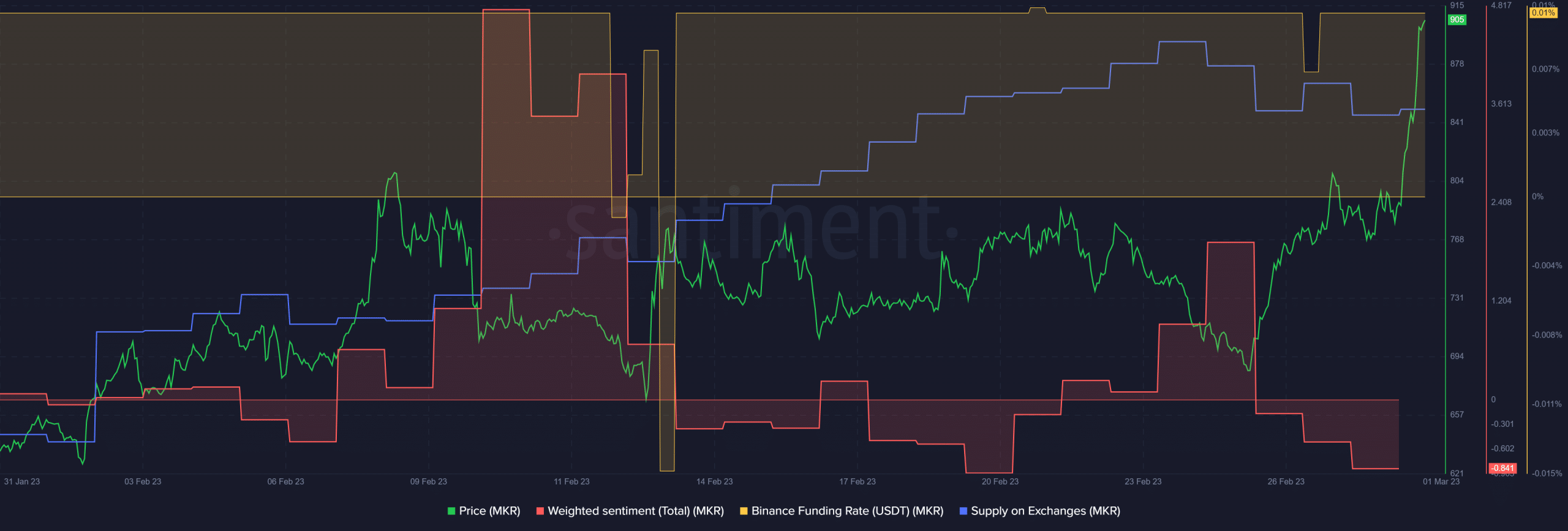

According to Santiment, MKR’s weighted sentiment dropped deeper into the negative territory.

In addition, short-term sell pressure increased, as shown by a spike in supply on exchanges, indicating more MKR tokens were on sale as investors sought to lock in short-term profits. If the trend continues, MKR could fail to close above $915, giving bears more influence in the market.

However, the Funding Rate remained positive, showing MKR was bullish in the derivatives market, which could boost further uptrend momentum.