Maker [MKR] posted an extra 10% gain – Is November high reachable?

![Maker [MKR] posted an extra 10% gain – Is November high reachable?](https://ambcrypto.com/wp-content/uploads/2023/02/christian-wiediger-y5qQJddyGmU-unsplash-scaled-e1676005778747.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- MKR mounted above its bullish flag but faced a price rejection at press time.

- Demand remained stable, but BTC’s price action could determine MKR’s price direction.

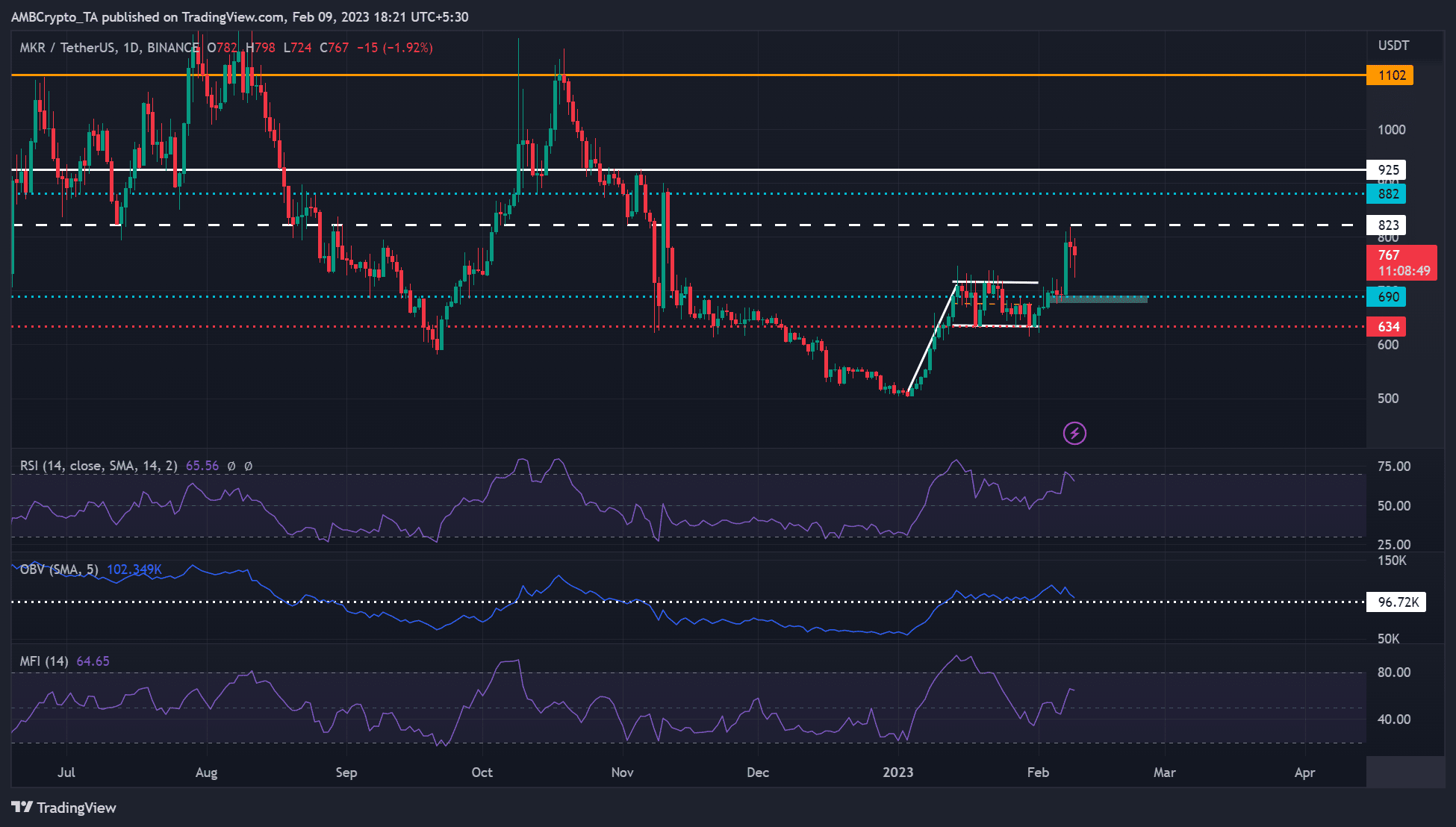

Maker [MKR], at press time, was closer to its November high of $925, but a few hurdles could complicate matters. At press time, MKR faced a price rejection at $823. The rejection threatened to eat away recent gains posted after escaping a price consolidation phase.

Read Maker’s [MKR] Price Prediction 2023-24

MKR mounted above its bullish flag – Will the uptrend continue?

MKR’s price action in January formed a bullish flag pattern – implying a high chance of a further rally. Indeed, MKR broke above it and posted another 10% gain on top of the January rally. But the token faced price rejection at $823 and flashed a red signal by the time of writing.

Is your portfolio green? Check out the MKR Profit Calculator

Notably, the altcoin could strive to break above the $823 level because the Relative Strength Index (RSI) denoted a bullish market structure. Similarly, the Money Flow Index (MFI) moved upward from the lower ranges, indicating an accumulation trend.

As such, MKR bulls could break above the overhead resistance level of $823 and target the November high of $925. The upswing could be accelerated if BTC breaks above the $22.75K level. At the same time, the bulls must clear the $882 hurdle to reach their target.

A drop below $690 would invalidate the bullish bias described above. The plunge could be accelerated if BTC falls below $22.5K. But bulls may find a steady hold at the $634 level in such a scenario.

MKR saw an accumulation trend and rising trading volumes

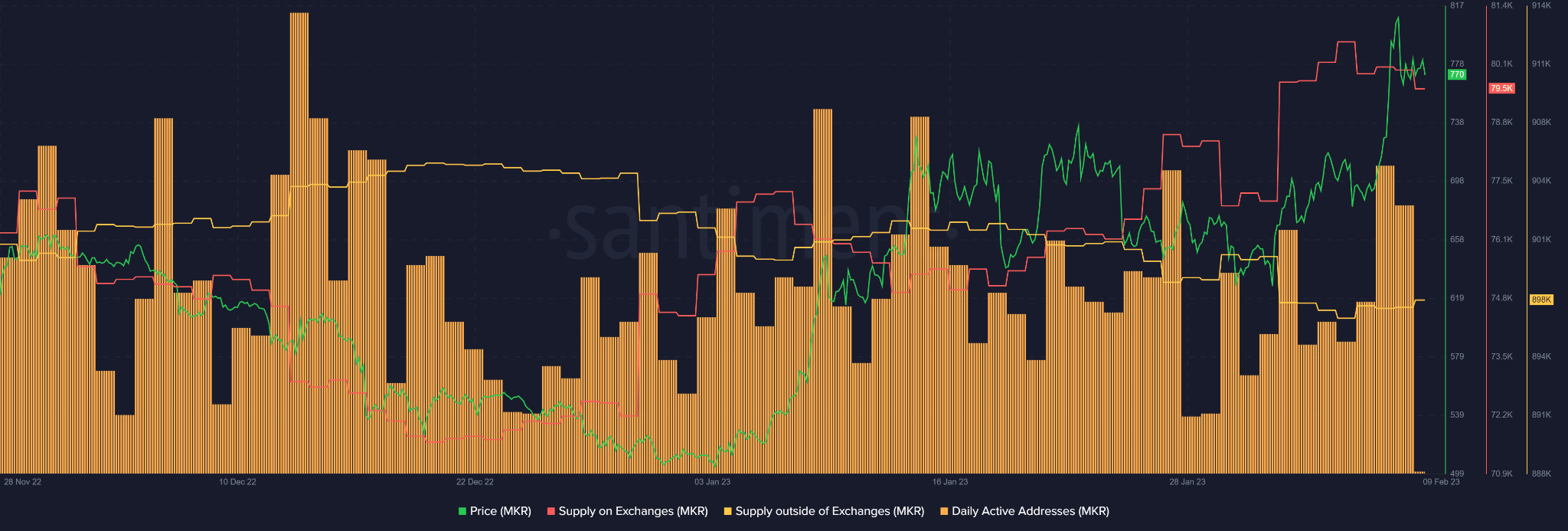

As per Santiment, MKR saw an accumulation trend as demand for the asset increased. Notably, MKR’s supply on exchanges dropped at press time, indicating limited sell pressure.

On the other hand, its supply outside of exchanges registered a slight uptick, indicating a rising demand and accumulation trend for the asset.

If the trend is sustained, MKR could attempt to retest or break above the $823 resistance level. In addition, the daily active addresses rose in the past few days, showing that more accounts exchanged MKR tokens.

As such, the trading volumes and uptrend momentum were boosted. A continuation of the trend could tip bulls to clear hurdles and target the November highs.

But if BTC drops below $22.5K, volumes could drop, offering bears a chance to extend MKR’s price correction.