MakerDAO has a new proposal to increase Compound D3M Debt Ceiling

- MakerDAO is set to introduce some changes to its Compound V2 D3M.

- MKR has seen a decline in buying pressure in the last week.

In a new proposal, the Open Market Committee of leading decentralized finance platform (DeFi) MakerDAO has sought community approval to increase the maximum debt ceiling on its Compound DAI Direct Deposit Module (Compound V2 D3M) by 300% and to set the Target Available Debt on the same vault to 5 million DAI.

??? A new wave of fresh 15 million DAI is getting ready for a direct, automated, and algorithmic deposit into @compoundfinance.

If enacted, the currently active Executive Vote will raise the Compound D3M Debt Ceiling from 5 million DAI to 20 million DAI! pic.twitter.com/NUZbuMc5jc

— Maker (@MakerDAO) January 27, 2023

According to its Operational Manual, MakerDAO’s DAI Direct Deposit Module (D3M) is a tool that enables the creation and deposit of DAI into other lending protocols on the Ethereum blockchain in exchange for a deposit/collateral token from those protocols.

It allows MakerDAO to distribute newly minted DAI through other lending protocols while maintaining a full backing of DAI.

Realistic or not, here’s MKR’s market cap in BTC terms

In December 2022, D3M was deployed on Compound Finance with a DAI supply of 5 million DAO tokens. The maximum debt ceiling was also pegged at 5 million DAI.

D3M deployed.

5 million fresh newly generated DAI have been deposited into @compoundfinance.

→ https://t.co/NOxDL5ugo6 pic.twitter.com/sPnttbj5hO

— Maker (@MakerDAO) December 6, 2022

The maximum debt ceiling represents the upper limit of the total debt that can be generated as DAI on Compound V2 D3M. This is usually specified and fixed to ensure the stability of the platform. With the new proposal, MakerDAO is seeking to raise the debt ceiling to 20 million DAI.

Further, the Target Available Debt on Compound V2 D3M will also be set to 5 million DAI, should the new proposal go through.

The Target Available Debt or “Gap” in MakerDAO is a measure of the amount of debt that can be safely generated in its vaults without compromising its stability.

Wholistically, these parameter changes aim to increase the ability of the MakerDAO to generate more debt in the form of DAI while maintaining a stable system and ensuring that there is enough collateral to back the generated DAI.

By increasing the Maximum Debt Ceiling and setting the Target Available Debt to a specific value, the DeFi protocol will be able to generate more DAI while also ensuring that there is enough collateral to back it.

This could lead to a more robust and efficient system, allowing more users to participate and generate DAI.

Read MakerDAO’s [MKR] Price Prediction 2023-2024

MKR in the last month

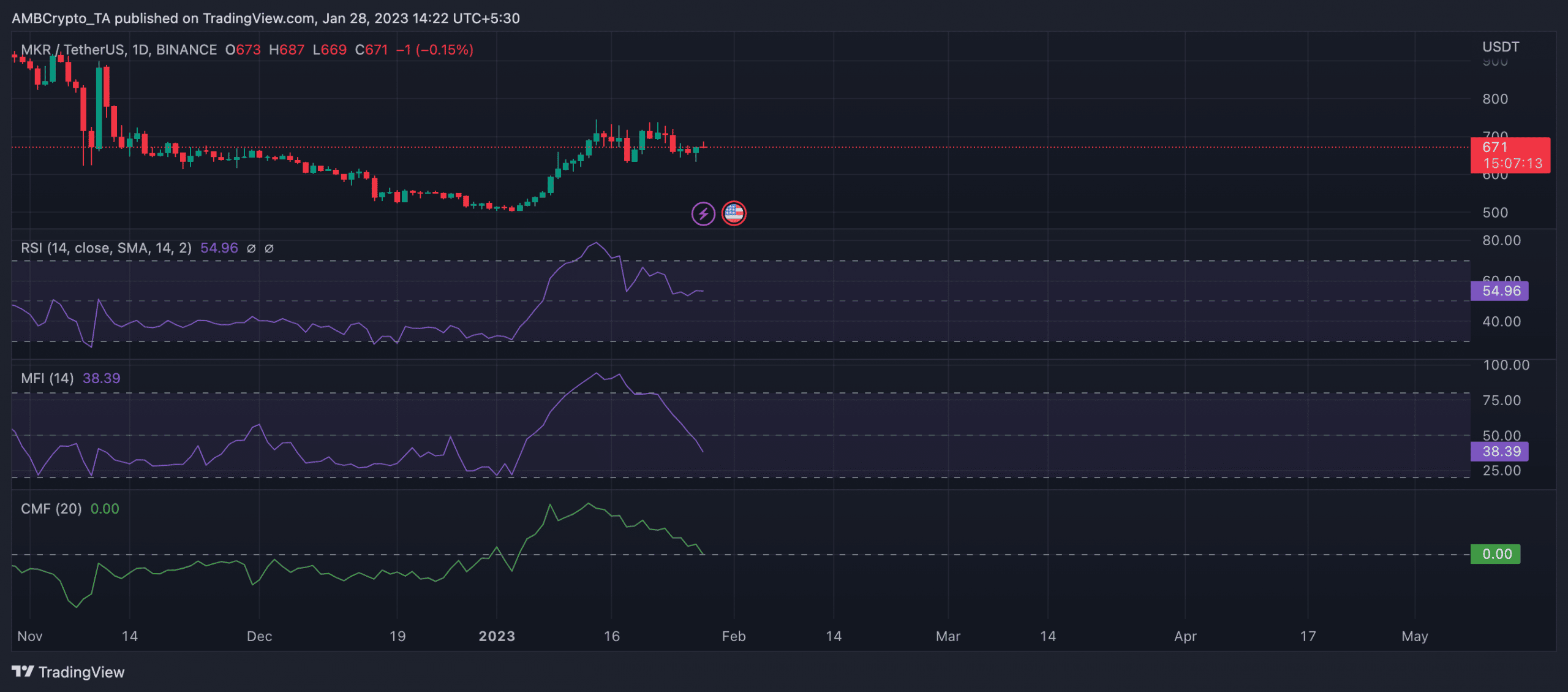

MKR’s price grew substantially in the first three weeks of the month but has embarked on a decline in the last week. Per data from CoinMarketCap, the alt’s value has dropped by 7% in the last week. At press time, MKR exchanged hands at $672.05.

On a daily chart, key momentum indicators were spotted in downtrends, suggesting a waning buying pressure. In fact, the token’s Money Flow Index (MFI) breached the 50-neutral region to be pegged at 38.39 at press time.

Also, the dynamic line (green) of the asset’s Chaikin Money Flow (CMF) rested on the center line at 0. All of these showed a significant decline in buying MKR momentum in the last week.