MakerDAO [MKR]: Here’s all you need to know about the protocol’s “Endgame”

![MakerDAO [MKR]: Here's all you need to know about the protocol's "Endgame"](https://ambcrypto.com/wp-content/uploads/2023/05/makerDAO_Endgame_1200x900.png)

- The development could result in a new ERC-20 token to support DAI.

- Co-founder says Ethereum deployment was necessary for tokenomics and security.

In an update released on 11 May, MakerDAO [MKR] disclosed that it was working to develop the project’s efficiency using Artificial Intelligence (AI). Termed “Endgame”, Maker noted that the process of finalizing the objectives might take five different phases.

Realistic or not, here’s MKR’s market cap in ETH terms

The decentralized protocol, which is also the issuer of the DAI stablecoin, mentioned that Endgame’s short-term objective would be to expand DAI’s dominance in the stablecoin market.

The communiqué, posted on Maker’s forum read,

“The short term objective of Endgame is to grow to the largest and most widely used stablecoin project within 3 years, and from there ensure that the growth is anchored in an autonomous and vibrant DAO economy.”

A fresh token should be in town

Furthermore, the explainer hinted at the creation of a new ERC-20 governance token to serve as an underlying asset for DAI and increase on-chain liquidity.

Apart from the focus on the stablecoin, Maker highlighted another important part.

According to the post, published by co-founder Rune Christensen, the AI-based development would lead to the creation of a new blockchain.

However, Christensen revealed that this was going to be the last step. Also, he noted that the blockchain would be strongly tied to Ethereum [ETH].

Citing reasons for the connection to the second-largest blockchain, the co-founder wrote,

“The final step of Endgame will be the deployment of a new blockchain that is tightly coupled to Ethereum while increasing the governance security of the ecosystem and implementing the full range of advanced Endgame features and tokenomics.”

To persist amid the shadows

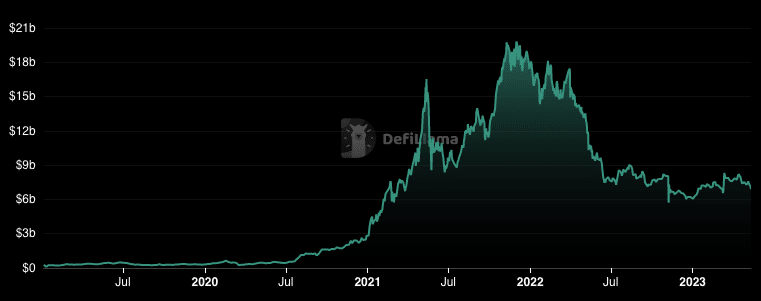

Lately, MakerDAO has been in the shadows of Lido Finance [LDO] in the Decentralized Finance (DeFi) space.

This has led to a drop in its Total Value Locked (TVL) position since the latter has been a core contributor to the staking activity on the Ethereum blockchain.

However, the project highlighted other phases including governance participation, SubDAO introduction, and the governance AI tools launch. All these were projected to happen before the final deployment of the blockchain.

While it was uncertain if the blockchain launch would impact the TVL, DeFiLlama showed that smart contract deposits on the protocol have decreased. At press time, the MakerDAO TVL lost 6.16% of its worth over the last week.

Read MakerDAO’s [MKR] Price Prediction 2023-2024

When the TVL increases, it implies that the health of a protocol is at its best. But when it falters, it depicts a situation of low liquidity and declining investors’ interest.

In addition, Maker noted that the launch of the new chain would improve the self-sustainability and immutability of the protocol.