MakerDAO proposes changes post recent bull cycle, details inside

- MakerDAO is proposing some changes to some of its vaults.

- Members of the MakerDAO community have voted against the loan requested by Cogent bank.

Leading DeFi platform MakerDAO [MKR] has proposed changes to some of its vaults, in a bid to better align them with risk and incentivize growth. This move comes as borrowing rates on MakerDAO and other DeFi platforms have risen in recent months due to market bullishness and the surge in risk appetite.

Read Maker’s [MKR] Price Prediction 2023-2024

Likewise, stablecoin borrowing costs have gone up, and centralized funding costs have also increased. In addition, general financial conditions have tightened due to persistent inflation, resulting in higher benchmark rates. Therefore, MakerDAO’s proposed changes were imperative to address these challenges and ensure the platform’s stability and growth.

The proposed changes include increasing the stability fee for low-rate vault types, such as ETH-C, WSTETH-B, and WBTC-C, to improve balance sheet utilization and efficiency.

The stability fee for YFI-A is also proposed to be increased, while the debt ceiling for RETH-A and Compound v2 D3M is proposed to be increased to 20 million Dai [DAI] and 70 million DAI, respectively.

As contained in the proposal, these changes are expected to drive additional protocol revenue while still maintaining acceptable cost levels for vault users. The proposed changes are expected to result in a 4.2% increase in annual protocol revenue, equivalent to approximately 1,750,000 DAI.

Maker says no to loan proposal from Cogent Bank

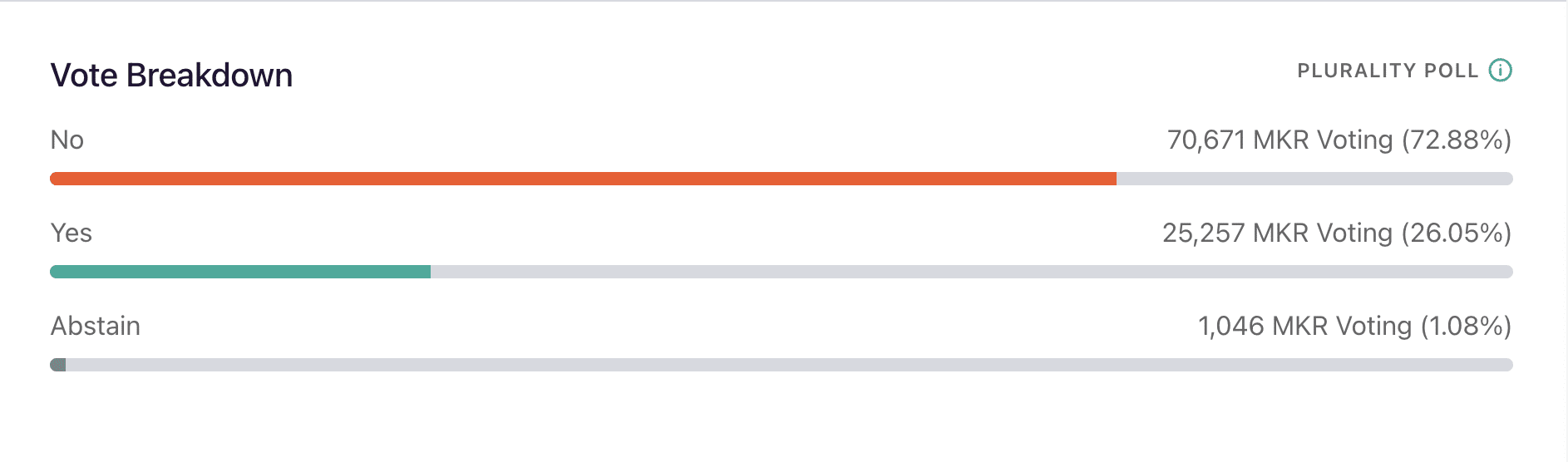

According to information from MakerDAO’s governance site, protocol members have voted overwhelmingly against Cogent Bank’s proposal to borrow $100 million from the decentralized lending platform.

Per MIP-95, which first appeared on the governance platform in January, Cogent Bank, a Florida-based commercial bank, had approached MakerDao with a proposal to borrow up to $100 million in DAI stablecoin.

Cogent Bank had proposed participating in the loan arrangement under MakerDAO’s existing RWA Master Participation Trust. It also intended to use the same Participation Agreement with the same terms that MakerDAO had with Huntingdon Valley Bank, which resulted in MakerDAO extending a loan to the latter in 2022.

Today is a defining moment to envision the potential of connecting decentralized finance and real-world finance.

Huntingdon Valley Bank and Maker pioneer the first commercial loan participation between a U.S. Regulated Financial Institution and a decentralized digital currency. pic.twitter.com/wajJYVJwwz

— Maker (@MakerDAO) August 23, 2022

As per the governance site, Cogent Bank’s proposed request received 72.88% votes against it.

A non-stop tussle between buyers and sellers

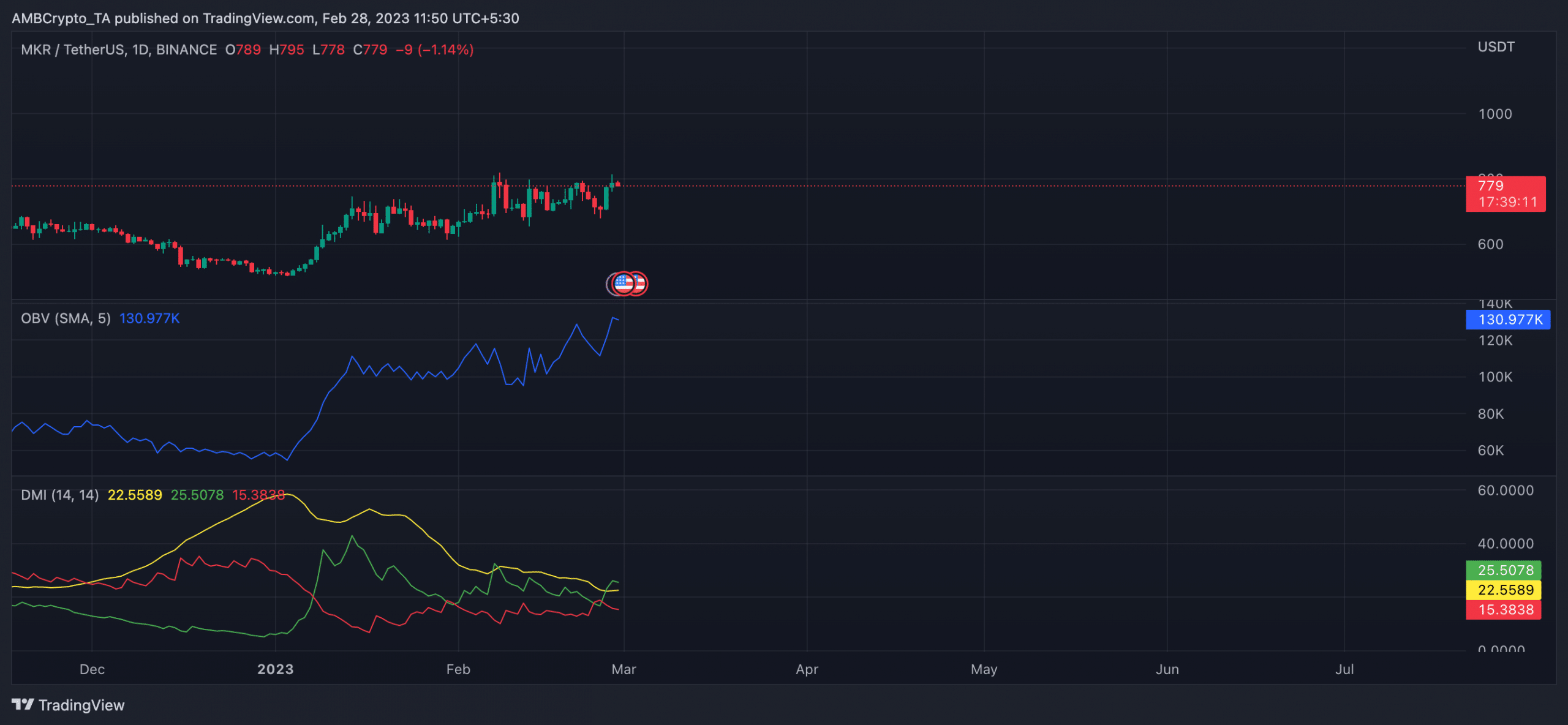

As of this writing, MKR traded at $780.66, per data from CoinMarketCap. The alt’s price was up by 2% in the last 24 hours.

Realistic or not, here’s MKR’s market cap in BTC terms

On a daily chart, buyers were spotted in control of the market. MKR’s On-balance volume was on an uptrend at 130.977k. When an asset’s OBV rises, it indicates that the volume of buy trades is increasing compared to sell trades. This often precipitates a price rally.

However, while buying momentum was on the increase, a look at the governance token’s Average Directional Index (yellow) at 22.55 revealed that sellers were gearing up to regain control. At 22.55, the ADX showed that MKR’s buyers’ strength remained weak. However, a decline in liquidity provisioning could put the sellers back in control.