MakerDAO proposes new changes to the protocol, details inside

- MakerDAO’s new proposals were set to pass with an overwhelming majority.

- Despite the improvements to the protocol, MKR’s prices fell.

MakerDAO’s [MKR] governance was extremely active over the last few months in terms of drafting new proposals. The protocol has been working to elevate the platform for users.

Read MakerDAO’s Price Prediction 2023-2024

Old DAO, new Proposals

The MIP102c2-SP2 proposal was put forward to vote on 10 April. The purpose of the proposal was to amend the Maker Constitution and the Scope Frameworks, which govern the operation of the Maker Protocol.

The changes were described as “long-term focused” and were determined in March.

At the time of writing, 87.32% of registered addresses did cast their votes in favor of the proposal. The voting period is scheduled to end on 24 April.

If the proposed changes involve amendments to the Maker Constitution, this could impact the governance structure of the platform and the decision-making processes used to manage the protocol.

Changes to the Scope Frameworks could impact the types of collateral that are accepted by the platform, which could in turn impact the overall stability and security of the protocol.

Additionally, some parameters of the MakerDAO protocol were changed as well. Those changes include Stability Fees, Target Available Debt, and Ceiling Increase Cooldown for several collateral types including ETH-A, ETH-B, ETH-C, WSTETH-A.

For context, Stability fees are fees charged to borrowers to maintain the stability of the Maker Protocol. Target Available Debt is the maximum number of DAI that can be issued against a cryptocurrency used as collateral, and Ceiling Increase Cooldown is the time period between successive increases in this maximum amount.

The Stability Fees, Target Available Debt, and Ceiling Increase Cooldown were all increased for various assets in an effort to improve the state of the protocol.

A set of parameter changes for ETH, wstETH, rETH, Curve stETH-ETH LP, and WBTC vault types has been approved by Maker Governance.

Check out the breakdown below: pic.twitter.com/ewPmuNmepa

— Maker (@MakerDAO) April 21, 2023

MKR holders see red

Despite improvements in the MakerDAO protocol, the overall interest in the MKR token continued to decline.

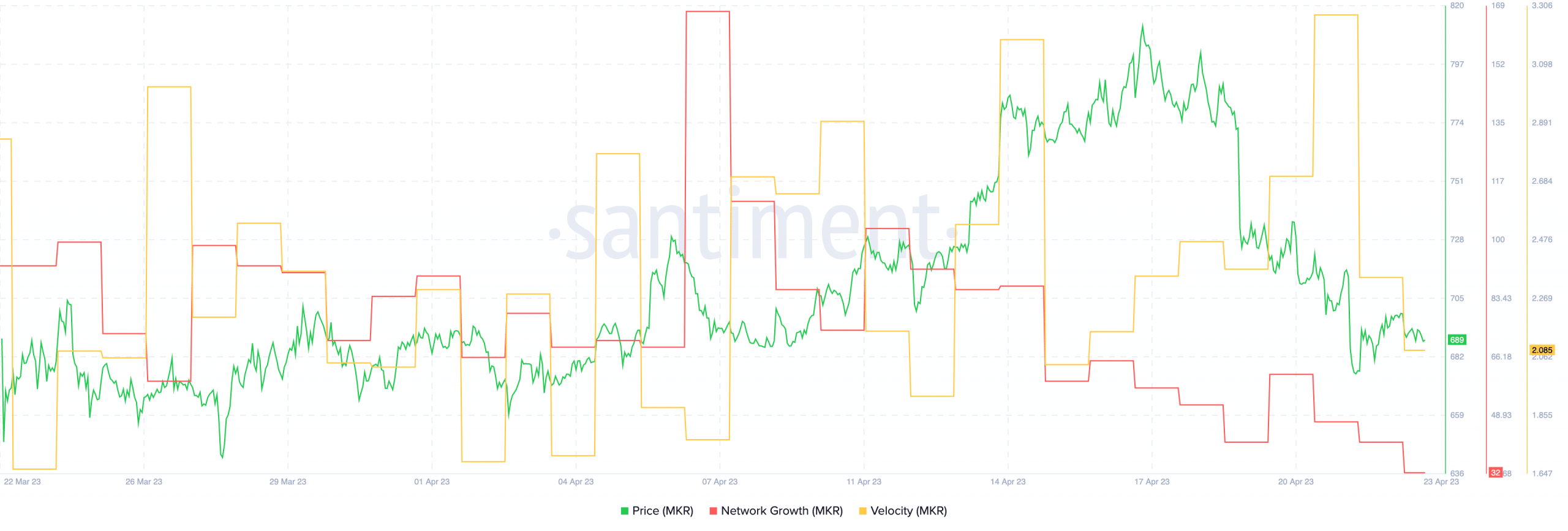

Moreover, Santiment’s data revealed that the price of MKR fell over the past few days.

Realistic or not, here’s MakerDAO’s market cap in BTC terms

Coupled with that, the velocity of the MKR token also fell. This meant that MKR was not being traded as frequently as earlier.

Additionally, the token’s network growth shrank, which suggested a lack of interest from new addresses in MKR.