MakerDAO raises DAI savings rate: Enough to help it flip Lido Finance?

- The project increased DAI’s savings rate since the community voted in support.

- Maker’s TVL in the last 30 days decreased but transactions using its stablecoin increased.

MakerDAO [MKR], the Decentralized Finance (DeFi) project behind the stablecoin DAI, has announced an increase in the DAI Savings Rate (DSR). The move comes after a voting procedure that ended on 15 June.

Realistic or not, here’s DAI’s market cap in MKR terms

For the unfamiliar, the DSR is funded out of Maker stability fees and helps to balance the supply and demand of DAI.

Higher DSR but a second-fiddle TVL

According to Maker, the implementation of the decision would begin on 19 June. And by raising the rate, holders of the stablecoin would be able to earn higher yields.

By opting in, DAI holders earn a consistent yield regardless of the size of their deposits, constantly streamed by the Maker Protocol’s surplus.

— Maker (@MakerDAO) June 16, 2023

However, Maker was quick to mention that the saving rate is subject to changes. And it also depends on the project’s governance decision. The DAI builders pointed out,

“We want to emphasize that the DSR’s annual yield is determined through Maker Governance participants via an Executive Vote and may undergo future adjustments.”

However, the question remains whether this adjustment will be sufficient to revitalize MakerDAO’s TVL. Also, would it be enough to attract a significant influx of users in an increasingly competitive DeFi landscape?

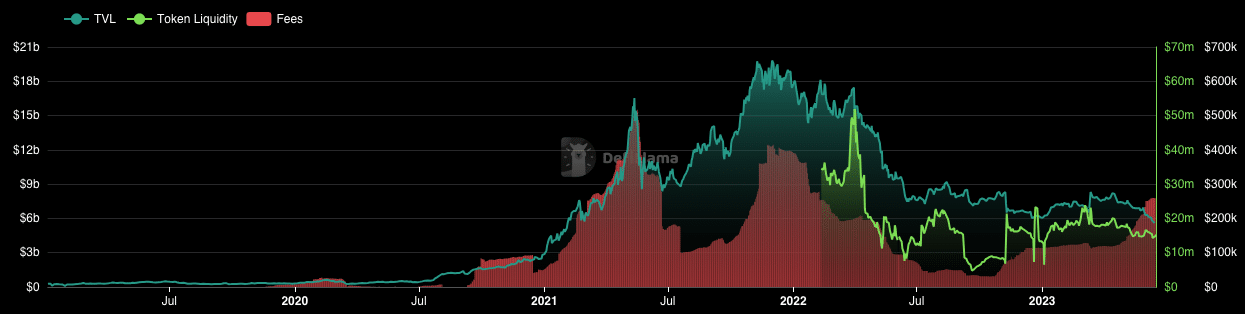

At press time, MakerDAO’s TVL was $5.66 billion, a 17.59% decrease in the last 30 days. As it stands, it looks unrealistic to overthrow the liquid staking platform Lido Finance [LDO] off the top of the standings.

Although the protocol registered a hike in fees, liquidity also fell like the TVL. This suggests that less capital has been locked in the Collateralized Debt Position (CDP) protocol.

DAI overtakes BUSD, thanks to…

However, in the last 24 hours, the TVL increased by a slight 2.41%. Still, it might be too early to assume that the DSR increase had an impact despite the potential access to higher yields.

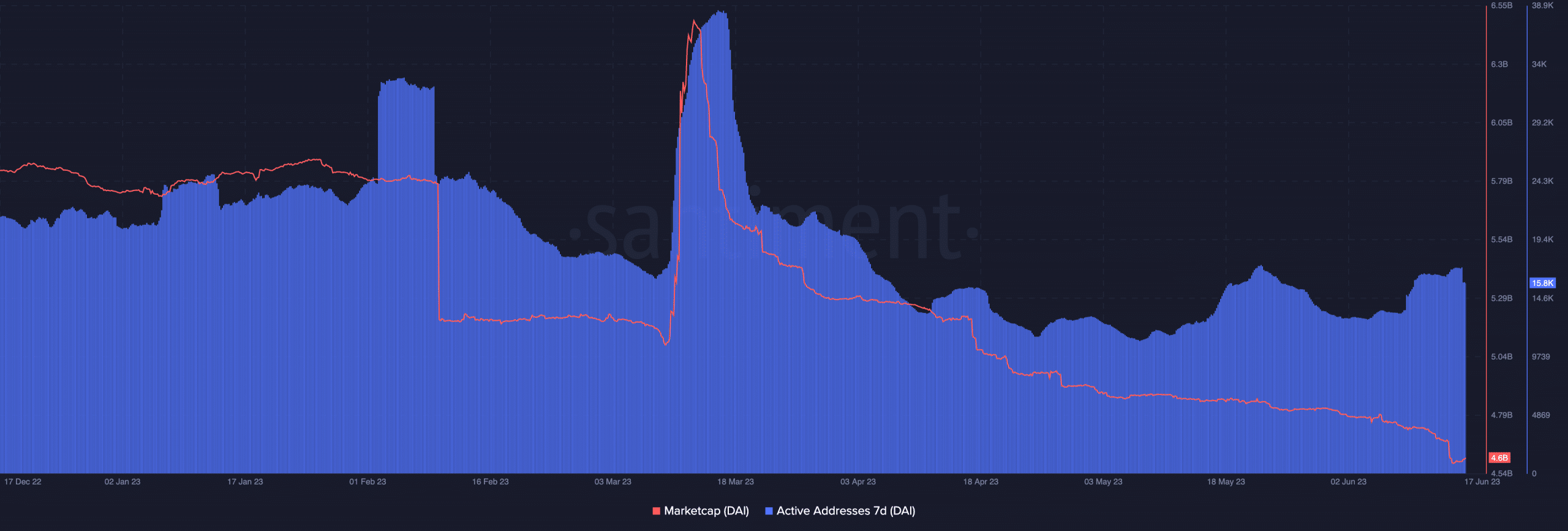

Meanwhile, DAI recently surpassed Binance USD [BUSD] to become the 15th-ranked asset in market capitalization. At the time of writing, the decentralized stablecoin market cap has grown to $4.6 billion.

The milestone infers an increasing interest in the stablecoins at the expense of BUSD which was in a phasing-out process.

Additionally, on-chain data from Santiment showed that DAI active addresses increased. As of this writing, the seven-day active addresses were up to 15,800.

How much are 1,10,100 MKRs worth today?

Active addresses show the number of distinct addresses participating in the transfer of an asset. Therefore, an increase in the metric means a hike in transactions on the Maker network.

Typically, this is a bullish signal. But since DAI operates on a 1:1 USD peg, the hike might only impact the market cap and circulation.