MakerDAO to remove redundant stablecoin vaults: Will MKR be affected?

- MakerDAO will liquidate its USDC-A, USDP-A, and GUSD-A vault types.

- MKR’s price has enjoyed a significant bullish momentum in the last week.

Leading decentralized finance (DeFi) protocol MakerDAO [MKR] has scheduled an 8 March date to offboard its redundant stablecoin vaults. This decision came after it obtained approval from members of the protocol’s governance team to do the same.

This is a final notice to all USDC-A, USDP-A, and GUSD-A users.

The USDC-A, USDP-A, and GUSD-A vault types are being offboarded from the Maker Protocol.

The offboarding process is currently scheduled to take place with the next Executive Vote on March 8th, 2023.

— Maker (@MakerDAO) March 3, 2023

The Risk Core Unit Team of MakerDAO previously published the offboarding parameters, which stated that the USDC-A, USDP-A, and GUSD-A vault types would be liquidated because they were no longer necessary following the introduction of the Peg Stability Module (PSM).

Read MakerDAO’s [MKR] Price Prediction 2023-2024

MakerDAO’s PSM is a system implemented to provide a more stable peg to the US dollar for its stablecoin DAI. The PSM works by allowing users to exchange DAI for USDC or other fiat-pegged stablecoins at a fixed exchange rate. This exchange rate is designed to maintain a stable peg to the US dollar and is set slightly above $1 to ensure that the price of DAI remains stable.

According to MakerDAO, the offboarding will involve a maximum debt ceiling of zero, a liquidation penalty of zero percent, a flat kick incentive of zero, and a liquidation ratio of 1500% on all three vault types. These parameter changes will effectively remove the vault types from the protocol and liquidate any remaining debt that is held within them.

MakerDAO added:

“It is likely that the corresponding collateral will be liquidated into PSM, which will increase current reserves.”

MKR enjoys bullish conviction

MKR’s price rallied by 29% in the last seven days, making it the crypto asset with the most gains in the last week, per data from CoinMarketCap. In fact, while the rest of the market traded sideways in the last month, MKR enjoyed a bullish conviction that caused its value to grow by almost 35% during that time. As of this writing, the DeFi token traded at $905.42.

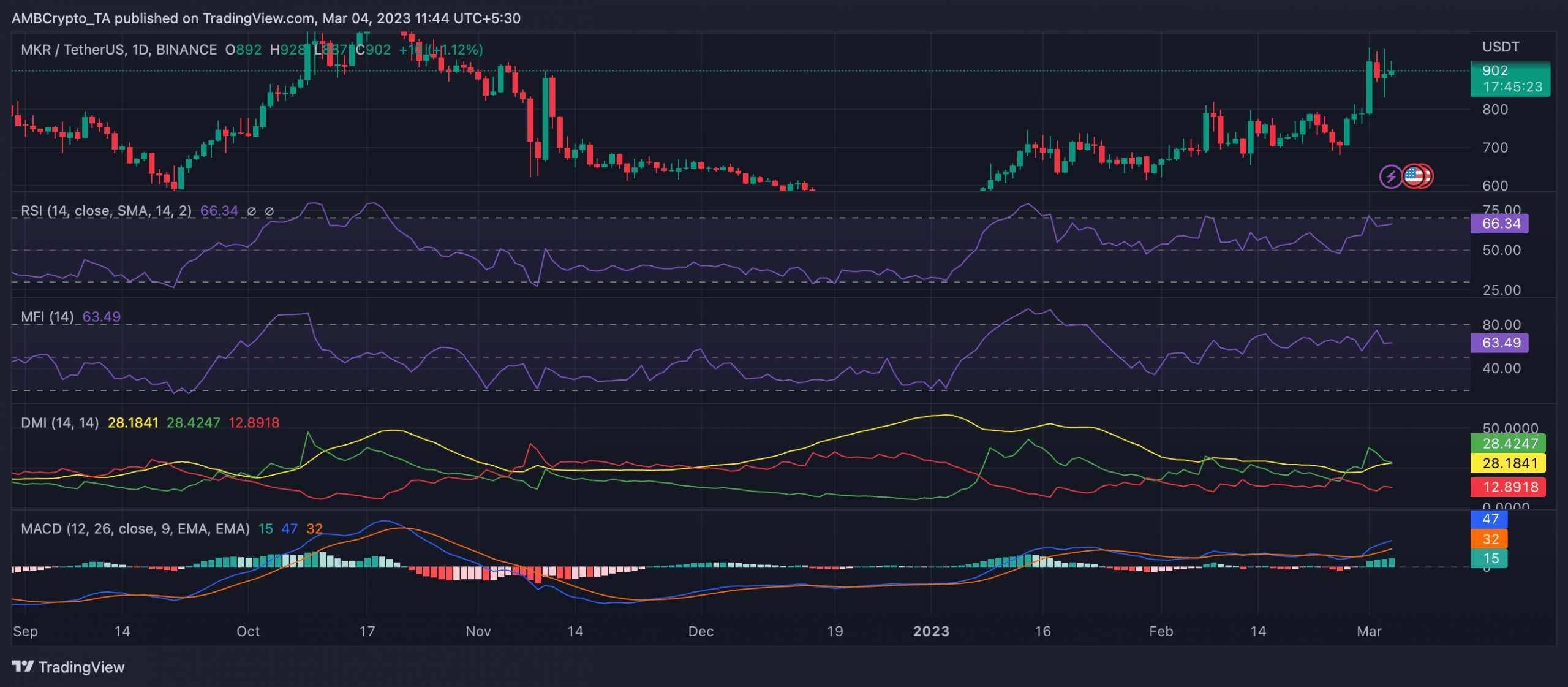

Moreover, readings of its price movements on a daily chart suggested that MKR’s value might grow even further. A look at the alt’s moving average convergence/divergence (MACD) indicator revealed the commencement of a new bull cycle on 28 February. Since then, MKR’s price has increased by 15%.

Increased MKR accumulation was also rampant in the current market as key momentum indicators such as the Relative Strength Index (RSI) and the Money Flow Index (MFI) were spotted in upward trends at press time. The RSI was 66.34, while the MFI was 63.49.

Is your portfolio green? Check out the Maker Profit Calculator

Lastly, the surge in token accumulation in the last month put buyers in control of the MKR market. This position was proved by the Directional Movement Index (DMI) as the buyers’ strength (green) at 28.42 rested solidly above the sellers’ (red) at 12.89.