MakerDAO’s annualized revenue hits ATH – Here’s what’s next

- Maker’s annualized revenue has hit an all-time high

- This, due to an increase in the activity around tokenized real-world assets on the protocol

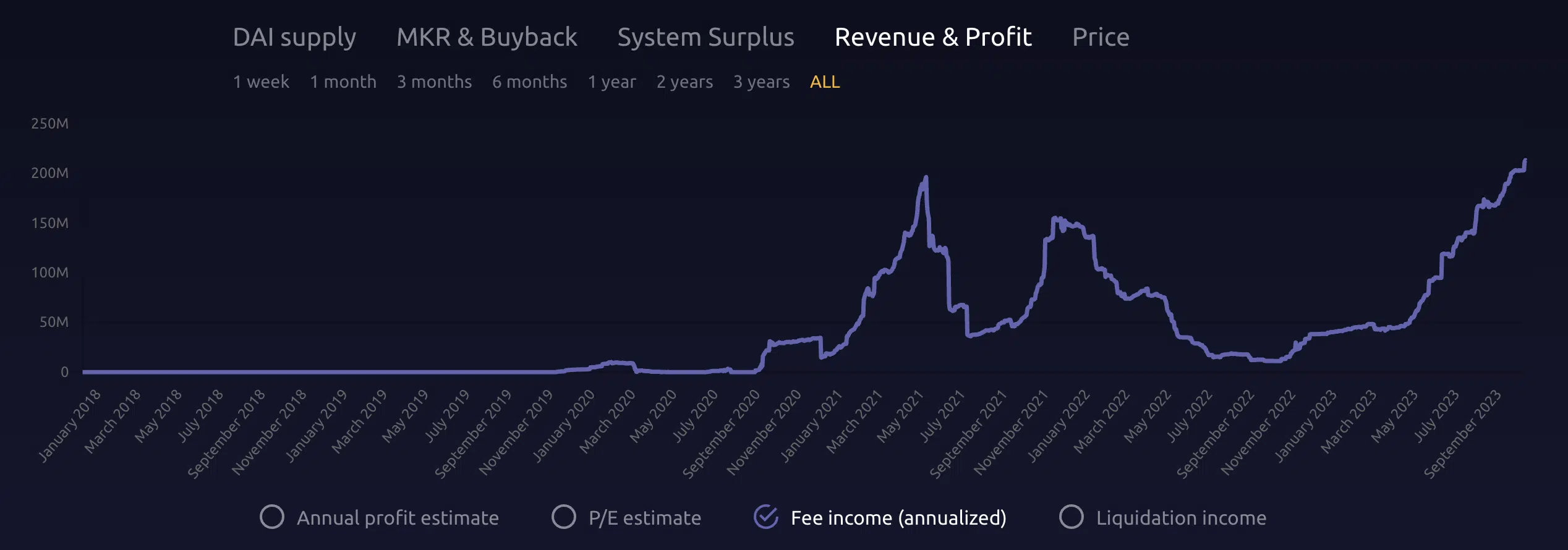

MakerDAO’s [MKR] annualized revenue obtained from transaction fees has climbed to an all-time high of $213 million, according to data from Makerburn.com.

On a year-to-date basis, the stablecoin lender’s annualized revenue has risen by over 450% on the charts. For context, on 1 January, Maker’s revenue was less than $50 million.

Is your portfolio green? Check out the MKR Profit Calculator.

Maker earns revenue by charging users fees for borrowing its stablecoin DAI and collecting fees in the event of liquidating a borrowed position.

According to data from Token Terminal, the protocol has seen a 438% hike in monthly fees since the year began. So far this month, users have paid Maker a total of $14.2 million in transaction fees. With roughly nine days until the end of the month, this already represents a 35% jump from the $10.5 million in network fees for September.

Real-world assets are the winners

Real-world assets (RWAs) refer to on-chain variations of assets that exist in the physical world or in traditional finance. They include real estate, bonds, stocks, commodities, invoices, trade receivables, etc.

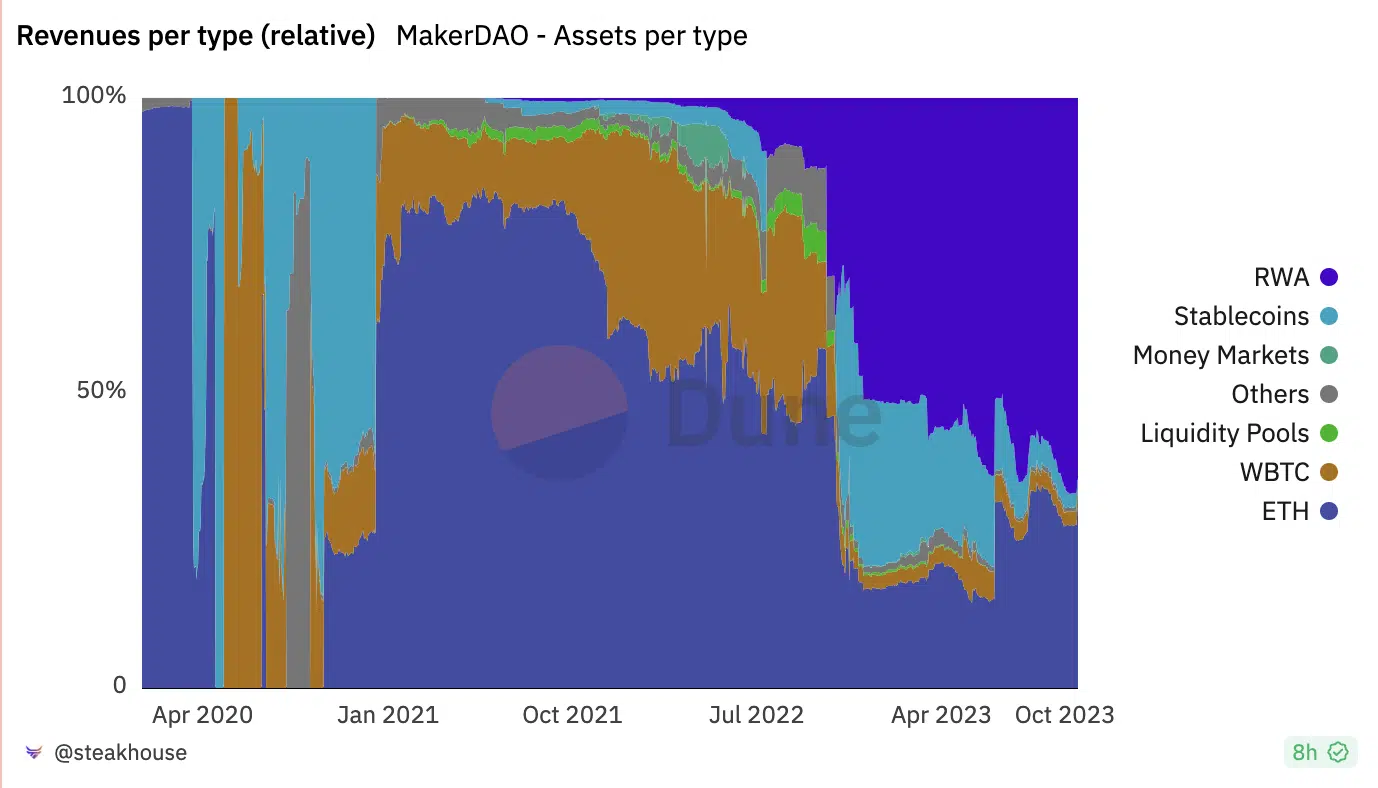

The surge in Maker’s revenue over the past few months is primarily due to the growth seen in its RWA vertical. The protocol lets its users deposit tokenized RWAs as collateral to mint DAI.

According to data sourced from a Dune Analytics dashboard created by data analyst Steakhouse, 67% of Maker’s fee revenue comes from its RWAs. As of 17 October, annualized revenue made from RWAs was $126 million, according to the dashboard.

According to DefiLlama data, RWAs currently make up 42% of Maker’s entire total value locked (TVL) of $7.82 billion. The significant hike in activity around the protocol’s RWA vertical has propelled Maker to the position of the second-largest decentralized finance (DeFi) protocol in terms of total value locked (TVL).

How much are 1,10,100 MKRs worth today?

Assessing MKR over the last 30 days

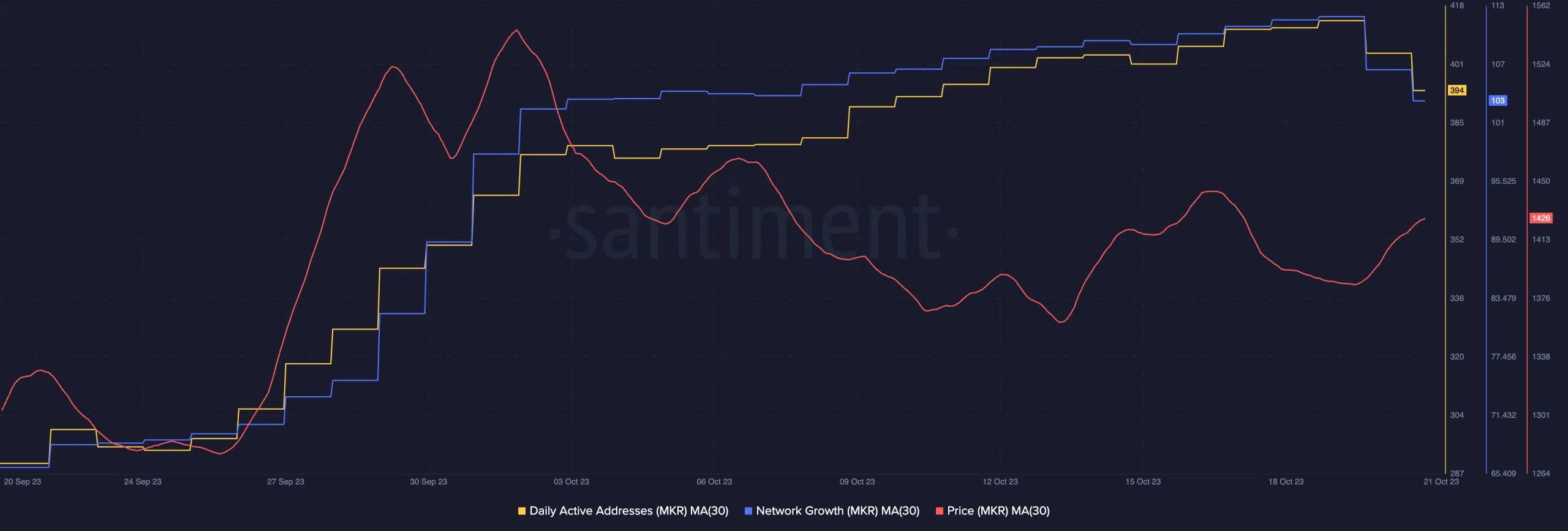

MKR has seen an uptick in network activity over the past month, data from Santiment revealed. In fact, according to the on-chain data provider, the daily count of the token’s active addresses observed on a 30-day moving average has risen by 35%.

Likewise, new demand assessed within a similar timeframe has appreciated by 56%. These have resulted in a 6% hike in MKR’s value over the past month.