MakerDAO’s co-founder sold large amount of LDO, here’s what happened next

- MakerDAO’s founder buys up MKR and sells Lido.

- Interestingly, the LDO token manages to outperform MKR in several areas.

According to data provided by lookonchain, it was observed that the co-founder of MakerDAO, Rune Christensen, bought MKR tokens while exiting his LDO positions.

Rune sold 18.86 million LDO tokens for an overall price of $27 million DAI. In the same period, he bought 15,092 MKR, which roughly amounted to $4.44 million DAI. Well, these transactions could impact the state of both tokens going forward.

Read MKR’s Price Prediction 2023-2024

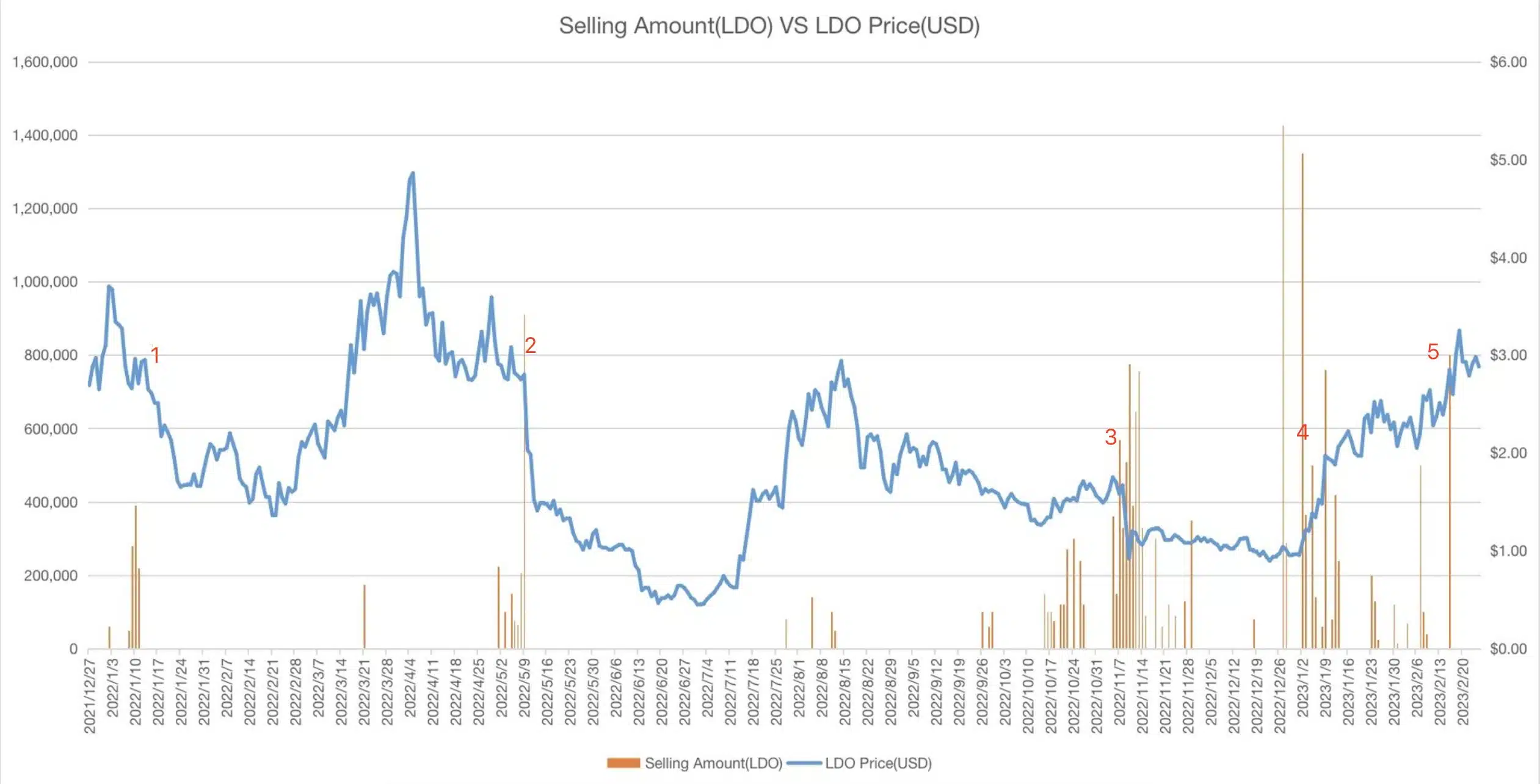

In the past, there were five instances where Rune sold large amounts of LDO. For the first three times, the large-scale selling of LDO occurred concurrently with price drops. However, for the last two times, there wasn’t any correlation observed as LDO prices surged despite the sell-offs.

Even though the recent sell-offs haven’t impacted LDO’s prices yet, this behavior could start FUD amongst LDO holders. However, on the flip side, the large-scale buying of MKR tokens could provide hope to holders of MKR.

Notably, despite the large amounts of MKR being bought, its market cap remained below that of LDO. According to data provided by Santiment, both LDO and MKR token’s market cap started to rise at the beginning of 2023. However, LDO outperformed MKR by a huge margin in this area over the last three months.

At press time, the market cap of LDO was 2.62 billion, whereas the market cap of MKR was just 751.71 million.

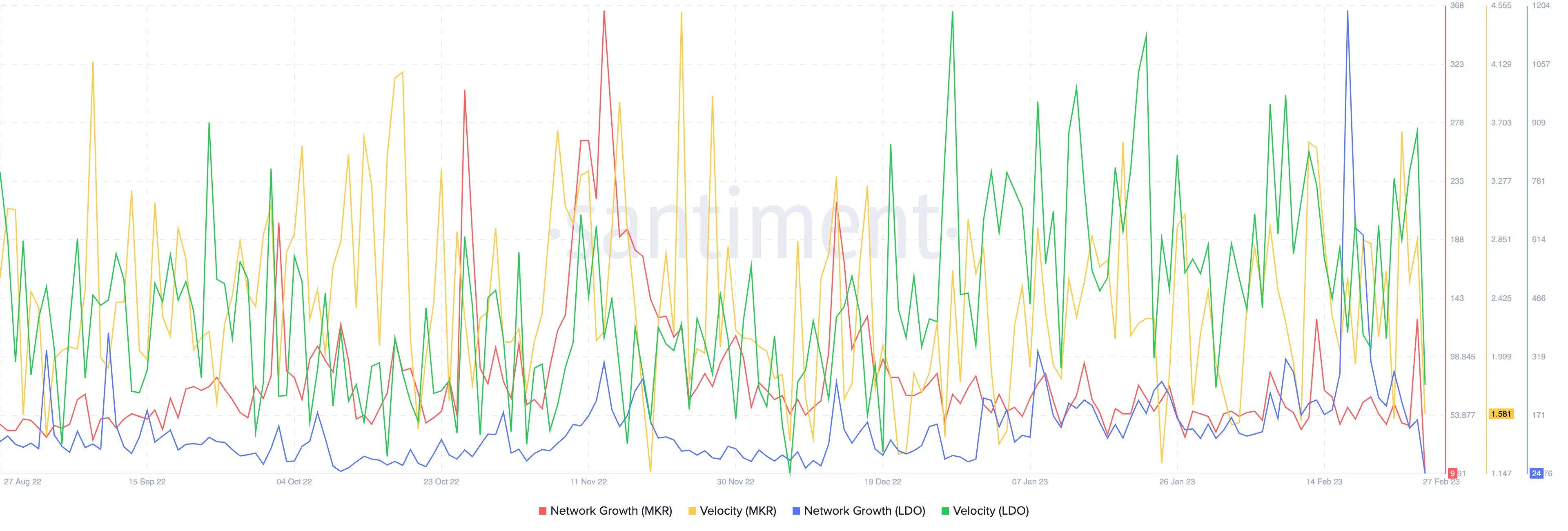

One of the reasons why LDO managed to outcompete MKR in this area could be due to its network growth and velocity.

On both fronts, LDO managed to outperform MKR. A higher network growth implied that LDO was more appealing to new addresses than MKR. On the other hand, a higher velocity suggested that there was much more activity around LDO tokens than MKR.

State of the protocols

Interestingly, the performance of the protocols of the respective tokens followed the same trajectory. Even though both protocols observed growth over the last quarter, Lido’s improvements in multiple sectors outpaced MakerDAO.

In terms of TVL, Lido accrued $9.1 billion, whereas MakerDAO’s TVL stood at $7.24 billion.

Realistic or not, here’s LDOs market cap in BTC’s terms

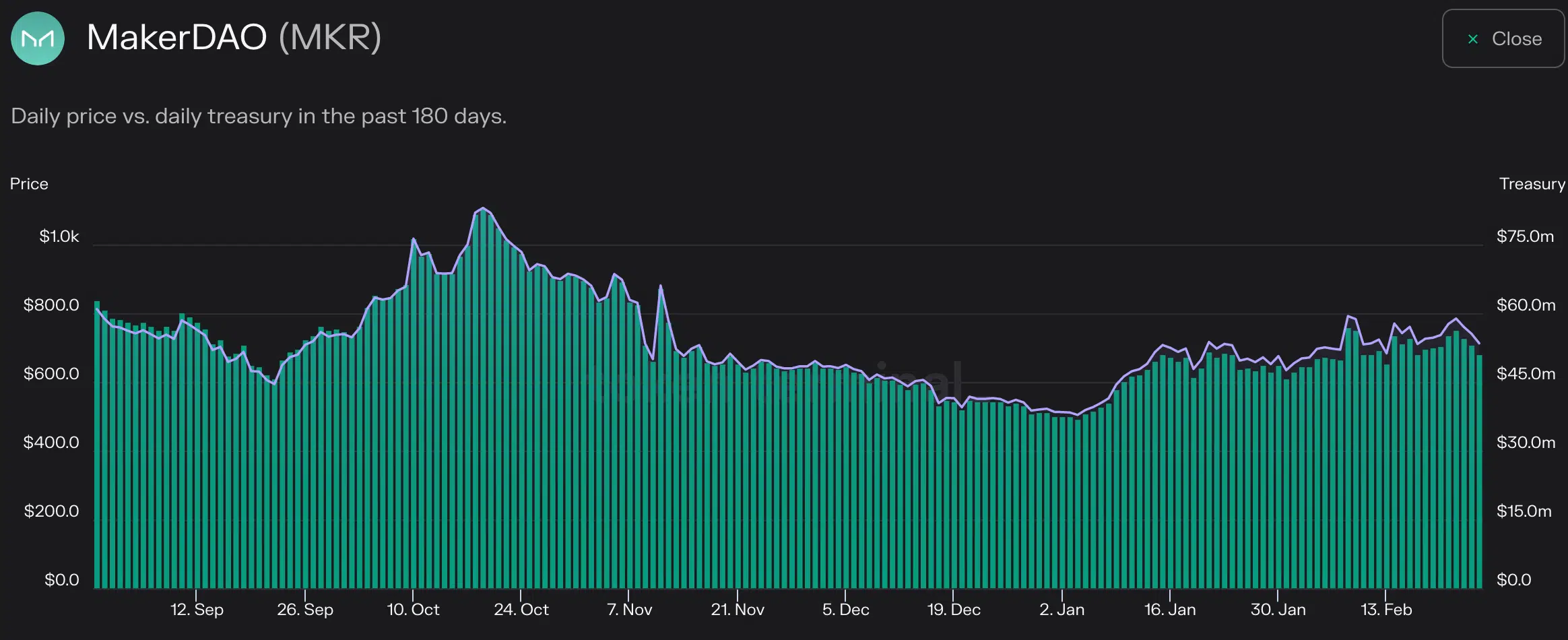

However, despite MakerDAO’s poor performance, its treasury holdings continued to surge. Over the last 30 days, MakerDAO’s treasury holdings increased by 15.2% according to token terminals data.

These treasury holdings could be used by the DAO to make further improvements to the ecosystem.

Even though Lido managed to perform better than MakerDAO in recent months, the competition between both protocols is neck to neck.

Strong competition between protocols is evidence of a healthy DeFi market and is a positive sign for the crypto community.