MakerDAO’s DAI supply surges but on-chain activity tells a different tale

- The DAI stablecoin witnessed a significant surge in marketcap.

- MakerDAO’s MKR wasn’t seen to be influenced by surging DAI demand.

The DAI stablecoin recently experienced a massive surge in its marketcap. Based on the underlying mint and burn mechanism, the surge indicated that the stablecoin has been hit with a strong demand wave.

Read Maker’s [MKR] price prediction 2023-24

Assessing the demand for DAI

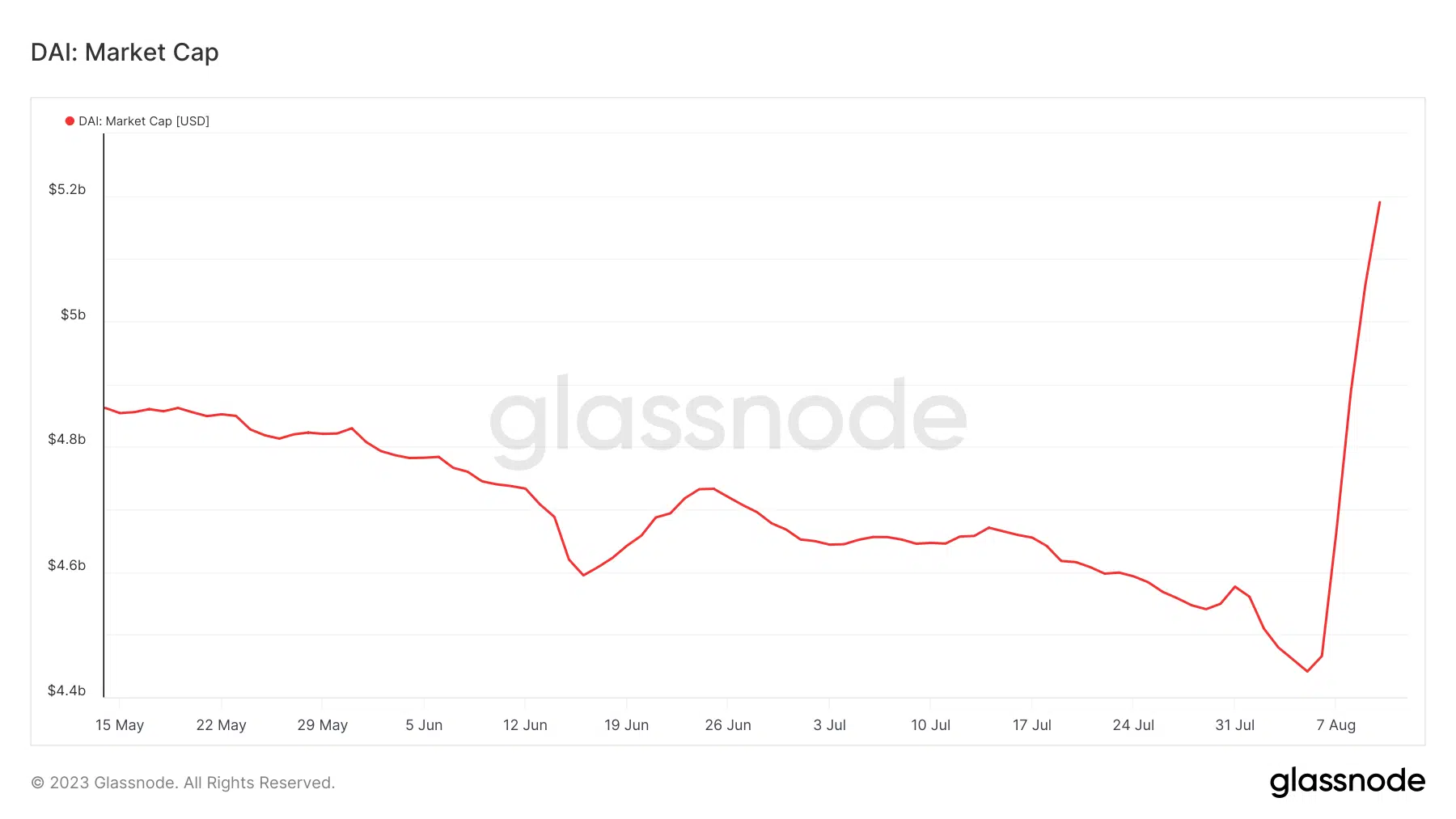

To put things into perspective, DAI had a $4.44 billion marketcap as of 5 August. The marketcap figure soared to $5.1 billion 5 days later. This meant that DAI’s marketcap grew by roughly $750 million in just a few days.

The same stablecoin had previously been experiencing liquidity outflows in the last three months.

So, what is the reason behind these observations? The sudden marketcap pivot means DAI’s supply experienced exponential growth in the last five days. An incentive to mint DAI is the likely reason for its soaring supply.

According to recent reports, MakerDAO’s DAI savings rate (DSR) recently pushed up to 8%.

MakerDAO’s DAI savings rate (DSR) rises to 8%, triggering a notable growth in supply. In the past week, the amount of DAI earning DSR climbed by nearly $1B, and the DAI supply increased by $800M, reaching a three-month high. #DAI pic.twitter.com/IneytHA2wO

— IntoTheBlock (@intotheblock) August 11, 2023

We have to look at some of the mechanics that underpin the MakerDAO ecosystem to understand how the DSR was influencing DAI supply. An overcollateralized mint and burn system powers the mechanism.

Users can deposit the accepted cryptocurrencies as collateral, which is then used to mint DAI. This minted DAI, therefore, acts as a loan issued against the deposited cryptocurrency.

The incentive behind this is that DAI holders get to earn passive income paid out from stability fees collected from collateralized debt positions (CDPs). An 8% DSR represents a healthy return hence a strong incentive to mint more DAI. But does this translate to more on-chain activity?

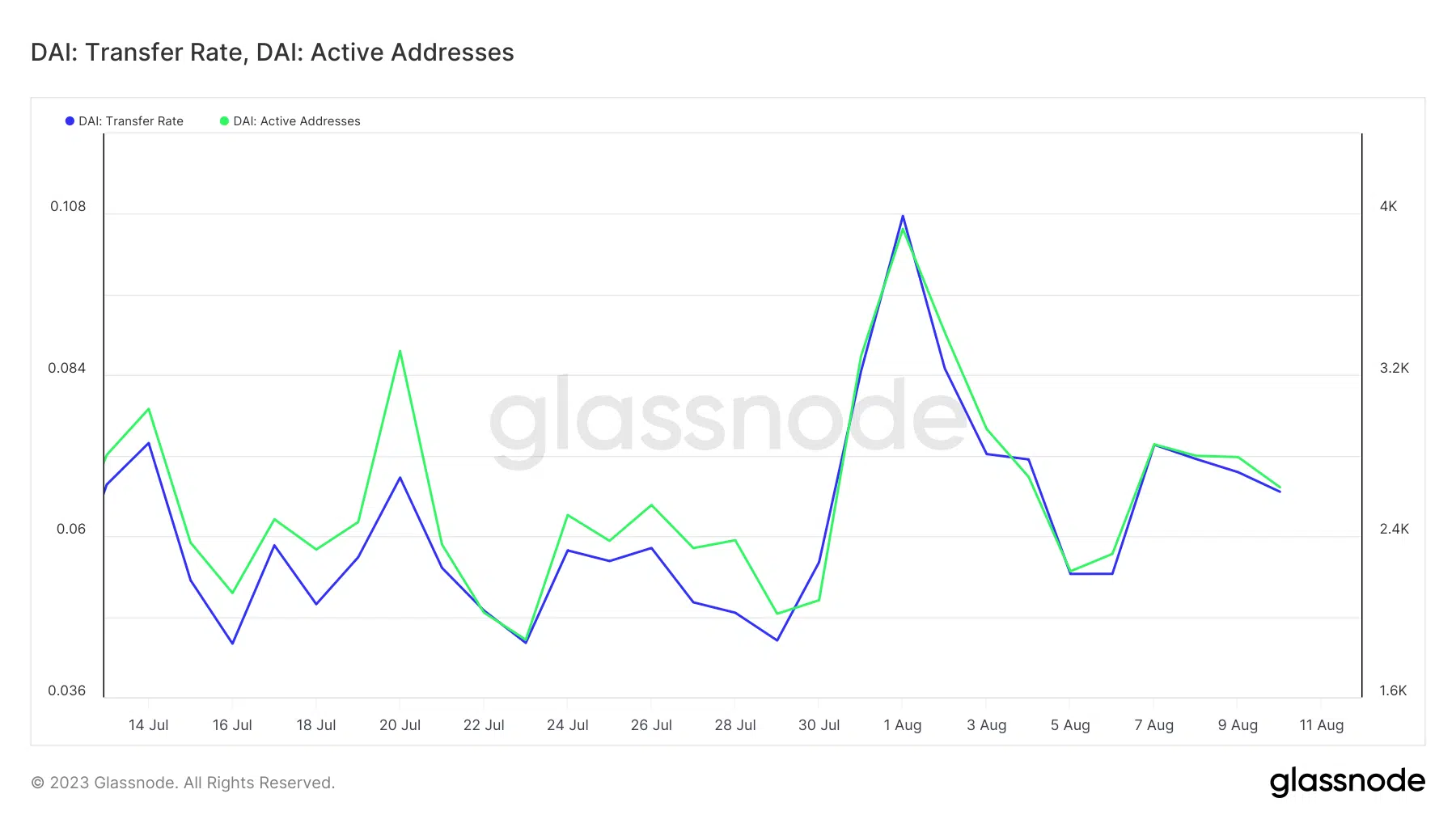

DAI’s on-chain metrics confirmed that the surge in DAI supply does not necessarily suggest a surge in DAI-related transactions. For example, active addresses and transfer rates have been on an overall downward trajectory since the start of August.

On the other hand, MakerDAO announced recently that the Spark protocol has been experiencing explosive growth. More importantly, over 198 million DAI was borrowed on the protocol since its launch in May.

Spark Protocol launched in May.

Three months later, it has climbed to the top 30 DeFi protocols based on total value locked.

From 0 to 198 million DAI borrowed — what a leap!

Let's explore Spark Protocol's incredible growth.

— Maker (@MakerDAO) August 10, 2023

Is MKR benefiting from DAI’s soaring supply?

The DAI minting will likely not have an impact on MKR’s price. This is because MKR is used as a governance token and not collateral for the DAI mint and burn mechanism. MKR’s price action has been overall bearish since 2 August. It peaked at $1366 on the same day, but it exchanged hands at $1248 at press time.

Is your portfolio green? Check out the MKR Profit Calculator

Note that the retracement in the first week of August represents a bullish recess considering that MKR was previously on a strong and lengthy rally. Thus, traders could only wait and watch which direction will MKR head in over the next few days.