MANA bulls begin to fade in strength after the loss of an important support

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The H4 market structure was bearish.

- A drop below $0.57 will likely see another leg downward for MANA.

In a previous report, it was highlighted that the market structure of MANA was bearish on the higher timeframes. This seller-favored outlook has not yet changed as the price action continued to support a bearish bias.

How much are 1, 10, or 100 MANA worth today?

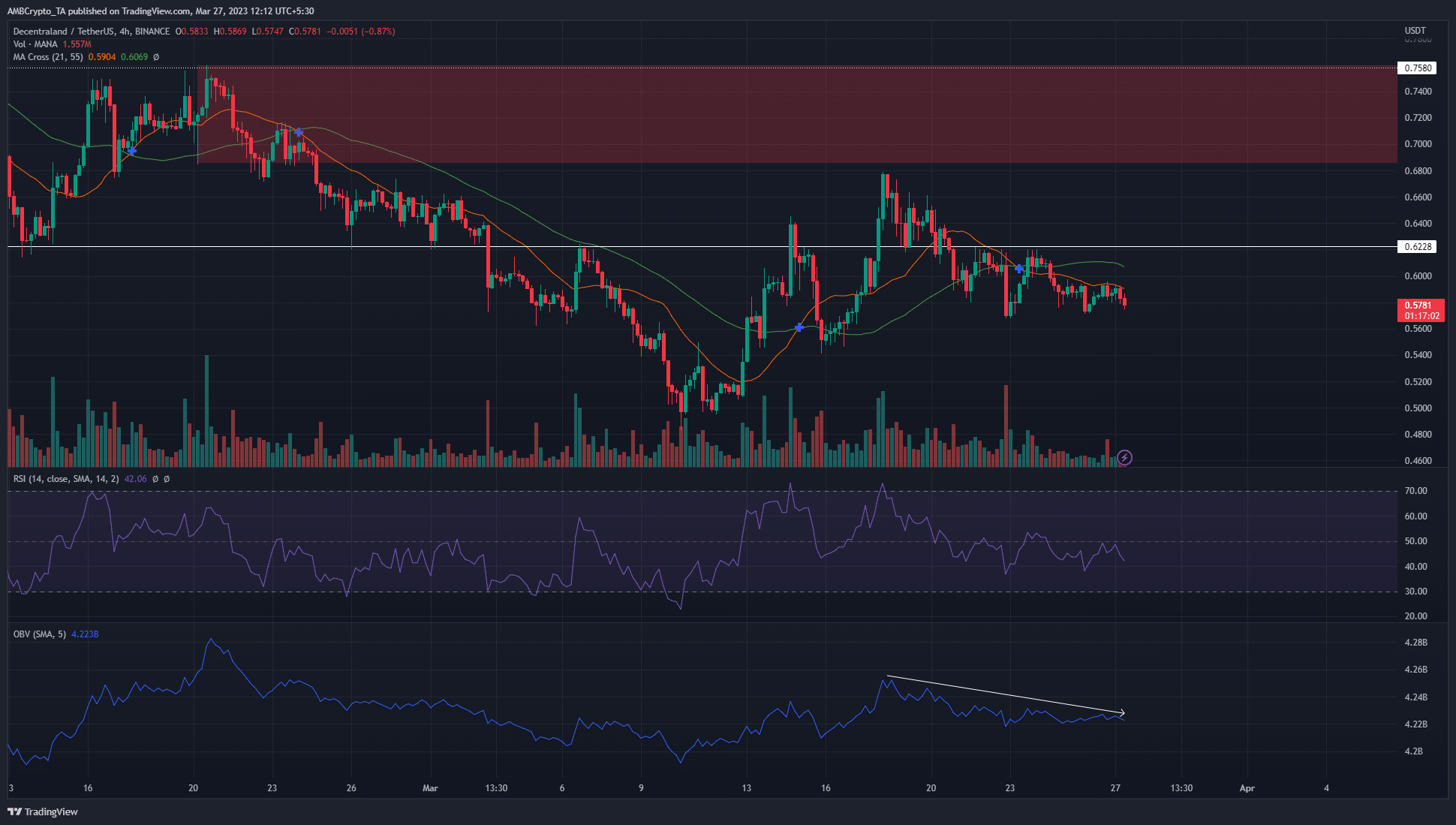

The 4-hour charts also showed that a move downward was likely, as the bulls were unable to hold on to the $0.62 support level.

Bitcoin traded at $27.8k at the time of writing, but it looked ripe for a retracement in the coming days. MANA would also likely head southward in such a scenario, and buyers must be cautious.

The bulls ceded control of $0.62 support and bears have forced prices lower

The $0.623 level of support was lost on 20 March and with that, the market structure also shifted bearish on the 4-hour chart. The OBV has been in decline over the past week and signified strong selling pressure.

The RSI was at 42 and denoted bearish momentum for MANA. It has been below the neutral 50 mark since 20 March, once more underlining the shift in momentum on that day.

Even though the recovery from $0.5 reached $0.677 within a week from 11 to 18 March, the price has steadily declined from $0.8 since early February.

The 1-day timeframe chart also showed that the structure was bearish. It indicated the possibility of a pullback to $0.42, and possibly as deep as $0.29-$0.33.

These were the two regions that had been important back in January, before the strong pump reached $0.84 on 2 February.

Is your portfolio green? Check the MANA Profit Calculator

The lower timeframe bias was bearish due to the H4 market structure and the $0.623 level needs to be flipped to support before MANA bulls can entertain any hope.

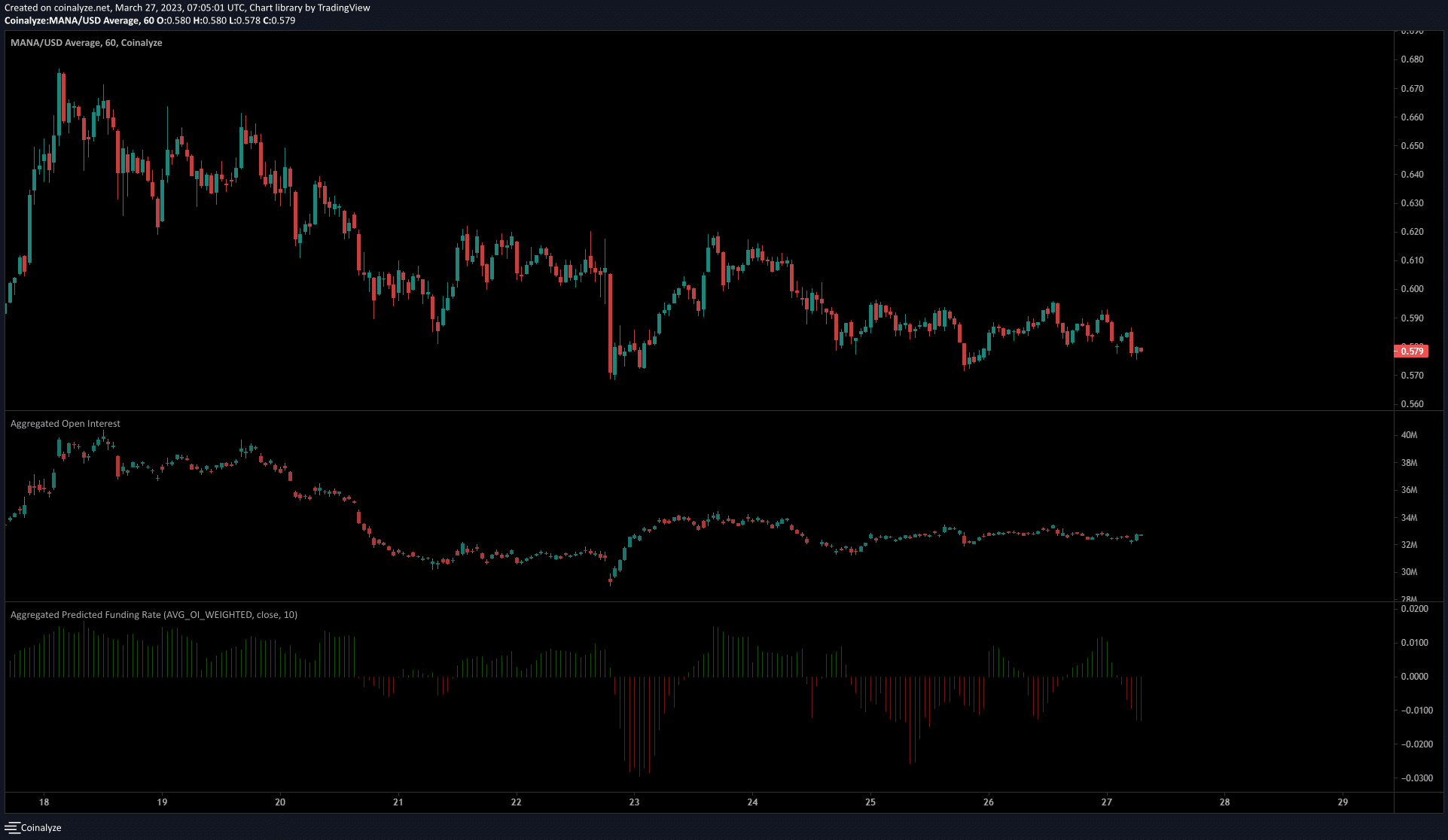

Futures market participants not yet shorting MANA in large numbers

Source: Coinalyze

Although the native token of Decentraland has slowly trended downward over the past week, the Open Interest did not show a large increase in recent days.

Instead, the OI has been flat while the prices fell. This was a sign of bearish sentiment, but it also showed short sellers did not yet flood the MANA market.

The predicted funding rate was in the negative territory, which was another indication of bearish sentiment on the lower timeframes.

![Algorand [ALGO]](https://ambcrypto.com/wp-content/uploads/2025/05/EE821387-E6C9-4C21-A2AC-84C983248D2F-400x240.webp)