MANA’s short-term, long-term projections have this key difference

Decentraland was the talk of the town back in November 2021. Right after Facebook announced that it was rebranding to Meta, gaming and metaverse tokens, including MANA, skyrocketed on the back on that euphoria. In under a month, MANA presented nearly 660% returns around its highs. But, that didn’t last too long.

By the end of November, MANA’s price action had cooled down. Towards the beginning of December, it began falling with the rest of the broader market. At press time, it was still trading 50% down from its ATH.

In fact, recent broader market recoveries haven’t been able to do much for MANA either.

To be or not to be

On the charts, there seemed to be an interesting trend playing out. Zooming out a little on the daily chart, the price action formed what is called a symmetrical triangle pattern. Now, there is no inherent bullishness or bearishness is such a candlestick pattern.

If the price manages to break out or break down from the narrow consolidation zone forming over the last two weeks, that is the direction the altcoin will continue with.

Since November, it has been accumulating in a very narrow range of around $2.5-2.8. Such a consolidation signifies that it is getting ready for a major move. However, we’re yet to see which direction it will take.

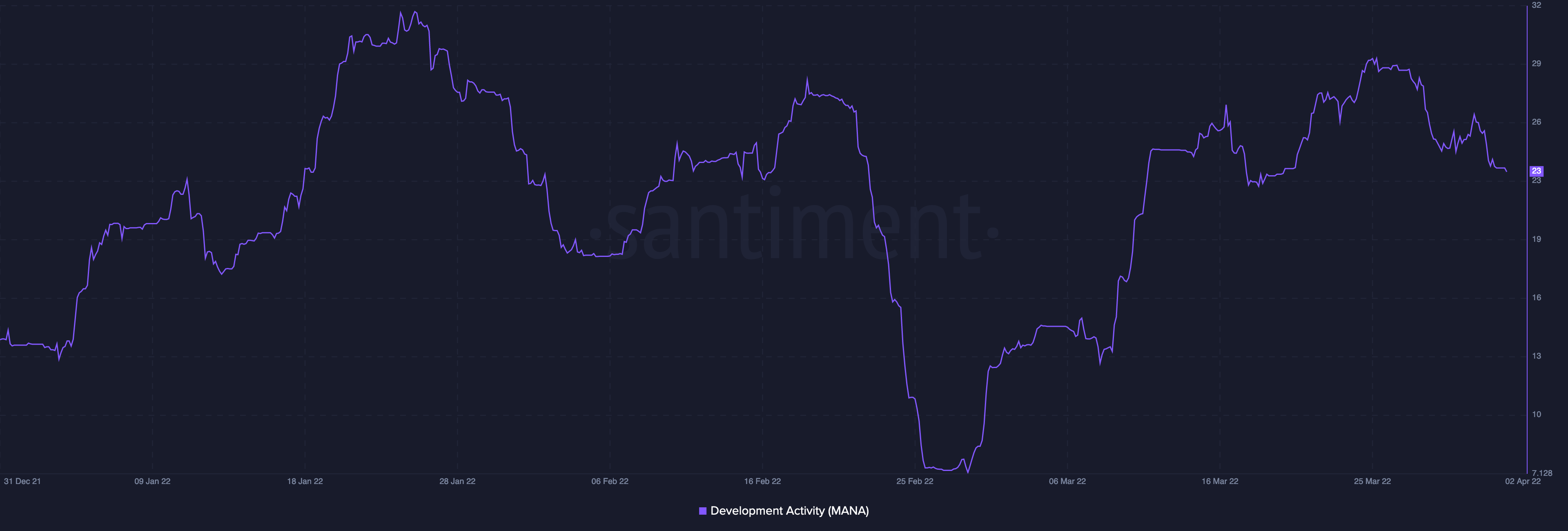

On-chain metrics also presented a confusing set of inferences. For instance, development activity for this crypto has been rising steadily since the end of February. This bodes well and shows that developers are continuously working to improve the ecosystem, building confidence among community members.

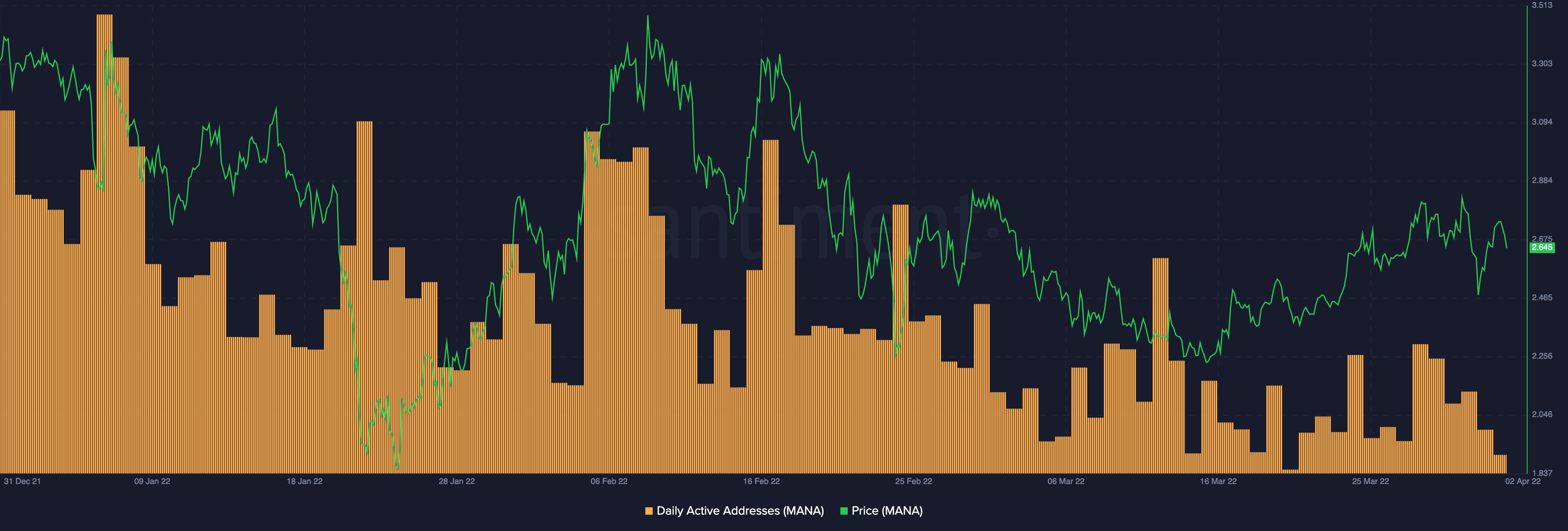

Despite that, daily active addresses on the chain have been reducing steadily. Simply put, stakeholders and investors aren’t exactly enthusiastic about MANA and what it offers in the current market scenario.

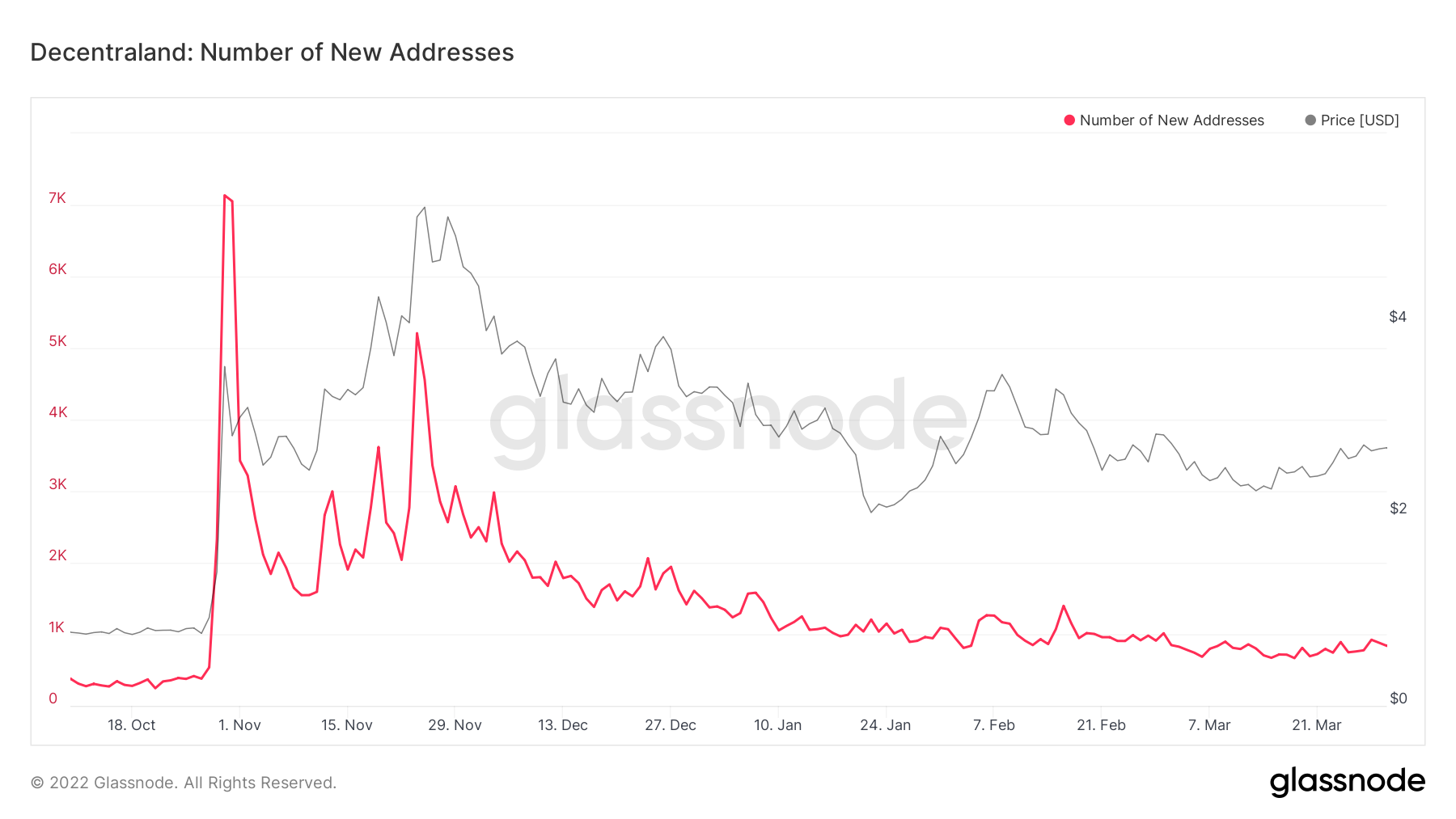

Along the same lines, according to data from Glassnode, the number of new addresses on the network has been sliding down too.

Not all’s lost

MANA’s price action is on the precipice of a move thanks to a symmetrical triangle pattern, one which can be on either side. However, on-chain fundamentals seem to indicate that a down move may be slightly more likely than the other. Here, it must be noted that a breakdown from here wouldn’t mean the end of the story for Decentraland.

While some people are still skeptical about the metaverse, Citi Group says it sees tremendous potential in this concept of extended reality or metaverse. According to Fortune, the company has also publicly said that it believes the metaverse economy could be worth $13 trillion by 2030.

So, from a long-term POV, things remain optimistic. Short-term drawdowns need to be taken into account though.