Mapping Dogecoin’s road to $0.45 – How and when?

- DOGE has seen a spike in dormant tokens that are back in circulation.

- The memecoin’s price has continued its consolidation attempts.

Dogecoin[DOGE] is consolidating around the $0.40 mark following an explosive rally in early November. Recent metrics reveal heightened on-chain activity, with dormant tokens resurfacing alongside increasing transaction volumes.

While DOGE shows signs of indecision, the interplay between age-consumed spikes and price movements highlights the need to watch key support and resistance zones closely.

Dogecoin dormant tokens resurface

One notable trend is the spike in Dogecoin’s Age Consumed metric, which tracks the movement of long-held, dormant tokens. As seen in the Santiment’s Age Consumed chart, major spikes occurred in late October, mid-November, and December.

The analysis showed that the metric spiked to 1 trillion on the 16th of December, the highest since October when it exceeded 1 trillion.

These movements often coincide with pivotal price changes, indicating potential profit-taking or strategic whale repositioning. When dormant coins move, it usually reflects long-term holders re-entering the market or building selling pressure.

The largest spike aligns with the initial price surge, reinforcing the correlation between on-chain activity and DOGE’s upward momentum.

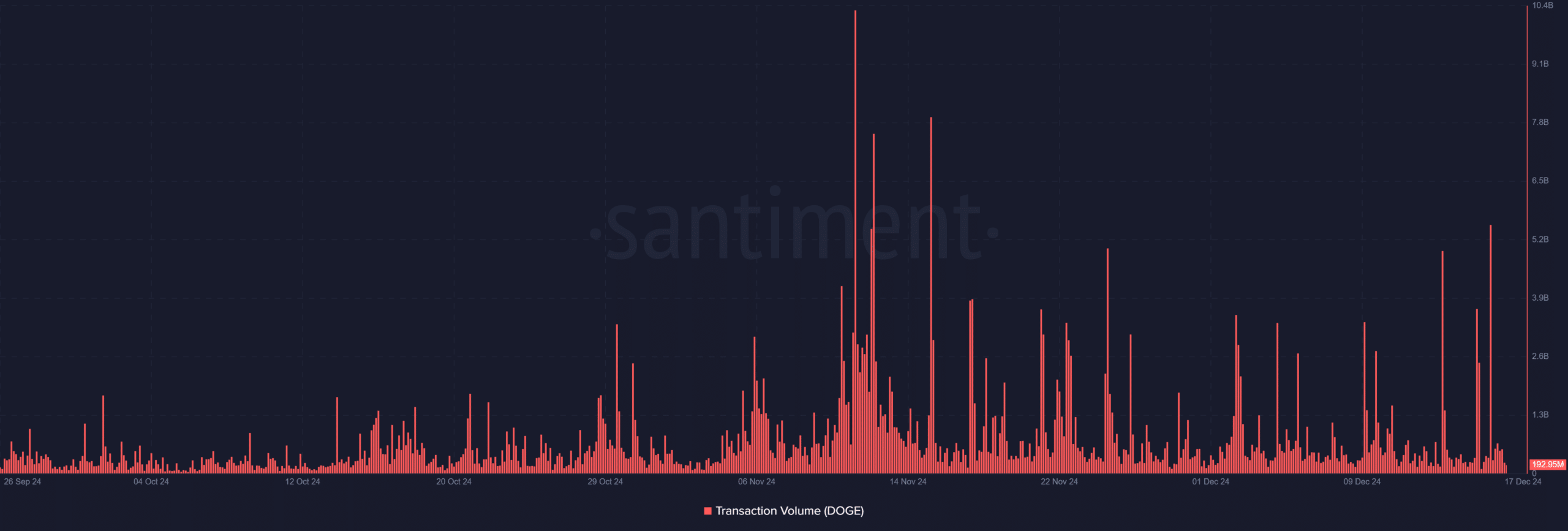

Transaction volume signals increased market activity

The Transaction Volume chart further validates this trend. Transaction volumes began rising sharply in late October, peaking in mid-November, coinciding with Dogecoin’s price rally.

Analysis showed a slight spike on the 16th of December when it grew to over 5.5 billion.

This heightened activity reflects strong market interest and liquidity entering DOGE. However, transaction volume declined slightly in December, aligning with DOGE’s price consolidation around $0.40.

This cooling phase suggests a neutral market sentiment, with traders waiting for a decisive breakout.

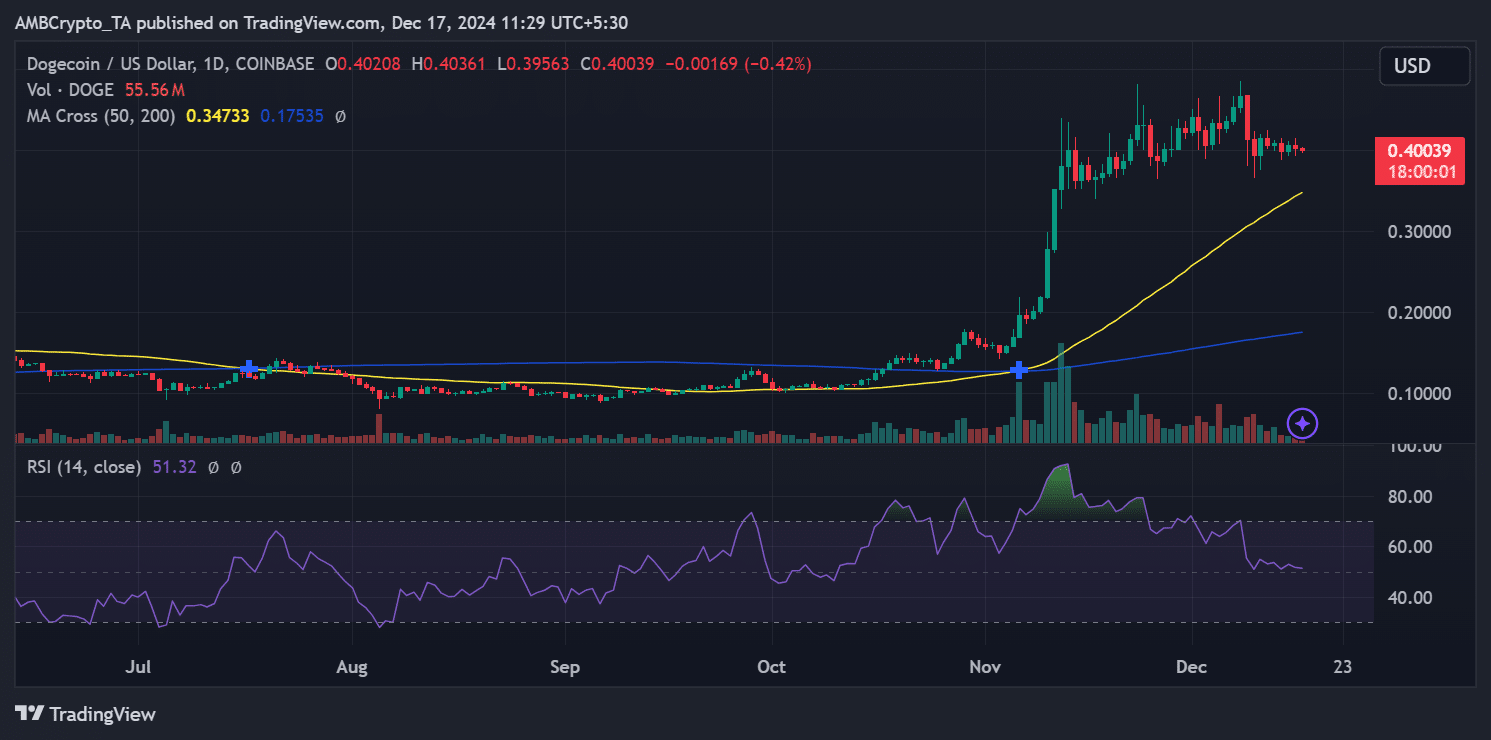

Dogecoin price holds support amid neutral RSI

From the price and RSI chart, Dogecoin was consolidating above its 50-day Moving Average (MA) at $0.34, reflecting continued bullish support. Meanwhile, the Relative Strength Index (RSI) at 51.32 indicated neutral momentum, suggesting that DOGE is neither overbought nor oversold.

If DOGE manages to hold this key support level and transaction volumes pick up again, a push toward $0.45 could materialize. However, a drop below the 50-day MA would signal weakening bullish strength and could lead to a pullback toward the $0.30 level.

– Is your portfolio green? Check out the Dogecoin Profit Calculator

Dogecoin’s on-chain activity and price movement signal a critical consolidation phase. While Age Consumed and transaction volume spikes highlight significant whale activity, DOGE’s current neutral RSI reflects a balanced market.

Traders should further monitor on-chain signals and price action to identify DOGE’s next move.