Altcoin

Mapping MKR’s road to $2200 – How and when?

Maker rebounds strongly, surging 3.67% daily, with bullish momentum targeting $2200 resistance levels.

- MKR has surged by 45.46% over the past month.

- Maker’s large transactions have surged by 130.43% in 24 hours as the market showed a strong recovery.

Since hitting a local low of $1107, Maker [MKR] has experienced a sustained uptrend to hit a high of $2073.

Since reaching a high, the altcoin saw a pullback, dipping to a low of $1634. However, it seems this market correction is over, and the uptrend is set to continue. At press time, Maker was trading at $1867, marking a 3.67% increase over the past day.

The altcoin has also gained 14.12% on weekly charts and 45.46% on monthly charts. Despite the price pump over the past month, MKR remains approximately 70.47% below its all-time high of $6339.

The prevailing market offers optimism, as Maker has made a considerable recovery across the charts.

What MKR’s charts say

Significantly, after a sharp decline with sellers retaking the market, buyers have made a strong comeback.

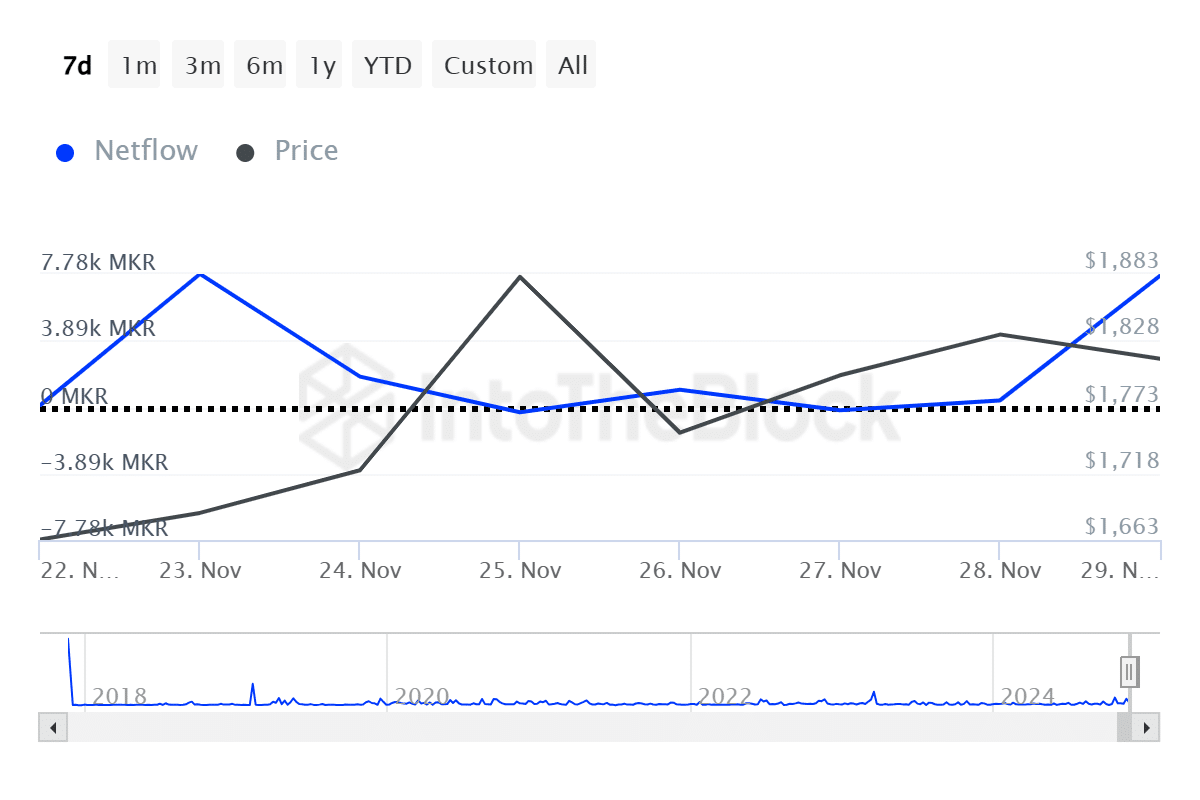

For example, Maker’s large holders netflow has surged over the past 48 hours from negative levels to 7.68k. This suggests that there are more funds inflow than outflow among large holders. As such, they are buying more than they are selling.

This increased activity by large holders is further evidenced by a spike in large transactions over the past day.

Large transactions have surged by 130.43% in 24 hours. This implies that whales are very active and with our observation above, we can ascertain that these large transactions are mostly funds inflows.

Additionally, this participation is not isolated to large holders only but across the market. As such, Maker’s daily active addresses have spiked 58.07% over the past 24 hours, from 503 to 803. A surge in active addresses is crucial for MKR price rally as it shows increasing demand, interest, and adoption.

Finally, while we see increased funds inflow, Coinglass data indicates that most investors are taking long positions. Therefore, the long/short ratio shows that the long position takes 50.83% on daily charts.

This implies these traders entering the market are betting on prices to surge further.

What next for Maker?

Simply put, Maker is experiencing a shift in market sentiment, with investors turning bullish. The prevailing market conditions could set MKR for more gains on its price charts.

Read Maker’s [MKR] Price Prediction 2024–2025

If these conditions hold, MKR will break out from the $2000 resistance, where it has faced multiple rejections, and attempt the $2200 resistance level for the first time since August.

However, if a trend reversal occurs, MKR will find support around $1680.