Marinade Finance’s UK lockout: SOL’s TVL persists amid price troubles

- Marinade Finances halted access to UK users due to compliance issues.

- Solana and Marinade Finance’s TVL have remained unaffected by the recent development.

A major Decentralized Finance (DeFi) platform on the Solana [SOL] network recently restricted access for users from the United Kingdom. This decision prompted concerns and inquiries regarding its potential implications for SOL and its Total Value Locked (TVL).

– Is your portfolio green? Check out the Solana Profit Calculator

Solana’s Marinade halts UK access

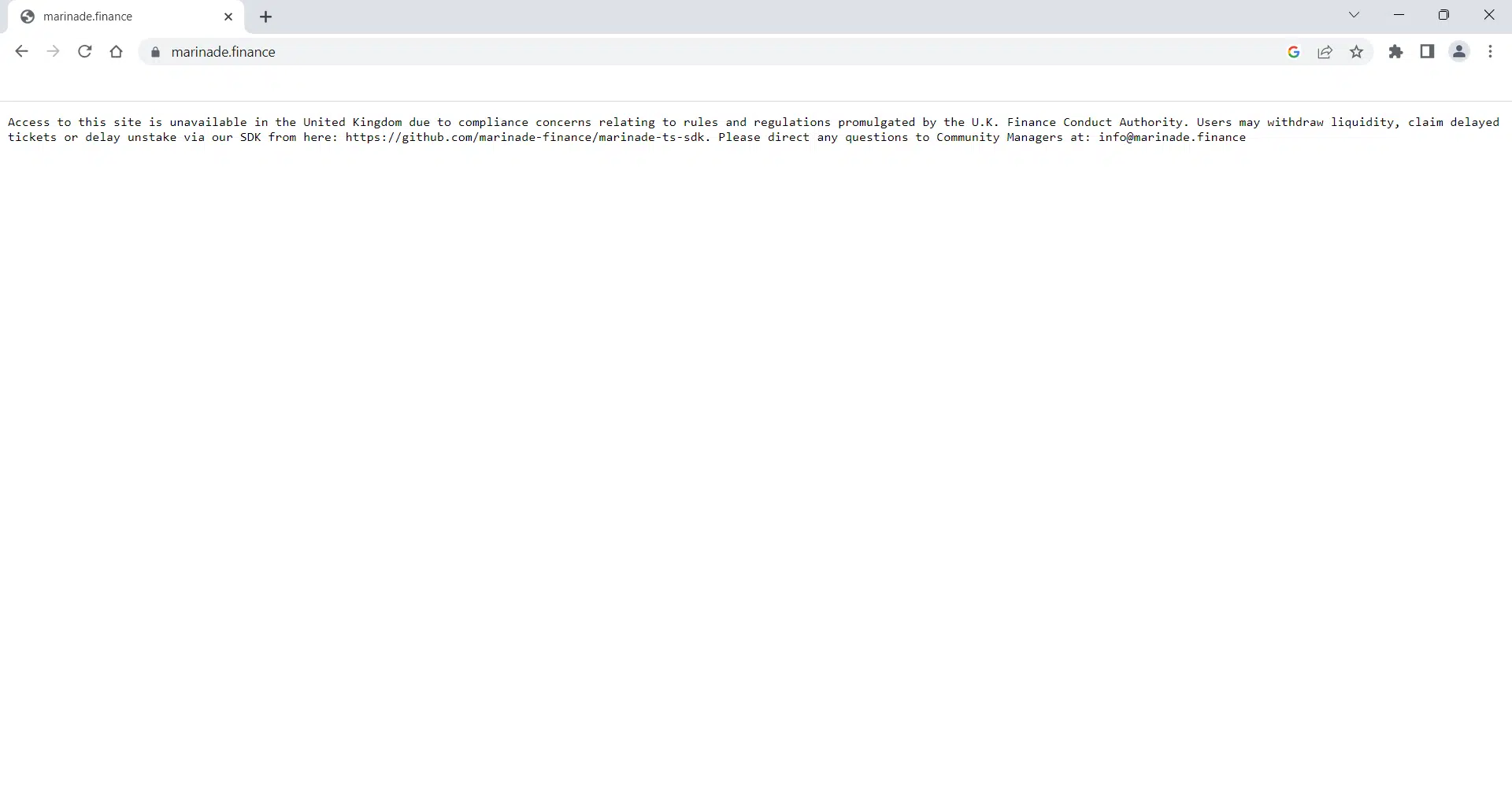

On 24 October, UK users of Marinade Finance found themselves unable to access the Decentralized Finance platform. Upon attempting to access the platform using a UK IP address, a message stating that access had been discontinued due to compliance issues was encountered.

However, users were offered alternative links for withdrawing funds and unstaking their assets. This recent development held significant importance within the Solana ecosystem. This was because Marinade Finance was the largest contributor to the TVL on the network. Did this development impact Solana’s and Marinade Finance’s TVL?

Analyzing Solana’s TVL

Upon examining the TVL of Solana on DeFiLlama, it was evident that there had been no adverse impact on the overall trend. This was despite the largest TVL contributor restricting access for some users. Furthermore, at the time of writing, the TVL stood at nearly $370 million, and it displayed an upward trajectory.

Similarly, when assessing Marinade Finance’s TVL, it appeared to have remained unaffected by the recent developments. At the time of this update, its TVL exceeded $265 million, indicating a substantial 10% increase in the past 24 hours. Furthermore, over the past week, there has been an impressive growth of over 90% in TVL.

Impact on SOL?

At the time of this writing, SOL was trading at approximately $31, reflecting a decline of slightly over 1%. This decrease followed a notable 9% surge that occurred on 23 October.

Upon reviewing the daily timeframe chart, it became apparent that the current trajectory of SOL suggested the potential for a price reversal. This inference was supported by the Relative Strength Index (RSI) line, which was trending above 80.

– How much are 1,10,100 SOLs worth today

Furthermore, SOL has been on a bullish trend and reached the oversold territory, which might be the primary reason for the recent price decline rather than any specific developments in the ecosystem. Given these indicators, it is conceivable that further price declines may occur in the coming days as the price seeks to correct itself.