MATIC holders aspiring to go long should consider these factors first

The current performance of cryptocurrencies is making many investors anxious. Some are thinking that the cryptocurrency market might be taking a turn for the worse. More than $91 billion has been wiped out of the market just in the last three days.

Consequently, altcoins such as Polygon’s MATIC might take a hit.

Polygon in the crosshair

MATIC alone isn’t the victim here, as most of the market might end up going through the same situation. Well, MATIC investors have been in the mood for accumulating the token for six months straight.

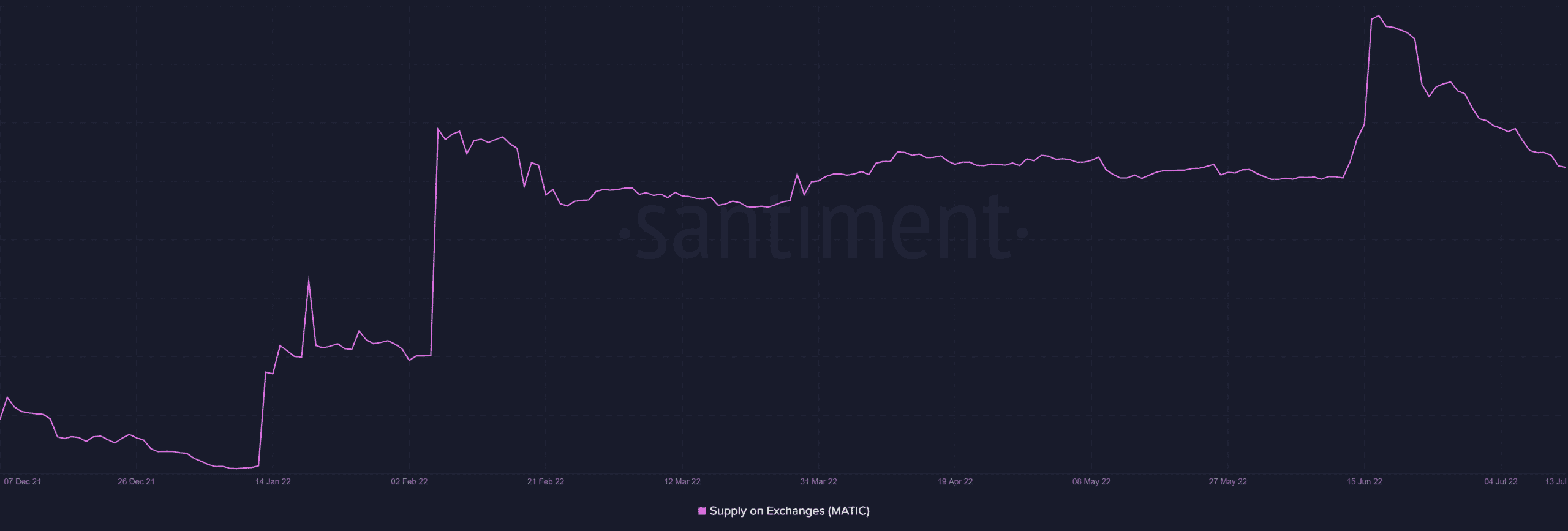

Furthermore, the supply on exchanges has only been reducing as the falling prices have created a bullish environment for Polygon to successfully attract new investors towards it.

And, surprisingly, 2.8 billion MATIC worth over $1.22 billion have been bought out of exchanges since January 2022.

Polygon supply on exchanges | Source: Santiment – AMBCrypto

In the same duration, more than 104k new investors have joined the network, which has impacted the average balance present at each address.

Down from its January high of $89k, the average balance has reduced to just $12.4k partly due to the rise in MATIC HODLers, with the falling prices adding to this downfall.

Polygon average balance | Source: Intotheblock – AMBCrypto

But since both price and inflows have taken a break, accumulation might halt as well. Despite going through high volatility since 13 June, MATIC stands at the same price level it was at a month ago.

Additionally, CoinShares’ latest report has highlighted that this week noted some of the lowest weekly inflows observed as of 2022. Thus, investors might begin clutching onto their money given the market isn’t going anywhere.

MATIC on cloud 9?

Looking at the price indicators on MATIC, it does seem like the altcoin is still holding on to the bullishness from a few days ago. The Relative Strength Index (RSI) too stood in a position of gradual incline, at press time.

Polygon price action | Source: TradingView – AMBCrypto

However, things may go south quickly if the selling pressure intensifies. Further, the RSI witnessing a downtick could be one of the first signs of an upcoming downtrend.