Matic is nearly wiped off of exchanges! What is the effect on the price?

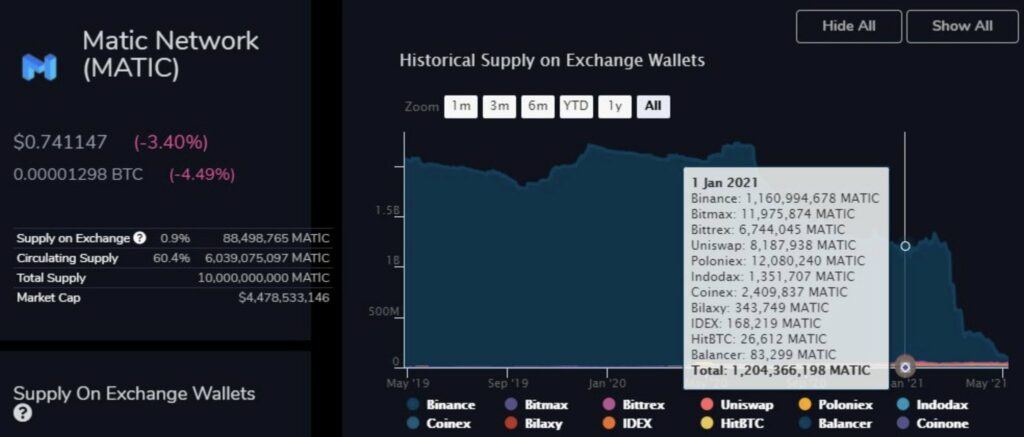

Ethereum’s price rally may have stunted the growth of most other altcoins, however, Polygon MATIC is now pretty much wiped off the exchanges. While in early January 2021, there was 1.24 Billion MATIC on spot exchanges and now in May 2021, in over 4 months, only 88.49 Million MATIC remains. On-chain sentiment suggests that retail traders are currently bullish for MATIC in the long term. This is based on the overall progress of the project and not just the price rally that started this alt season.

Much of MATIC’s supply is being actively used through Polygon ecosystem for various productive activities. Based on this, it’s obvious that Polygon is a project that has found product/market fit that very few altcoins have. Additionally, MATIC has proven its utility and importance for the Polygon ecosystem. It differentiates itself from speculative assets and memecoins sitting on exchanges and concentrated in large HODLer wallets.

AAVE and SUSHI takeover on 0x Polygon was a significant event in DeFi summer 2021 and as more projects inject liquidity through Polygon it becomes more relevant. Since Ethereum flowing out of exchange signals increasing investor confidence, a similar theory applies to MATIC as well.

With it being #1 L2 Scaling solution for ETH 2.0 the upcoming halving events and updates on the ETH network are bullish for MATIC’s price as well. The retail traders and HODLers with ETH in their portfolio are also the ones with MATIC in it, in most cases and this has led to an increasing correlation between the price of the two assets based on spot exchange activity.

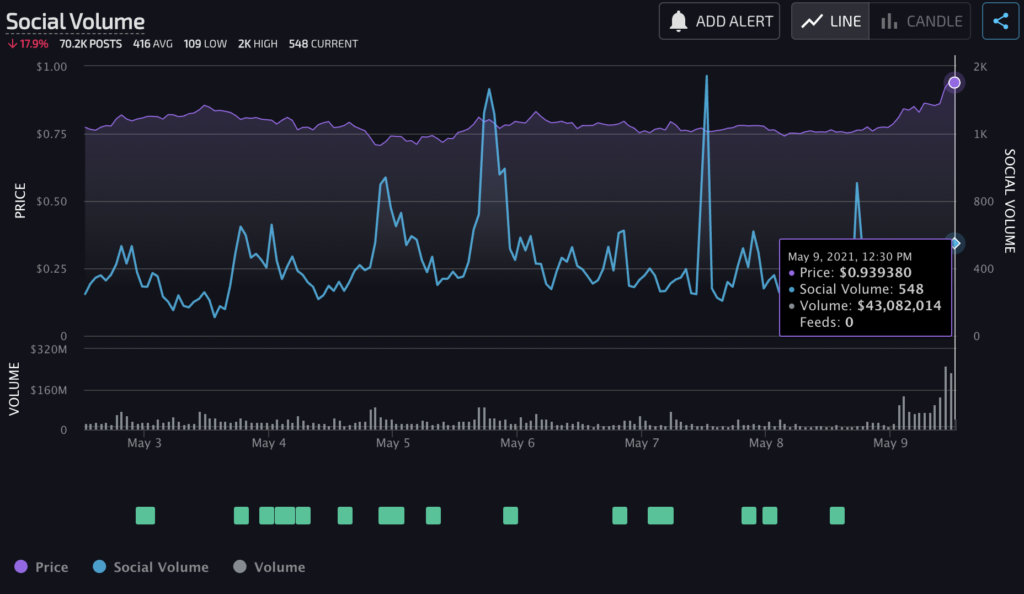

Source: Lunarcrush

Based on the above chart from Lunarcrush, MATIC’s social volume has currently dropped, however price is close to the $1 level. The spike in social volume has been followed by periods of range-bound price action and it is, therefore, conducive that the social volume is low.

There is a higher correlation between the MATIC reserves on exchanges and 24-hour trade volume, vs the social volume. This chart also shows that MATIC is not driven by mere speculation or social media frenzy and the price is not controlled by a few wallet addresses. MATIC’s price rally is anticipated to continue alongside ETH’s price discovery and rally to the $4000 level.

![3 catalysts that could send Ethereum [ETH] to $5,000 in 2025](https://ambcrypto.com/wp-content/uploads/2025/05/Abdul_20250515_122605_0000-400x240.webp)