MATIC offers a risky buying opportunity at $0.79, should traders take it

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- MATIC was beneath both the 61.8% and 78.6% Fibonacci retracement levels

- While this showed further losses were likely, there was a chance prices could see a bounce

Bitcoin traded above the $16.6k support level over what can be considered a weekend of reduced volatility and volume. MATIC has been in a downtrend on lower timeframes after the rejection at $0.928 on 14 December. It has support at $0.75 and $0.68 and faces stiff resistance at the $0.82 and $0.95 levels.

Read Polygon’s [MATIC] Price Prediction 2023-24

On-chain metrics and technical indicators highlighted bearish sentiment and outlined that buyers would be trading against the higher timeframe trend.

The 12-hour bullish order block served well over the weekend but bulls want to see $0.822 beaten

Based on the move from $0.686 to $1.3, a set of Fibonacci retracement levels (yellow) was drawn. MATIC fell beneath the 78.6% retracement level at $0.822, but it traded within a 12-hour bullish order block from mid-October. The technical indicators showed sellers were dominant.

The On-Balance Volume (OBV) has been in a downtrend since the first week of November. This meant selling volume has been dominant in recent weeks. The Relative Strength Index (RSI) also stayed below neutral 50 for a good chunk of the past month. It was unable to ascend past 60 when MATIC bulls grappled with the $0.95 resistance.

Hence, buying the token at these prices was risky. However, a move back above $0.822 and a subsequent retest can act as a trigger for the bulls to enter longs. Their profit targets include $0.86 and $0.92, with $0.95 being an optimistic target. If MATIC slid back beneath $0.77 this idea would be invalidated.

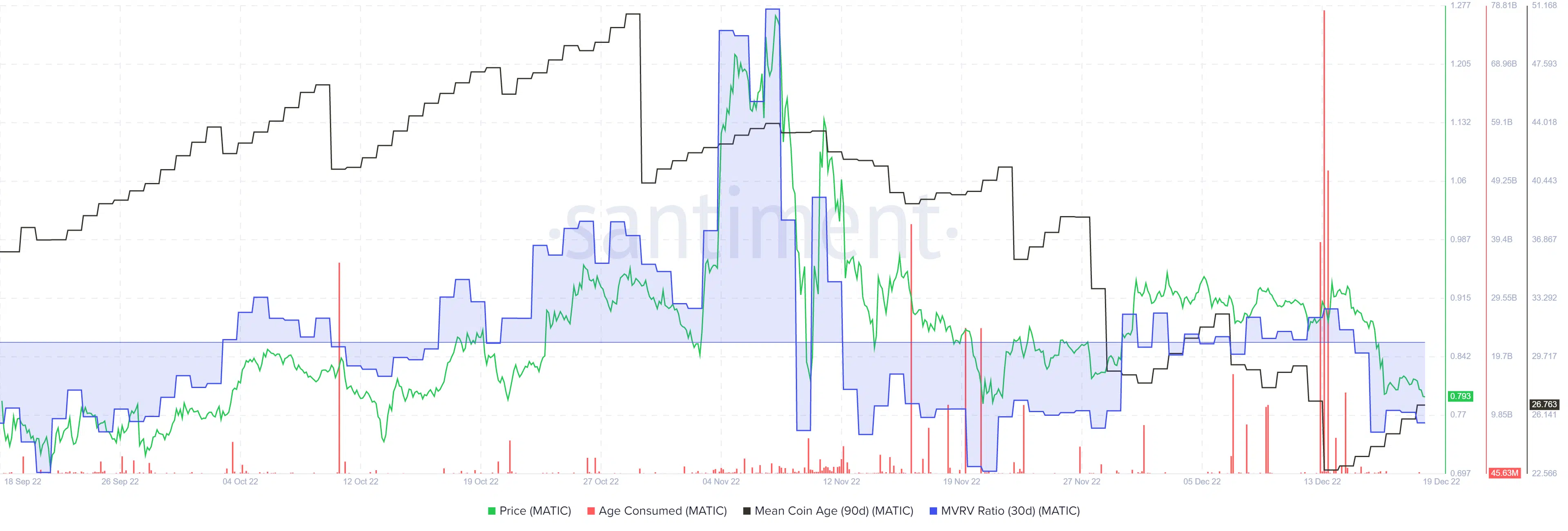

Mean coin age and MVRV decline sharply

Source: Santiment

Since October, the 90-day mean coin age has been falling to show increased MATIC movement between addresses. At the same time, the 30-day Market Value to Realized Value (MVRV) took a tumble and has been in negative territory since November. This showed short-term holders were holding the asset at a loss.

The age consumed metric saw large spikes on 13 December which meant a large amount of previously idle tokens were on the move. Shortly thereafter, MATIC fell from $0.915 to $0.8, hence the increased movement likely signified distribution.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)