MATIC rises 17% in 7 days: Can the momentum sustain?

- MATIC capitalized on the latest altcoin resurgence, marking a decoupling trend from Bitcoin.

- The Polygon zkEVM network offered optimism, as it experienced a 40% TVL increase and reached an all-time high.

Amidst the recent surge in Bitcoin’s price, several altcoins have seized the opportunity to shine. Specifically, Polygon [MATIC] experienced a significant boost.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

MATIC on the rise

MATIC’s recent ascent can be attributed to the broader altcoin resurgence that coincided with Bitcoin’s [BTC] latest push beyond the $30,000 mark.

Unlike previous instances where Bitcoin’s rise overshadowed other digital assets, this time, altcoins like MATIC have displayed remarkable decoupling from Bitcoin’s price, as reported by Santiment.

? Unlike #Bitcoin's previous two brief visits to $30K, this latest resistance level break to end the weekend has occurred as #altcoins surge, rather than falling behind $BTC's price. $LINK, $MATIC, $UIP, $APT, and $AAVE are all seeing their best performing decouplings of 2023. pic.twitter.com/ci7MPh25yf

— Santiment (@santimentfeed) October 23, 2023

On 12 October, MATIC faced a significant test when it approached the $0.501 support level. The token not only overcame this hurdle, but surged by an impressive 25%. At the time of writing, MATIC was trading at $0.634, reflecting its substantial growth in a short period.

Despite the price rally, the Chaikin Money Flow (CMF) for MATIC dropped to -0.07, indicating a bearish trend in money flow. However, the Relative Strength Index (RSI) remained notably high at around 75.99, suggesting strong bullish momentum.

While the number of MATIC holders increased with the price surge, a notable decline in network growth occurred. This trend indicates a reduced frequency of new addresses engaging in MATIC transactions.

A massive spike in activity

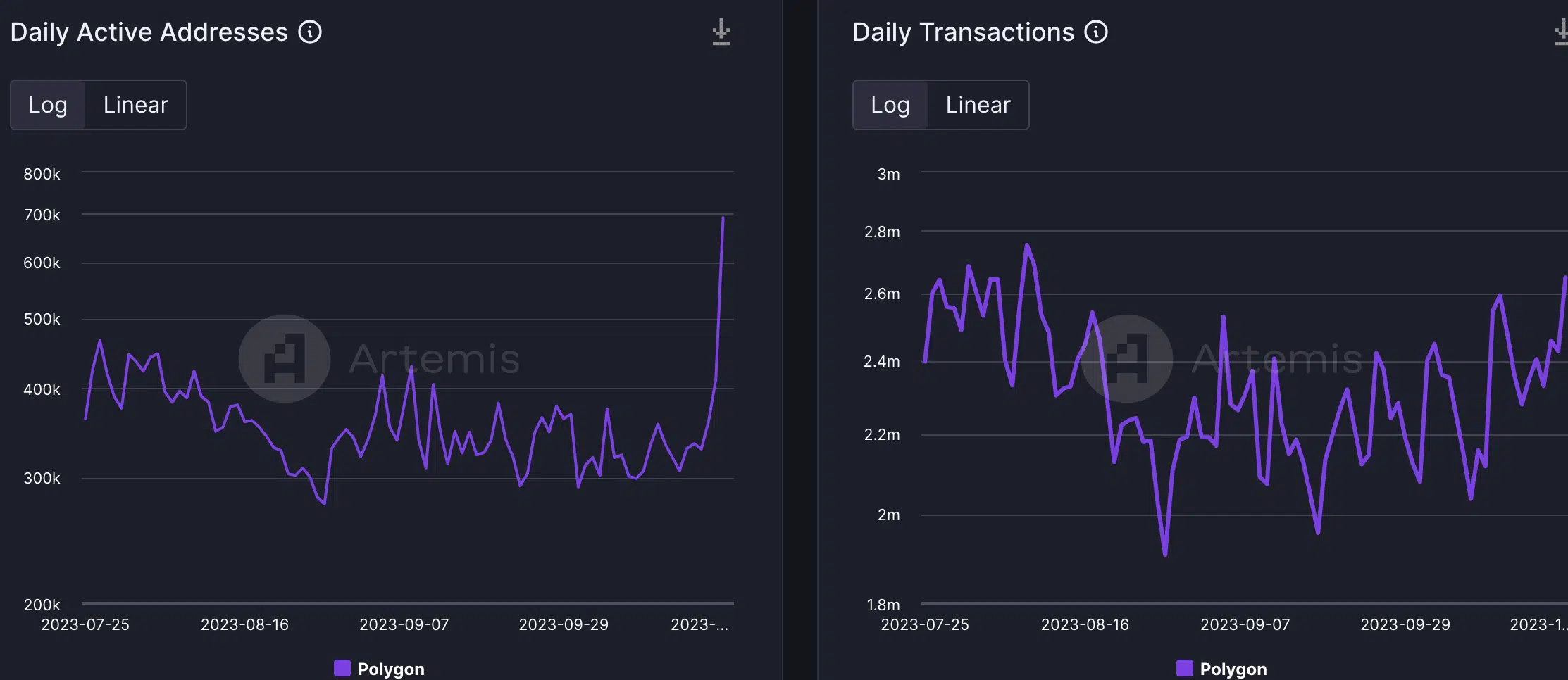

Conversely, the protocol’s operational aspects saw significant improvement. The number of daily active addresses on the network experienced a substantial spike in the past few days. Furthermore, the volume of transactions within the protocol, including daily transactions, also surged.

However, the DeFi sector on Polygon presented a less optimistic picture. According to Artemis’ data, the Total Value Locked (TVL) in the protocol experienced a significant drop. Additionally, Decentralized Exchange (DEX) volumes on the Polygon network remained stagnant, indicating a lack of substantial activity.

Is your portfolio green? Check out the MATIC Profit Calculator

Despite these challenges, there was a glimmer of hope for Polygon, primarily driven by the Polygon zkEVM network. This solution witnessed an impressive 40% uptick in TVL, reaching an all-time high.

This achievement hinted at the potential for increased adoption and network activity on Polygon’s ecosystem.

All TIME HIGH

Polygon zkEVM has reached a new ATH in TVL and has increased 40%+ over the last 30 days. pic.twitter.com/LA27j68u9n

— Today In Polygon (@TodayInPolygon) October 20, 2023