MKR attempts recovery as MakerDAO makes a significant move. What next?

- MakerDAO was in the process of experimenting with tokenized treasury bills.

- A look at why MKR might face more selling pressure down the road.

MakerDAO might become the first WEB3 platform to roll out tokenized treasury bills. The DeFi protocol is reportedly in talks for an experiment with tokenized tokens. A move that will reportedly involve a $100 million investment.

Is your portfolio green? Check out the Maker Profit Calculator

There are a couple of reasons why MakerDAO’s experiment with treasury bills could be a game-changer for the platform. Every DeFi protocol aims to tap into robust utility which in turn unlocks heavy liquidity.

Facilitating treasury bill tokenization and issuance could unlock immense value not only for MakerDAO but also for users and governments.

NEW: @MakerDAO in discussion to allocate up to $100 million to develop and experiment with tokenized T-Bills pic.twitter.com/7kKujIcsHp

— Messari (@MessariCrypto) September 7, 2023

Tokenized T-bills could blur the lines that limit accessibility to such investment instruments. Such a feature may allow anyone from across the world to invest in T-bills. It underscores one of the most useful ways of deploying on-chain assets or tokens pegged to real-world assets.

Would the T-Bills on MakerDAO support MKR’s price action?

Tokenized treasury bills may unlock more utility for the MakerDAO protocol. More importantly, initial reports suggested that DAI could play a part in the collateralization mechanism.

Either way, this development could be good for both MakerDAO and the MKR token, MKR was one of the most bullish top cryptocurrencies by market cap in the last four months. It is currently trading at a premium compared to its June lows.

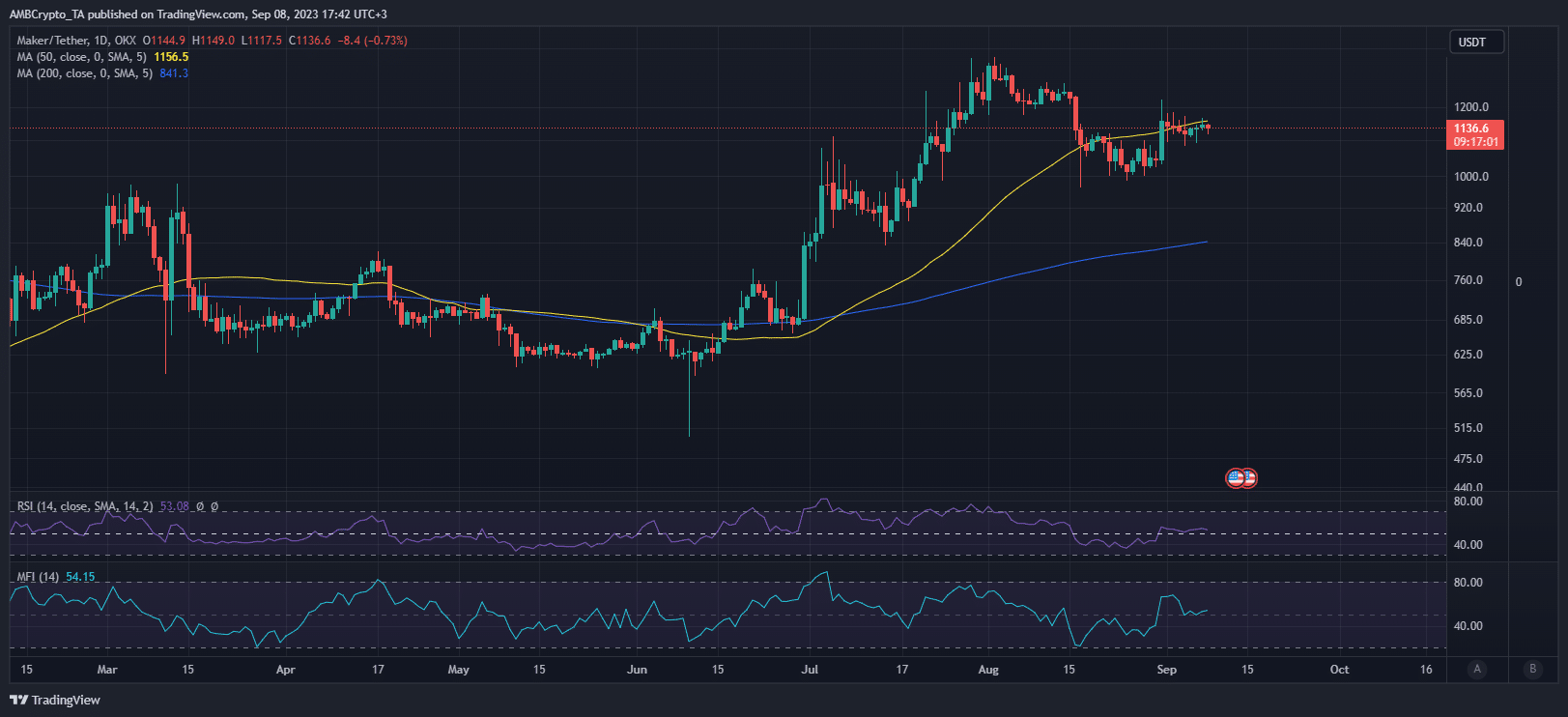

However, its price experienced some weakness in August and the bulls have been struggling to maintain dominance.

MKR’s Money Flow Index (MFI) indicated that there have been some outflows since the start of September. But that is not the only bearish sign. The weighted sentiment metric ended August on a bullish note but it has since reverted to negative levels.

Read about Maker’s price prediction for 2024

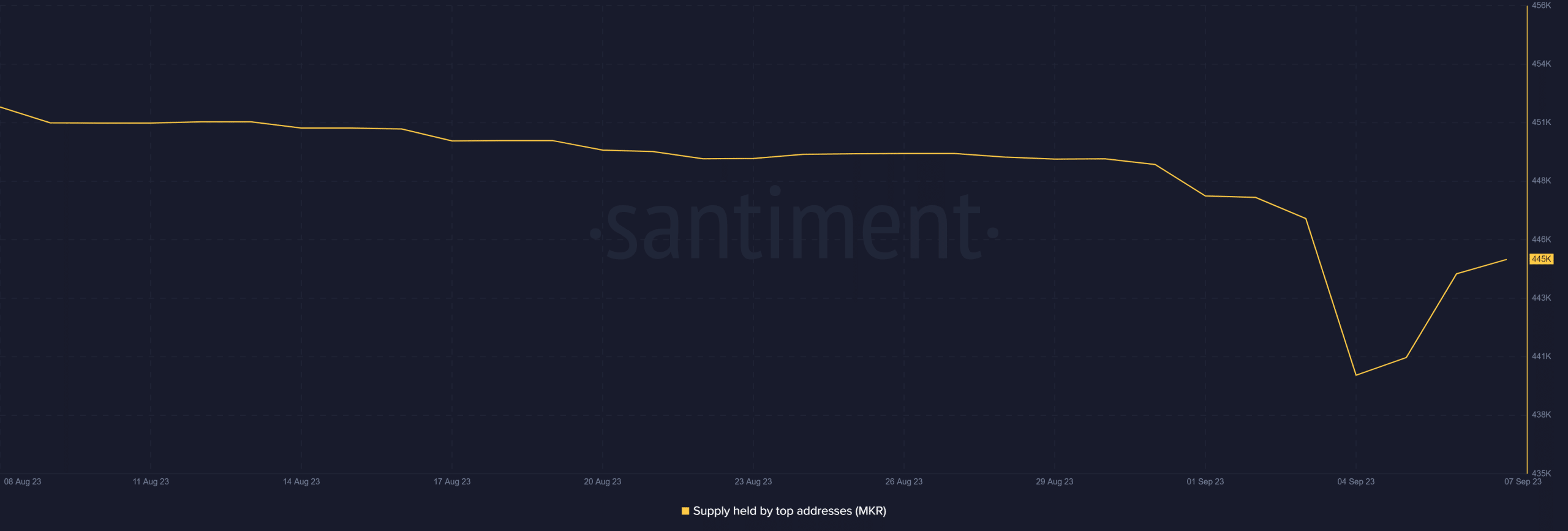

MKR’s mean coin age metric also registered some downside, which confirmed that coins previously hodled for some time have been moved. This aligns with the observed outflows from the supply held by top addresses.

This also confirmed that whales have been contributing to sell pressure. However, the same whales have also bought back after a slight discount.

The same supply held by the whales metric indicated that whales have also bought back a substantial amount of coins after a slight discount. While the downside indicates that whales expect more downside, the re-accumulation suggests that the whales might be looking to play the market.

On the other hand, the recent downside was quite limited, suggesting that MKR holders are still optimistic about their prospects.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)