MKR sees large sell-offs; will traders stay put in the face of this adversity?

- Whales began to sell MKR and the altcoin witnessed a correction over the last few days.

- MVRV ratio fell, implying that most holders were not profitable.

MakerDAO [MKR] showed immense resilience over the past few months despite market volatility. However, in spite of the growth seen by the protocol, some investors were losing faith in its governance token, MKR.

Is your portfolio green? Check out the MakerDAO Profit Calculator

Whales shy away

As per data from lookonchain, FalconX, a well-known crypto trading platform, seemed to be offloading MKR. Over the last week, FalconX moved a sum of 9,085 MKR, which was worth $12.8 million, into OKX and Binance.

At press time, there were 7,261 MKR, equivalent to $10 million, remaining in their holdings.

FalconX appears to be selling $MKR.

In the past 7 days, FalconX deposited a total of 9,085 $MKR ($12.8M) into #OKX and #Binance.

There are currently 7,261 $MKR ($10M) left.https://t.co/RUnvI47lMB pic.twitter.com/mQ3uV8nHc2

— Lookonchain (@lookonchain) October 30, 2023

FalconX selling MKR could have a couple of impacts. On the positive side, if demand for MKR stays strong, the reduced supply could increase its price. On the negative side, if FalconX’s actions raise concerns among traders, it might lead to a dip in MKR’s value as people may become cautious.

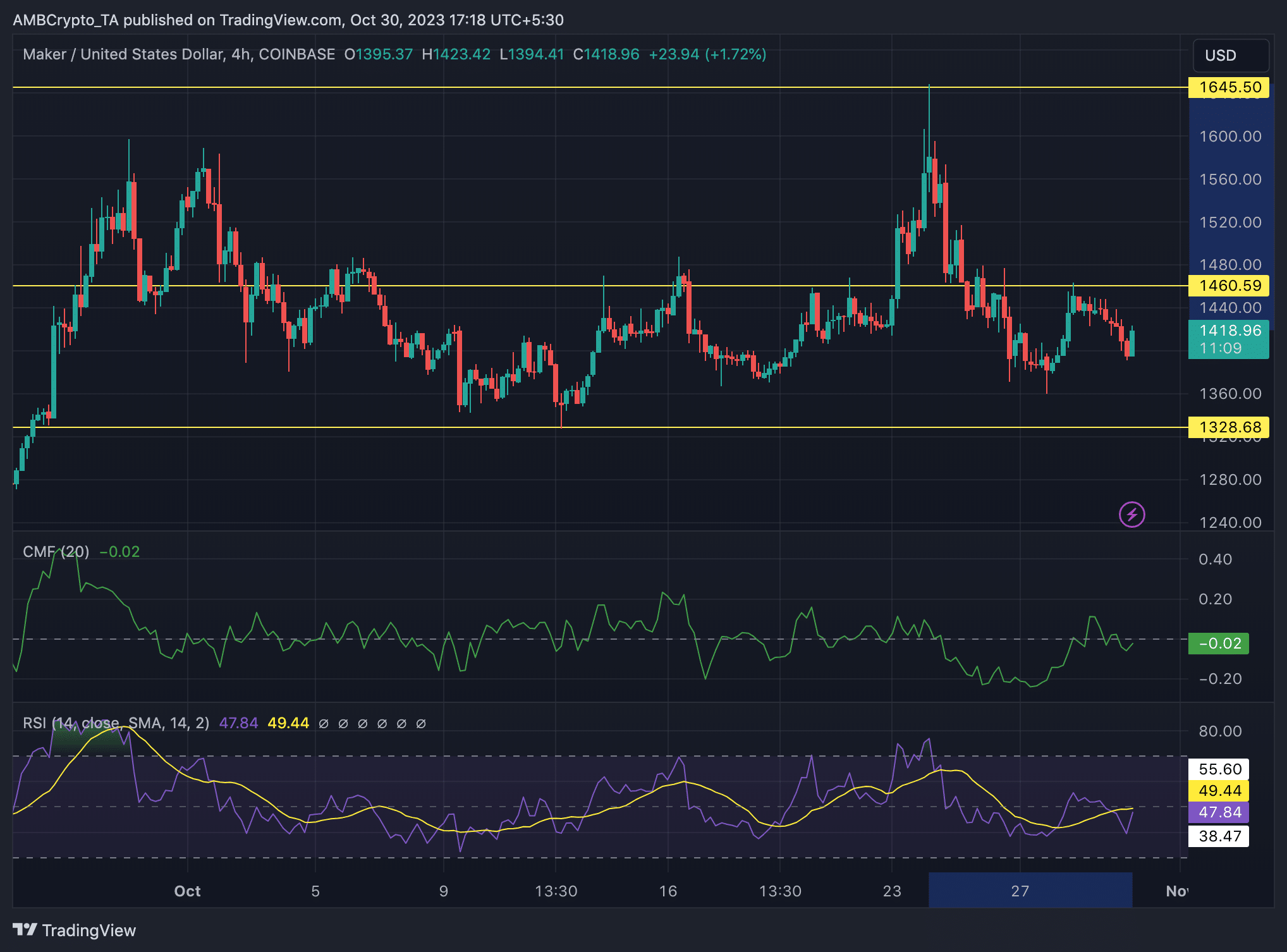

Furthermore, talking about MKR’s price, it was seen that its price declined by 11.78% since 24 October. However, while zooming out and looking at the larger picture, it was seen that MKR’s price was moving sideways. No specific bullish or bearish trend had been established. At the time of writing, MKR was trading at $1418.29.

The Chaikin Money flow (CMF) was slightly below 0 at -0.2. This implied that money flows toward MKR had slightly fallen. Additionally, MKR’s Relative Strength Index (RSI) also fell to stand at 47.83. The RSI on the lower side could suggest that momentum was with the sellers at the time of writing.

Where do the metrics stand?

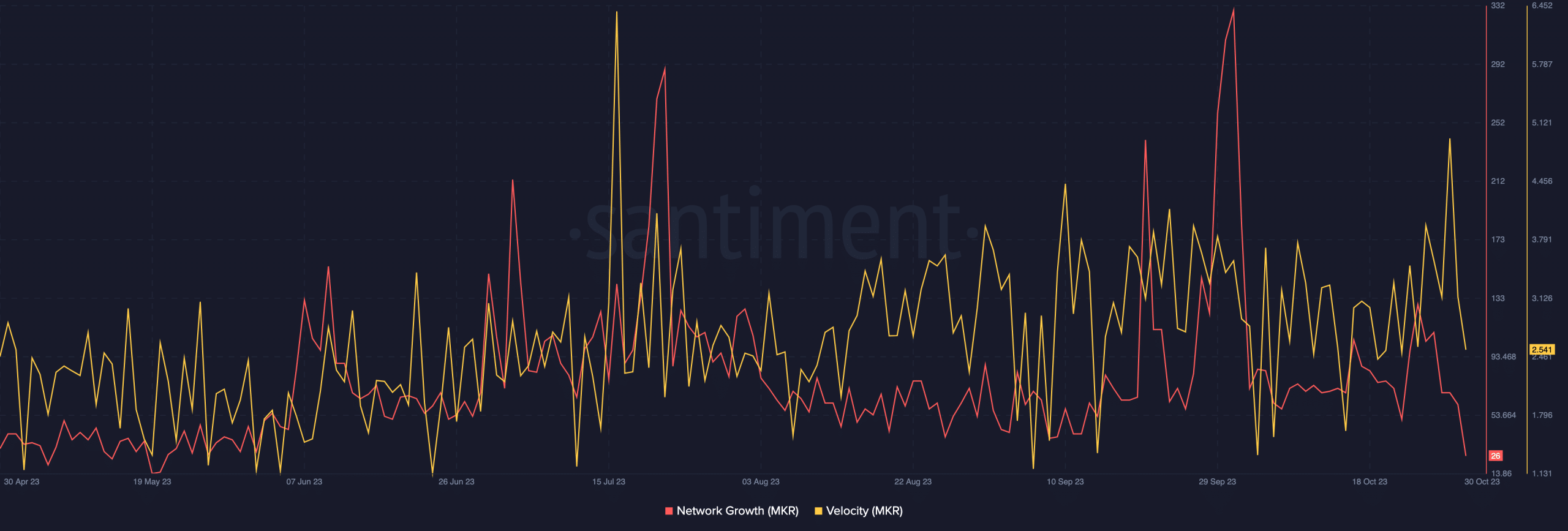

The Network Growth metric for MKR witnessed a dip as can be seen in the chart given below. The falling Network Growth metric implied that new wallets were losing interest in MKR. Coupled with that MKR’s Velocity also witnessed a drop. This indicated that the rate at which MKR was being traded had fallen over the last few days.

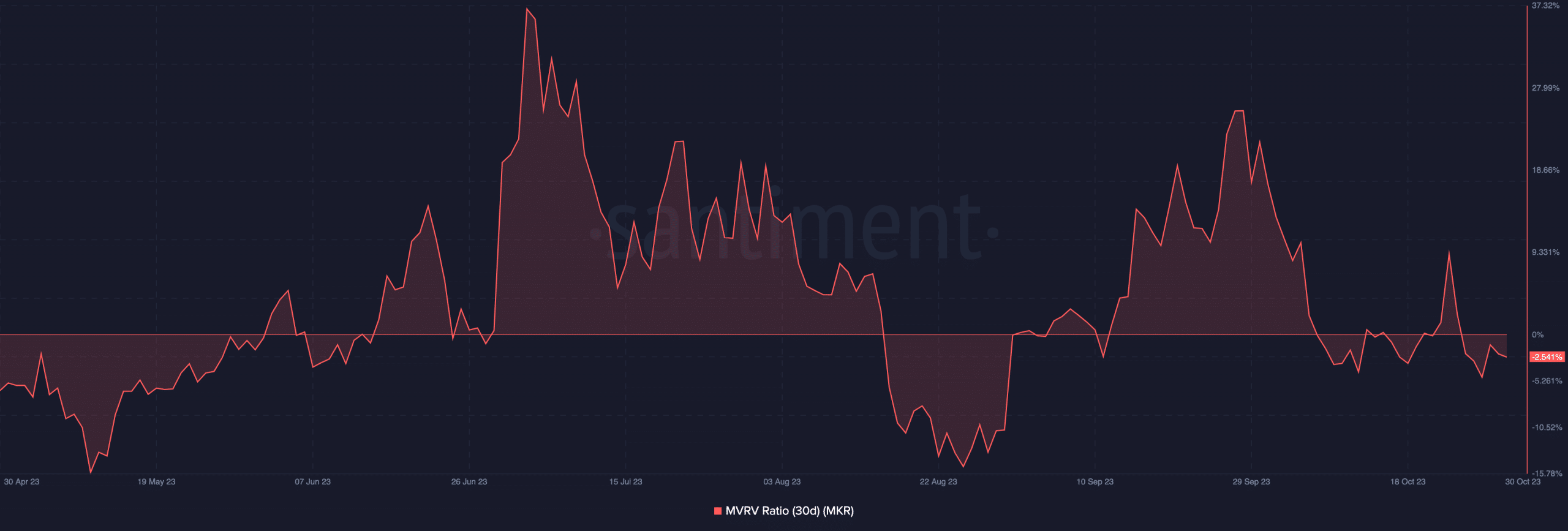

During this period. the Market Value to Realized Value (MVRV) ratio of MKR had started to fall. A falling MVRV ratio indicated that there was less selling pressure on token holders. This was due to the fact that most of them would be selling at a loss if they decided to sell now.

Realistic or not, here’s MKR’s market cap in BTC’s terms

Additionally, this also meant that the likelihood of the MKR’s price falling further would be low as most holders would like to sell their MKR at a profit.