Monero [XMR] could post a 10% gain past the $200 mark if these conditions are met..

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the opinion of the writer.

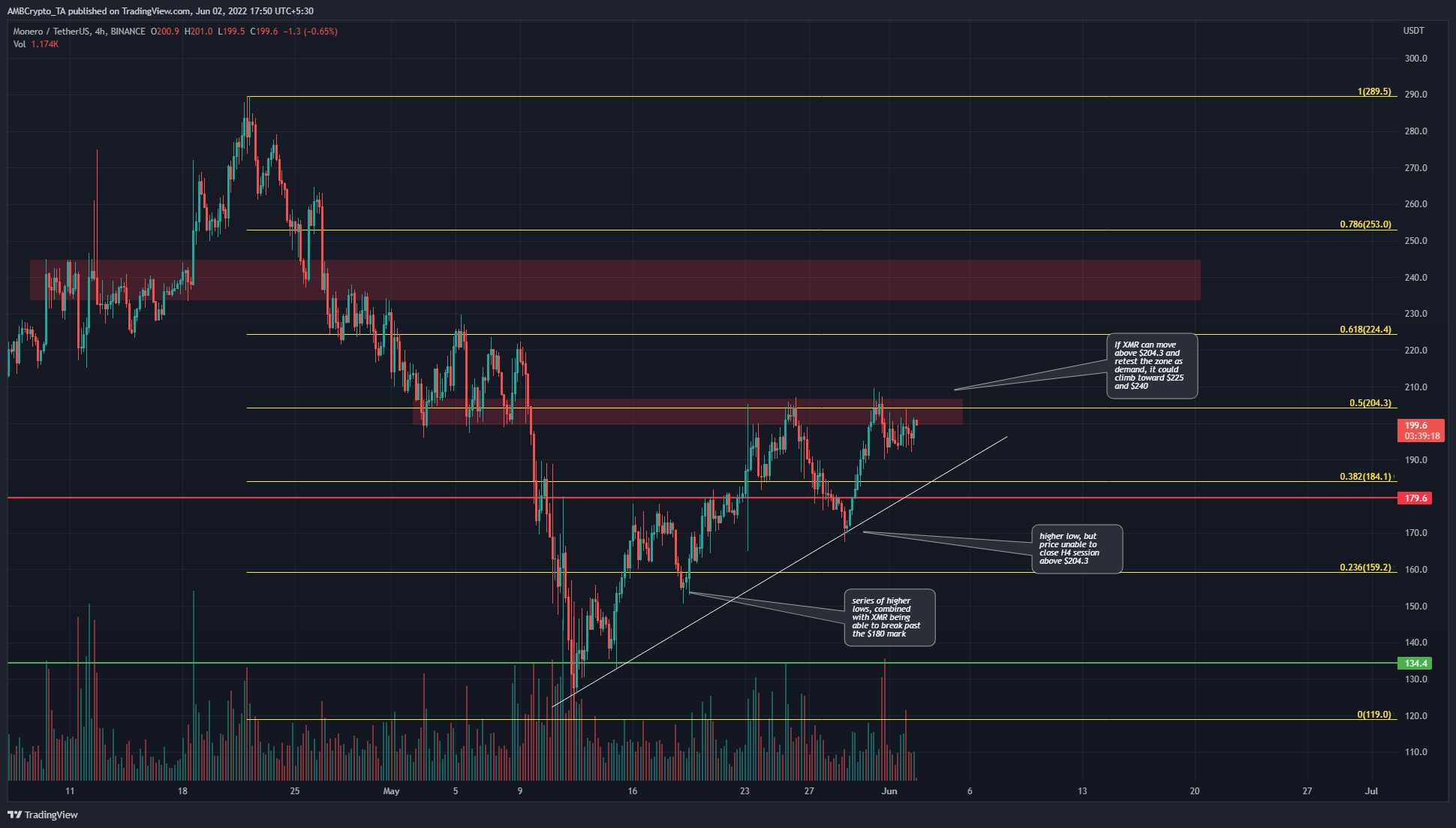

Monero dipped sharply beneath the $180 level a few days ago but was swift to bounce back and reach the $200 mark when Bitcoin rallied from its range lows. At the time of writing, Monero was trading within a range beneath a bear-dominated area on the chart, but a breakout and retest could offer an opportunity to buy XMR.

XMR- 4 Hour Chart

Since 12 May, the price has formed a series of higher lows, as highlighted by the ascending trendline. Moreover, it has broken past the $190 mark, and the $200 psychological and technical resistance zone has been tested multiple times in the past week.

When the price slipped beneath the $190 mark a few days ago, it was thought that the price would push toward the $150 level, especially as Bitcoin was trading within a range and weakly bounced from the $28.8k support.

Instead, Bitcoin pushed to the $32k mark, and this push gave some impetus to XMR bulls as well. At the time of writing, the $200 zone (red box) still put up stiff resistance.

XMR- 1 Hour Chart

The H1 chart showed a range between the $193.2 to $201.3 level over the past couple of days. This was a short-term consolidation beneath a level of resistance, with a bullish structure over the past two weeks on the same hourly chart. The price has made a candle wick above both the $179.6 and $204.3 levels and also formed higher lows at $156 and $168 too.

Therefore, a trader might want to look to enter long positions, but not immediately because the $200-$205 resistance zone was not yet flipped to a demand zone. Hence, a breakout from the short-term range, followed by a retest of the $201-$204 area, can be used to buy the asset. A drop below $190 would invalidate the idea.

The RSI oscillated between 45 and 55 over the past couple of days, which meant the momentum did not favor either the buyers or the sellers. The OBV has declined somewhat in the past three days, and the two levels marked on the OBV (dotted white) are places where bulls would want to see the OBV rise past.

The CMF has been above the +0.05 mark in the past three days as well, which indicated good buying pressure behind the crypto asset.

Conclusion

If the price can break out past the short-term range, and the OBV rises past the two levels marked as well while the CMF stayed above +0.05, it would be likely that a move upwards could materialize for XMR. In such a scenario, a retest of the $201-$204 area can be used to enter long positions, with a stop-loss beneath $190. As always, risking less than 1-2% of the trading capital when taking a trade would be prudent. The $225 can be used to take profit, as well as move the SL to breakeven if so desired.