Monero [XMR] in the derivatives market could see its demand go up, only if…

![Monero [XMR] in the derivatives market could see its demand go up, only if...](https://ambcrypto.com/wp-content/uploads/2023/03/hu-chen-FZ0qzjVF_-c-unsplash-scaled-e1677826906690.jpg.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- XMR cleared all the gains made in early 2023.

- Demand fluctuated, but development activity increased sharply.

Monero [XMR] dropped to its December 2022 lows of $140, clearing all the gains in the past two months. The retracement followed a sharp plunge of Bitcoin [BTC] to $22,000 amidst the Silvergate bank fallout as its crypto clients like Coinbase suspended business with it.

Read Monero [XMR] Price Prediction 2023-24

Will the $140 support hold?

XMR hiked 27%, rallying from $147 to $187 in January. A correction in February cleared part of the gains, and the token dropped to its December lows of $140 on 3 March.

However, the Relative Strength Index (RSI) on the three-hour chart hit the oversold territory and rebounded, showing a solid price reversal could continue.

As such, near-term bulls could target the 50% Fib level of $147.1 if they clear the 38.2% hurdle. Other key resistance levels that could act as bull targets are $148.7 (61.8% Fib level), $151 (78.6% Fib level), and $153.8 (100% Fib level).

On the contrary, bears could devalue XMR, especially if BTC drops below $22K. Such a move by king coin could sink XMR to retest the December lows of $140. Short-sellers could use the level as a short-selling target.

Is your portfolio green? Check out the XMR Profit Calculator

Development activity increased, but demand for XMR fluctuated

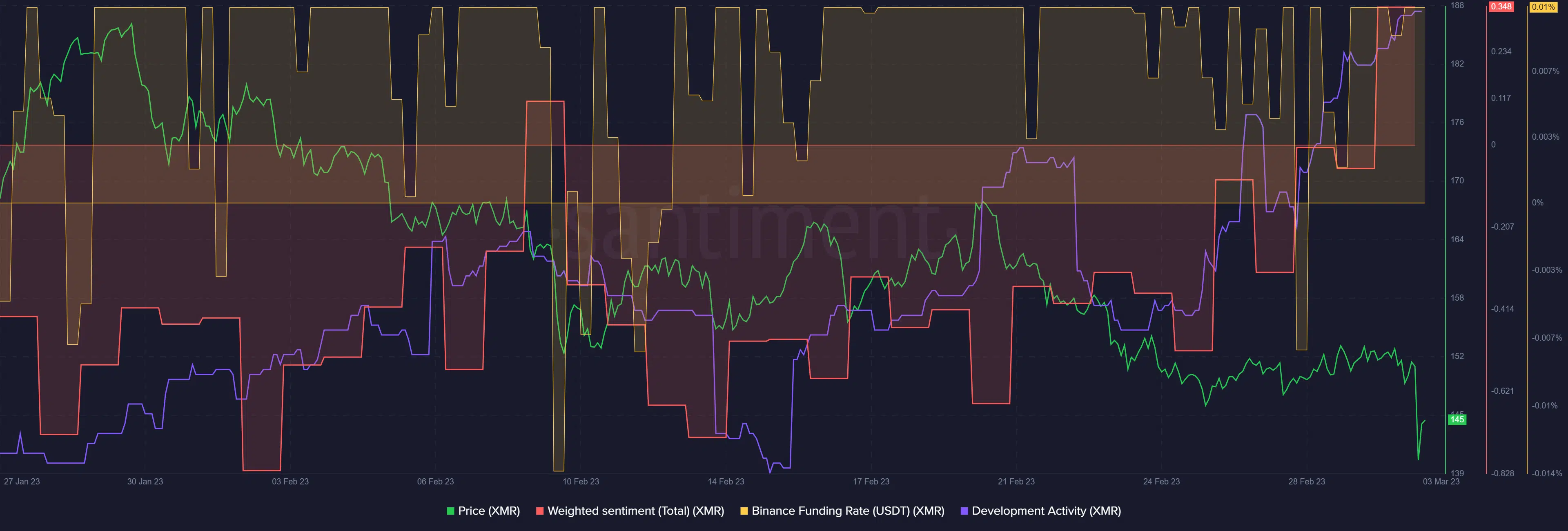

The privacy-focused network has seen tremendous development, as evidenced by the rising development activity.

Notably, the continuous building has boosted investors’ confidence in its native token, as shown by the weighted sentiment, which improved and flipped into positive territory.

Such a positive outlook on the token could increase its price in the short term and boost its recovery.

However, XMR has experienced demand fluctuations in the past few days, as shown by flip-flopping Funding Rate on the Binance exchange for the XMR/USDT pair.

The demand fluctuations could delay a strong recovery and should be a caution to investors. But a bullish BTC could improve the demand for XMR in the derivatives market, thus worth tracking the king coin price action.