NEAR could get into bear trouble, but investors can still benefit from these levels

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

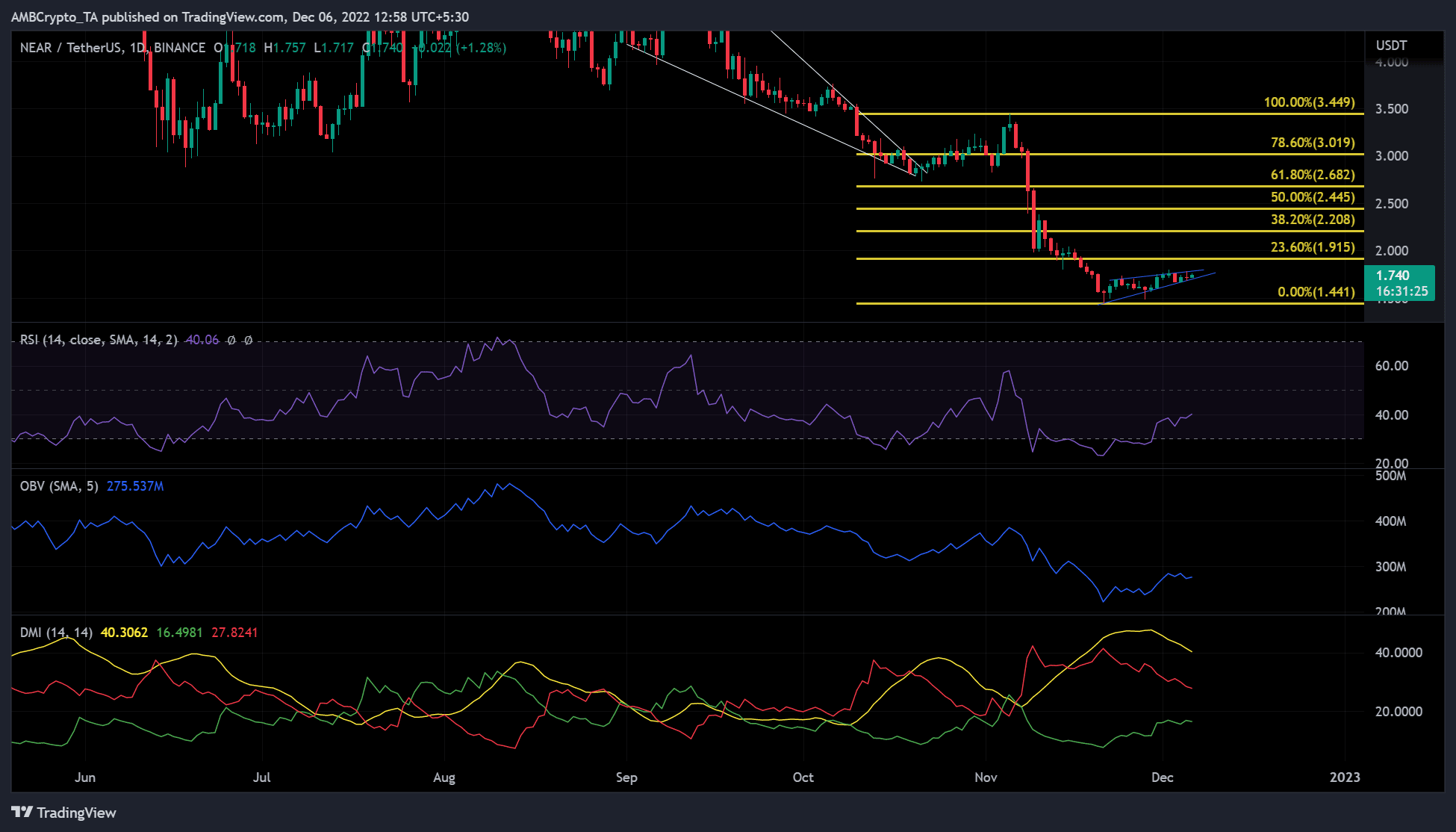

- NEAR formed a bearish rising wedge

- A bullish breakout and intraday close above $1.915 would invalidate the bearish forecast

NEAR’s recent rally could run into trouble if bearish sentiment continues to haunt Bitcoin [BTC]. At press time, NEAR was trading at $1.740 and could easily tempt traders to go into a long position. Appearances are deceiving, and technical indicators show that NEAR’s uptrend could face headwinds.

Read NEAR’s price prediction 2023-2024

NEAR forms a rising wedge: are the bears preparing for a bloodbath?

In September and October, the price action of NEAR formed a rising wedge. This was followed by a bullish breakout that initiated a short-lived uptrend after the FTX implosion put the brakes on the rally.

At the time of publication, the price action of NEAR formed another wedge chart pattern. The only difference was that the recent wedge pattern was a bearish rising wedge that could set NEAR on a downtrend. The Relative Strength Index (RSI), Directional Movement Index (DMI), and On Balance Volume (OBV) indicators all suggest that NEAR could be heading downward.

After retreating from oversold territory, the RSI was at 40, still just below the neutral level of 50. This indicated that buyers faced strong resistance from sellers despite increasing buying pressure.

The DMI reinforced the above trend. The red line (sellers) stood above 25, indicating that sellers still influenced the market. On the other hand, the green line (buyers) was well below 20, indicating that buyers still had a long way to go gain complete control of the market.

In addition, the OBV recently reached highs but was moving sideways at press time. This showed that the recent increase in trading volume was about to stagnate, which could undermine high buying pressure.

A downward breakout from the rising wedge could, therefore, drop NEAR to new support at $1.441 in a few days or weeks.

However, a bullish breakout and subsequent breach of current resistance at $1.915 would invalidate the above inclination. Such invalidation will see NEAR’s new target at the bearish order block within the 38.2% and 50% Fibonacci pocket.

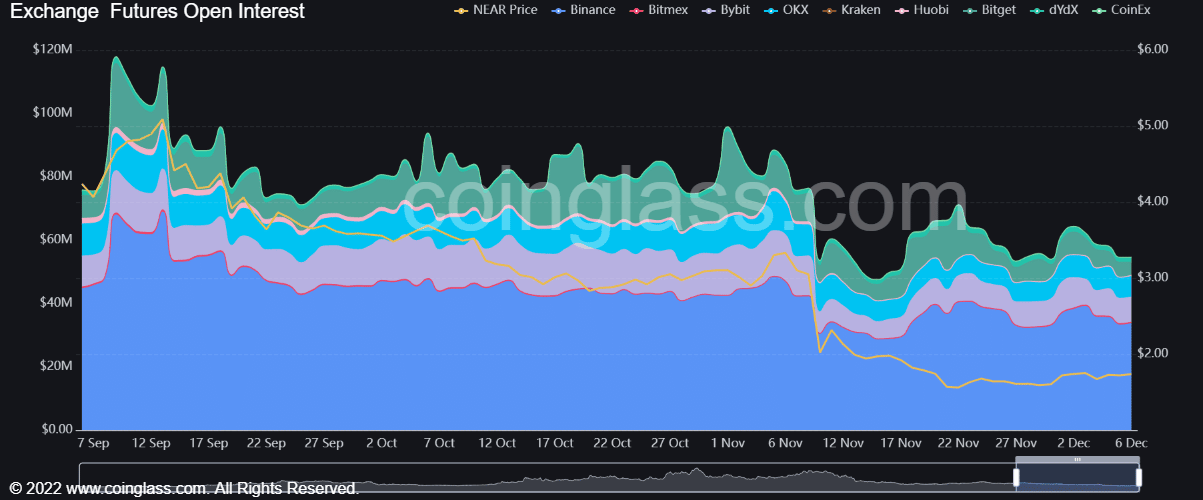

NEAR recorded a decline in open interest from Q3

NEAR’s open interest (OI) declined since Q3, and recovery was far from sight, according to Coinglass data. This meant that money flowed out of the derivatives market from NEAR since September, which was a bearish outlook.

Defillama data support this view. Its data show that NEAR’s total value locked at the time of publication fell from $250 million to $78 million. Thus, given the declining OI, NEAR could fall further.

However, a bullish BTC could influence the price rise of NEAR and disprove the above bearish prediction. Thus, traders must keep a close watch on the performance of BTC.