NEAR Protocol approaches a Fibonacci support level, but further losses are likely

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

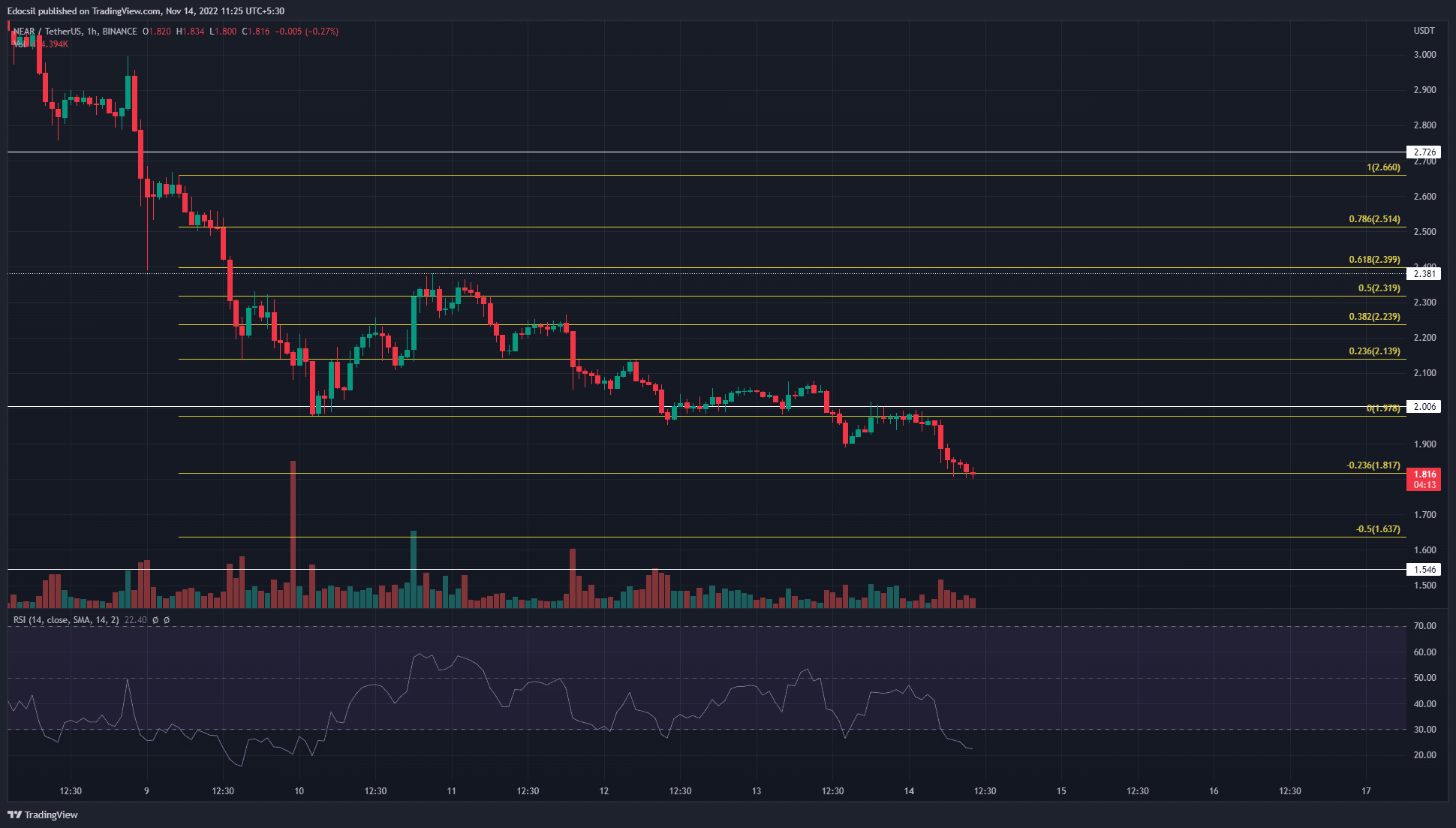

- The Fibonacci extension level showed that a bounce was possible for NEAR

- Lower timeframe resistance sat at $1.9 and $1.97

The founder of Binance Changpeng Zhao announced that Binance was forming an industry recovery fund to help strong projects suffering from a liquidity crisis. The minutes following this announcement saw a small bounce in the prices, and Bitcoin climbed from $15.9k to $16.3k, and was climbing, at the time of writing.

Read NEAR Protocol’s Price Prediction 2023-2023

NEAR Protocol traded at a Fibonacci extension level, but will the prices see a noticeable bounce? It was unlikely that a trend reversal was in sight, as the bearish sentiment was here to stay. If the $2 area was retested as resistance, it might offer a shorting opportunity for NEAR traders.

A bounce from the 23.6% extension level can materialize, but that might not push above $2

On the one-hour chart, the move from $2.66 to $1.97 on 9 November was used to plot a set of Fibonacci retracement levels (yellow). The Fibonacci retracement levels have been respected as support on the way down, and each of them was flipped to resistance after the bounce to $2.38 on 10 November.

13 November saw the $2 level retested as resistance. In the past few hours, NEAR sank from $2 to reach the 23.6% extension level at $1.817. The 23.6% and 61.8% extension levels might see a positive reaction from the price, even though the bounces could be brief.

The Relative Strength Index (RSI) was at 22.4 on the hourly chart and showed extreme bearish momentum. Its deep foray into the oversold territory could see a possible bounce, although oversold RSI by itself does not indicate relief was imminent.

Any move above $1.98-$2.01 was unlikely because it was a strong zone of resistance. To the south, $1.63 and $1.55 (50% and 61.8% extension levels) can be targets for bears to take profits at.

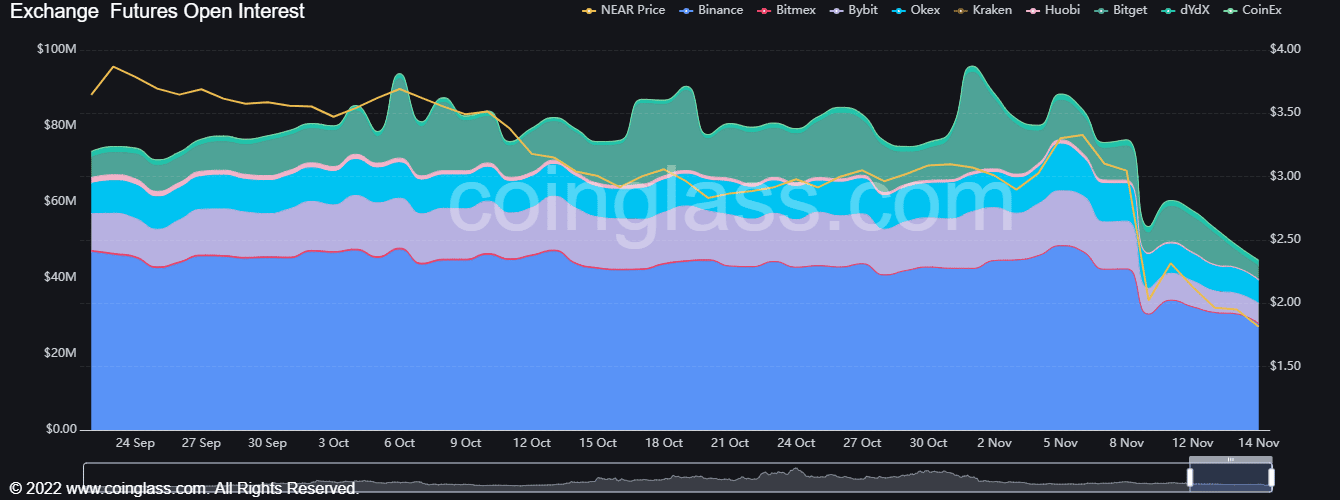

Open Interest in decline as the price plunged from $3.5

Source: Coinglass

The price was in decline since 5 November. At that time, the Open Interest stood at $88.4 million at its peak. Since then, the OI has nearly halved to reach $45 million. Alongside the depression in prices, the drop in OI suggested that long positions were getting severely discouraged. In the meantime, short positions were not building up.

A rise in OI in the coming days would be interesting and can further insight into whether bears remained in strength, or whether a reversal to the upside can be expected. The reaction at the $2 resistance level can also lend clarity.

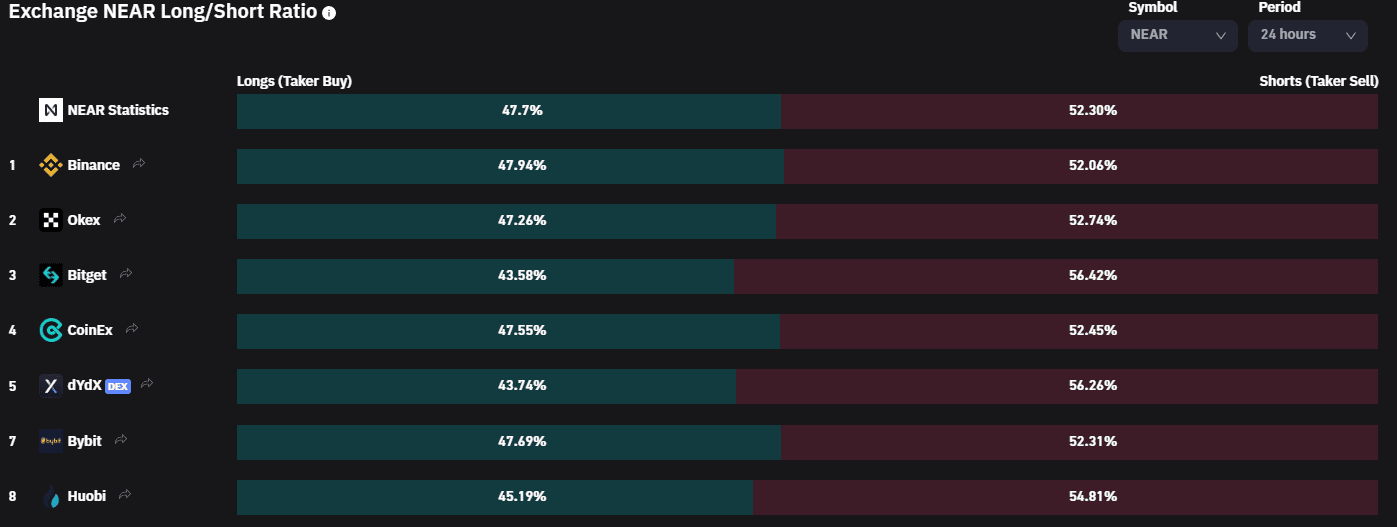

Source: Coinglass

As expected, the past 24 hours have seen futures participants heavily bearishly positioned. However, this could see a large move upward to hunt stop-losses. Therefore, volatility was something to watch out for.

Lower timeframe traders can look to enter short positions near the $1.95-$2 region targeting a move to $1.63 and $1.54. Invalidation would be a session close above $2.02, which would flip the structure to short-term bullish.