Near Protocol sentiment falls after recent surge: Here’s what happened

- The excitement around NEAR decreased as DEX volume and contract deployment fell.

- The token momentum was neutral after leaving an overbought region.

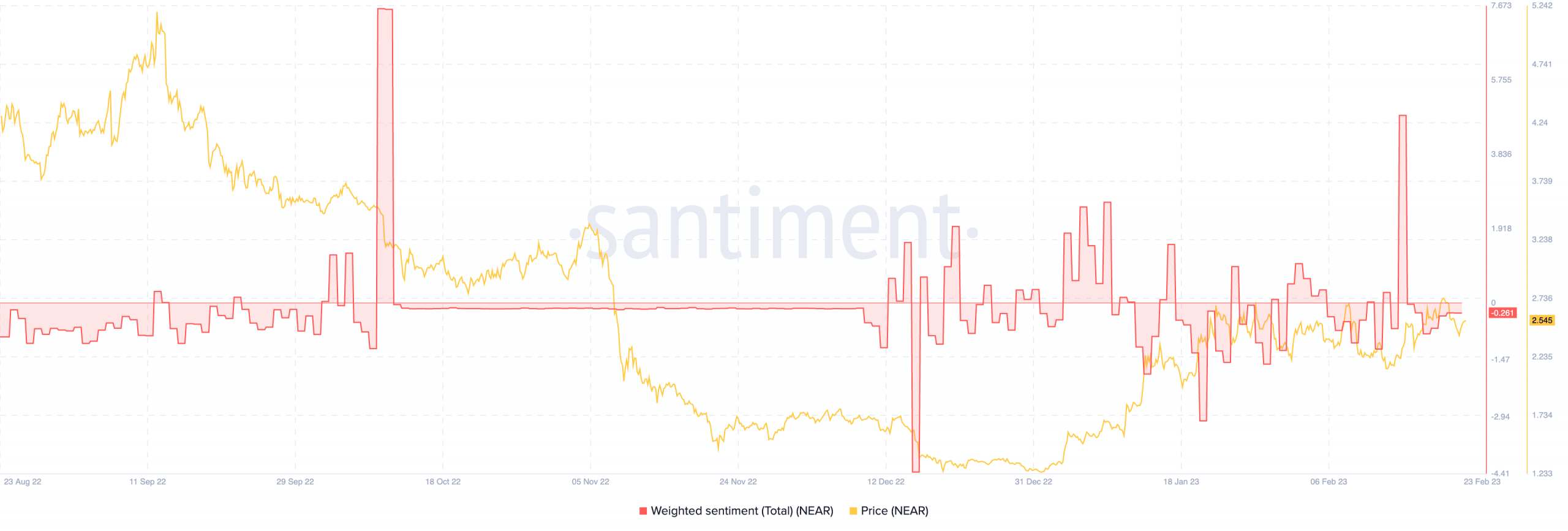

Near Protocol’s [NEAR] investor bias was largely positive as of 15 February, according to Santiment. However, data from the on-chain analytic platform showed that its weighted sentiment had left the above-zero region, settling in at -0.261 at press time.

How much are 1,10,100 NEARs worth today?

Backtracks on the contracts

The weighted sentiment acts as an improved version of the unique social volume and measures the broader perception towards an asset. So, the decline means that investors were no longer excited about NEAR’s short-term prospect. But what else led to the fall?

According to Artemis, Near Protocol enjoyed a hike in unique contract deployment with an all-month high on 30 January. Deploying contracts on a protocol like NEAR implies that several dApps can interact with one another while transactions move smoothly from one smart contract to another.

However, the crypto metrics dashboard showed that the contract deployment had decreased incredibly. Until 13 February, the unique contracts deployed on Near Protocol’s mainnet was 149.

Another notable part of the NEAR ecosystem was its volume of Decentralized Exchanges (DEXs). Artemis revealed that the volume of the token on these exchanges had been static since 20 February. This stationary point aligned with the viewpoint that investors had slowed down the initial euphoria.

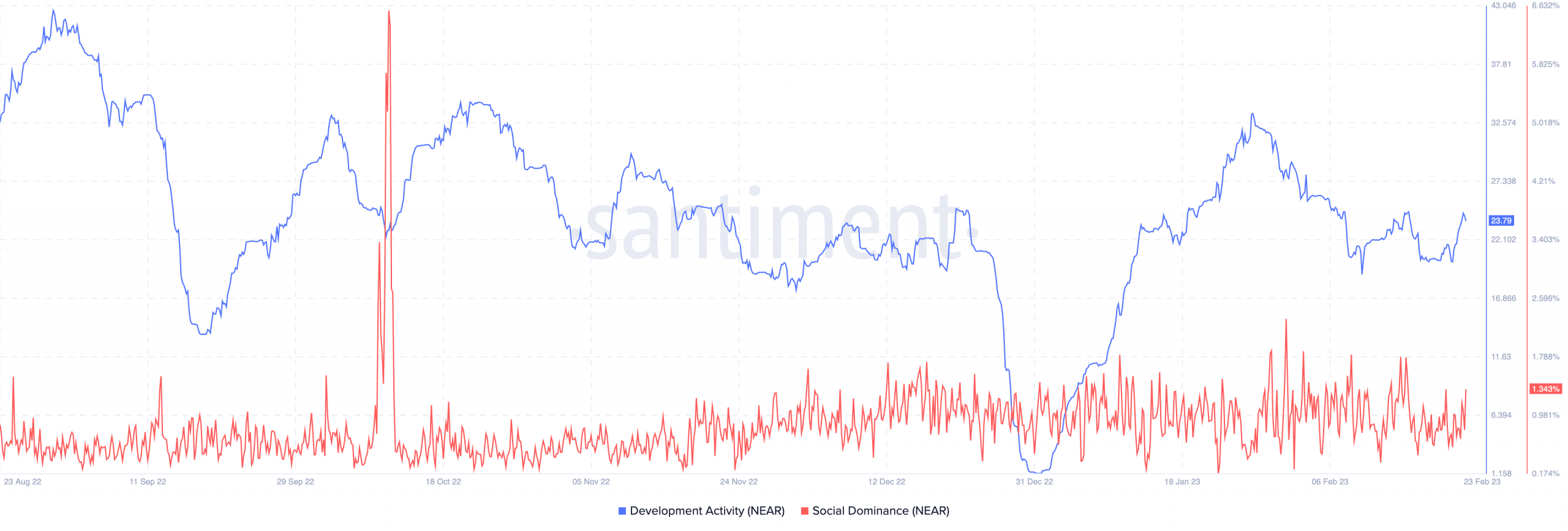

Further on-chain signals pointed to a few bright aspects of the project. At press time, development activity on the NEAR chain had improved to 24.24. The surge in the metric inferred that Near Protocol’s team was active with its public Github repositories.

Similarly, its social dominance, which weighs the share of discussions based on social data and hype, increased. At the time of writing, the metric was at its weekly high of 1.343%.

Expanding volatility on the NEAR side

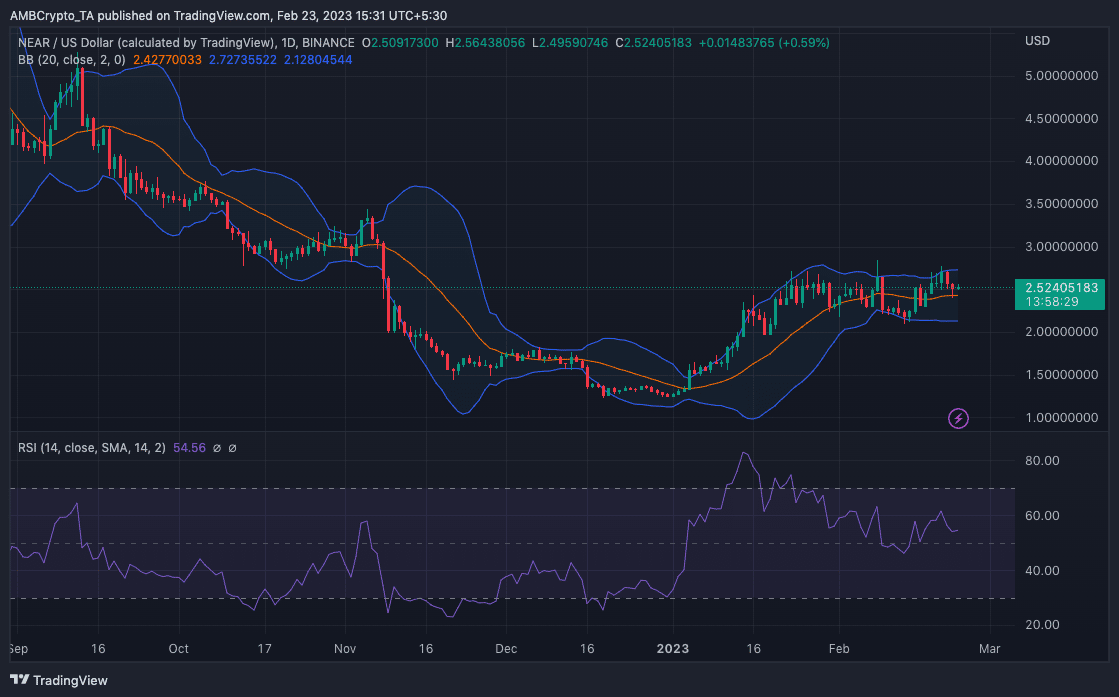

Concerning the price, CoinMarketCap showed that NEAR exchanged hands at $2.52. Interestingly, this was the same value it was 30 days back. But are there hopes for an improvement from this point?

Is your portfolio green? Check out the Near Protocol Profit Calculator

Based on the daily chart, NEAR’s volatility was adjusting to expanding volatility swings. This was revealed by the Bollinger Bands (BB). However, indications from the BB revealed that NEAR had left the overbought region since the price no longer touched the upper band.

On the Relative Strength Index (RSI) part, the momentum was relatively neutral at 54.55. However, a further fall below this zone could trigger a bearish impulse in the short-term.