Near Protocol: The A to Z of NEAR’s ‘May’ month performance

As the month of May ended and blockchain platforms embarked on their monthly housekeeping journeys, the Near Protocol, in a tweet made on 2 June stated that the platform recorded increased traction and growth during the month.

The Protocol indicated that a total of 25, 265,452 transactions were processed in May which represented a 13% uptick from the number recorded two months ago. According to the protocol, a total of 160,086,889 transactions have been processed on the Near Chain since its launch.

Furthermore, according to the post, the network saw a 256.3% spike in the number of new accounts on the platform in May. This put the total number of accounts on the protocol at 13,231,951.

In addition, it was stated that a total of 472, 468,347 of the Chain’s native token, NEAR, has been staked so far. With such growth recorded by the Protocol last month, a look at how its native token, NEAR, performed is pertinent.

Price is NEAR the bottom

Although recording significant growth on its network during the month of May, Near Protocol’s native token did not register such growth in price. Starting the month at an index price of $10.3, the price per NEAR token declined by 48% over the course of 30 days. At the time of writing, the price was pegged at $5.30 with a 2.76% decline in the last 24 hours.

Furthermore, with the month of May marked with a continuous struggle to ward off bears, the Relative Strength Index (RSI) and the Money Flow Index (MFI) for the NEAR token set up tents beneath the 50 neutral region. Furthermore, increased selling pressure was recorded during the entire month, consequently, the price of the NEAR token struggled. At press time, the RSI stood at 36. The MFI on the other hand stood at 40.

The bearish movements that plagued the token during the month of May were also indicated with the red MACD bars. However, on 22 May, the MACD line intersected with the trend line on an upward curve. With price down, this indicates that the market is currently oversold and therefore a correction is likely.

In addition, within the period under review, the market capitalization of the NEAR token recorded some lows. At $6.97b at the beginning of the month, the token saw a 46% decline in its market cap over the course of 30 days.

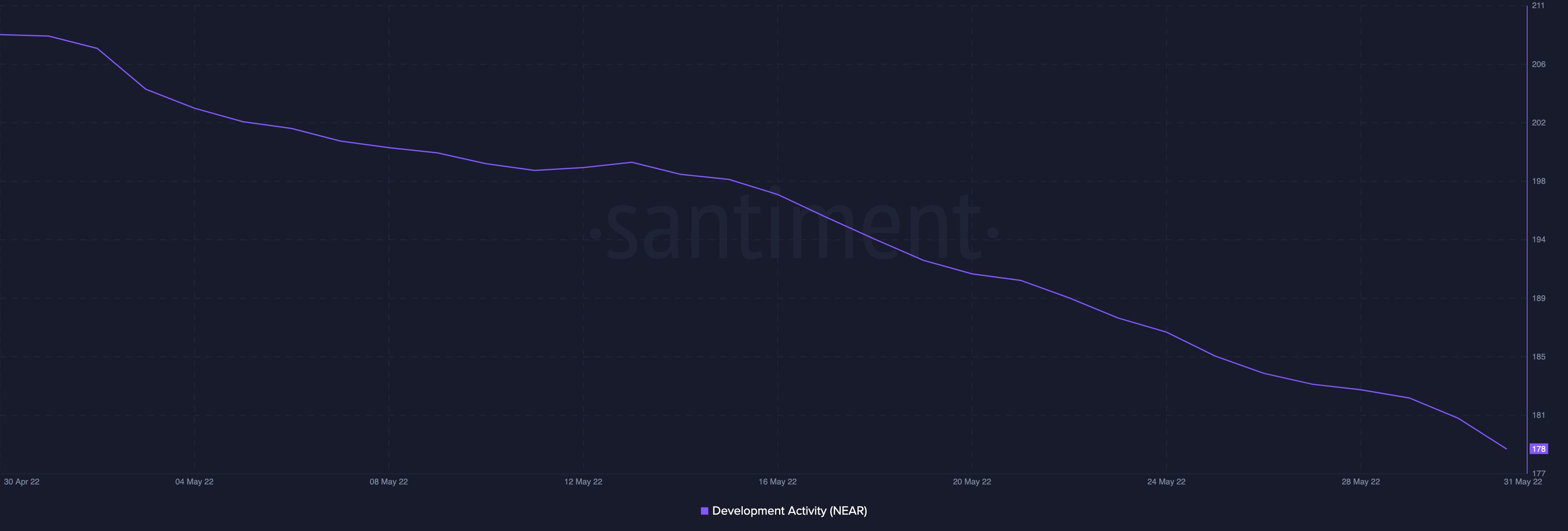

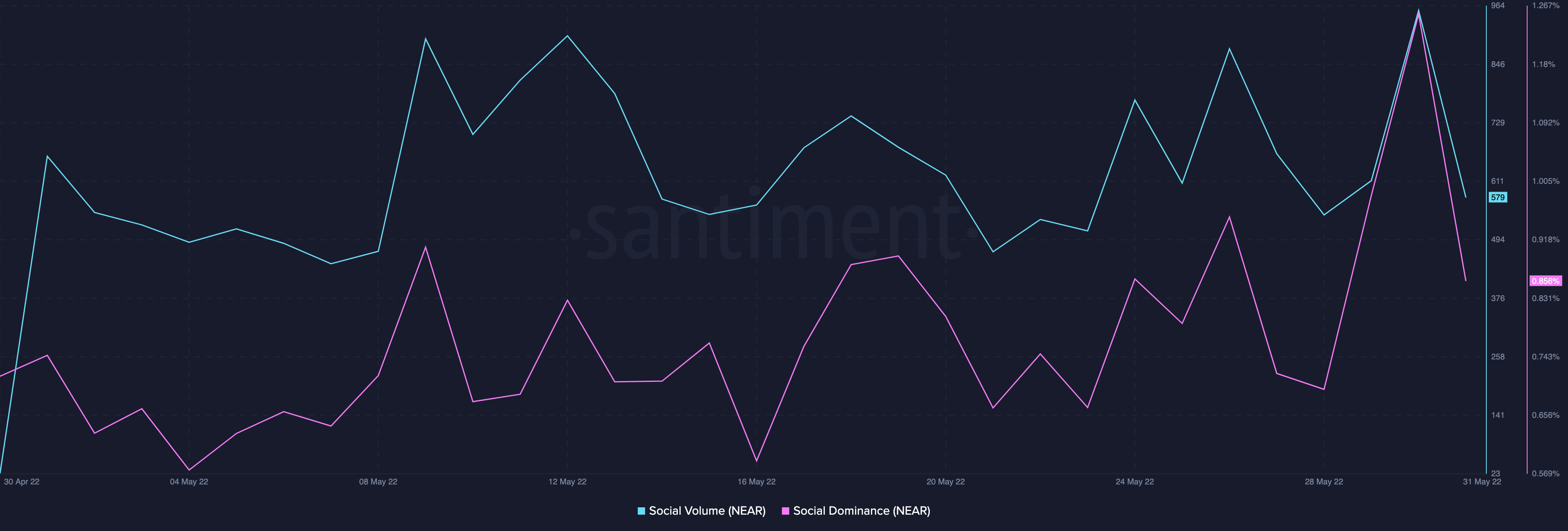

Developmental and social activity

Interestingly, despite its many achievements last month, the developmental activity for the NEAR token went on a steady decline. Marking the first day of the month with an index of 208, the development activity went on to record a 14% decline over the 30-day period. At press time, this was pegged at 178.

On a social front, the social dominance for the token took on a gradual uptrend. This led it to mark a high of 1.25% on 30 May. A reversal, however, occurred that pushed this down to 0.856% at press time. The social volume also marked a high of 955 on 30 May, a 33% spike from the 662 it registered on 1 May.