NEAR set for 23% gain if THIS key resistance breaks

- Should the bullish market sentiment persist, NEAR could achieve an additional gain of 23.15% in the days ahead.

- However, a significant hurdle looms at the 5.526 resistance level, where substantial selling pressure has previously been observed.

Near Protocol [NEAR] has already seen impressive weekly gains, amassing a 34.5% increase, with a 12% surge in the last 24 hours alone, as reported by CoinMarketCap.

Despite a recent slowdown in momentum, AMBCrypto analysis predicts this is only temporary and an upswing is around the corner.

NEAR’s rally eyes $6.4 as momentum builds

NEAR’s recent upward trajectory is largely due to its rebound from a major resistance-turned-support zone at $4.366, which propelled its growth.

Despite encountering a new hurdle with a resistance line at $5.256—a minor level marked by a low selling pressure—NEAR is positioned within an overall symmetric triangle pattern.

Historically, this pattern indicates that NEAR could ascend to a high of $6.489. At this peak, substantial profit-taking could occur driving prices down or potentially witnessing increased liquidity which will further drive NEAR’s price to $7.6.

To assess whether the $5.256 resistance is indeed minor, AMBCrypto has analyzed the latest technical charts.

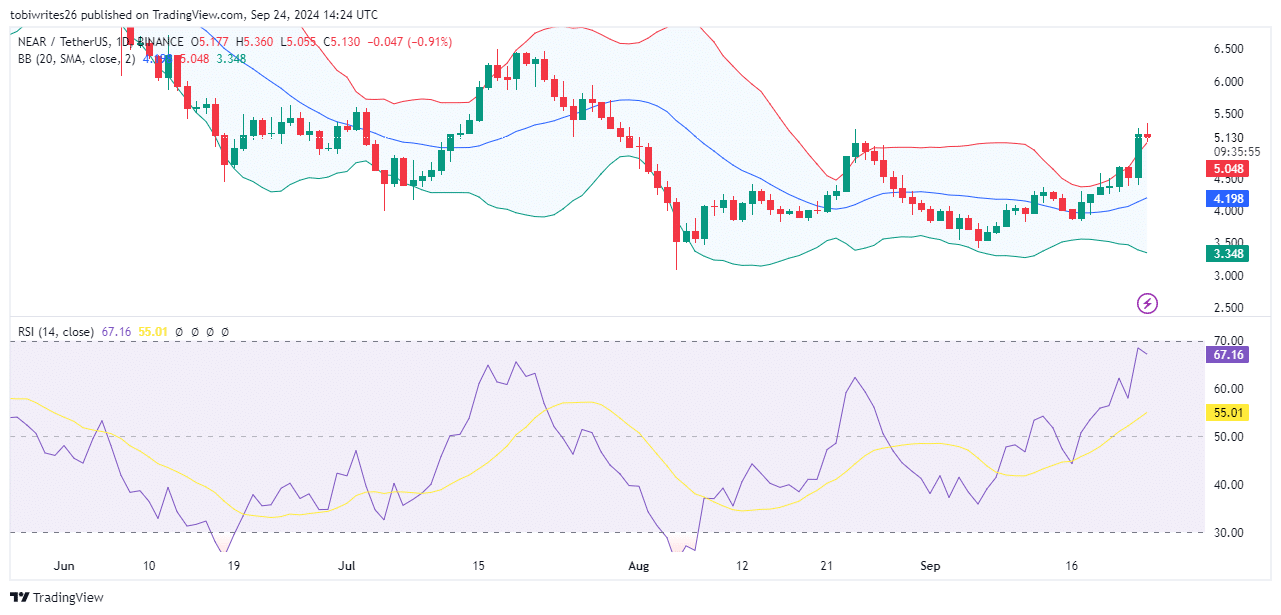

Technical indicators suggest NEAR is set for volatility

The Relative Strength Index (RSI), which measures the velocity and magnitude of price movements, indicates a strong bullish sentiment for NEAR with a current reading of 68.5.

Although an RSI above 70 typically signals an overbought market meaning a potential pullback is on the horizon, NEAR’s present level indicates ongoing accumulation and a continued upward trend in the coming days.

Conversely, the Bollinger Bands (BB) have moved above the upper threshold which shows that the price is currently in the overbought zone. This condition aligns with NEAR crossing the resistance line, which traditionally precedes a price correction.

While these indicators suggest a possible near-term decline, there is still potential for NEAR to climb higher before any downward adjustment. The probability remains uncertain.

Overall, the technical outlook suggests that NEAR may breach the resistance level at 5.256, further validating the bullish trend.

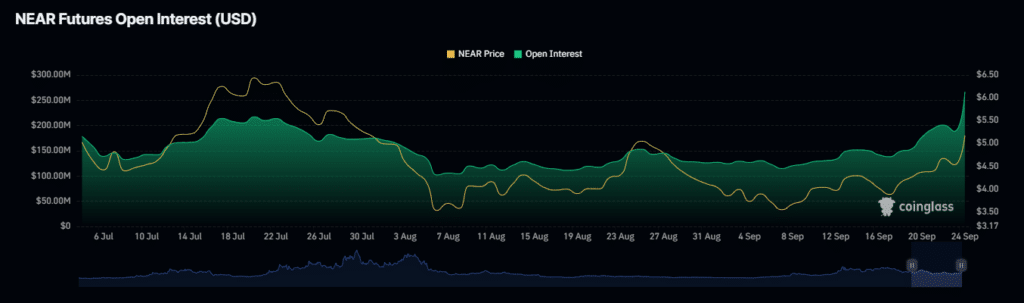

Open interest indicates a continued rally for NEAR

AMBCrypto’s analysis using Open Interest (OI) suggests that NEAR is still well-positioned for a rally, with expectations for the price to reach higher levels.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

Data from Coinglass reveals an 18% increase in NEAR’s open interest, soaring to $266.84 million from a previous low of $188.54 million. This surge reflects the strength of the market engagement and bullish sentiment.

Should this upward trend in open interest continue, NEAR’s trajectory is likely to ascend even further.