NEAR surges 11%, but is a decline impending?

- NEAR recorded intraday growth following the announcement of a new partnership.

- While the token traded at overbought highs, the bulls remained in control of the market.

The native token of the layer 1 Near Protocol [NEAR] recorded an intraday price rally of 11% on 1 November following the announcement of a partnership with Nym Technologies.

Read NEAR Protocol’s [NEAR] Price Prediction 2023-24

According to the announcement blog post, the partnership will see the integration of the Nym mixnet into the Near ecosystem. Through this integration, Near seeks to ensure the privacy and security of developers, operators, and users within its ecosystem.

While NEAR has since shed most of these gains, its price was still up by 9% in the past 24 hours, data from CoinMarketCap showed.

Price decline is imminent

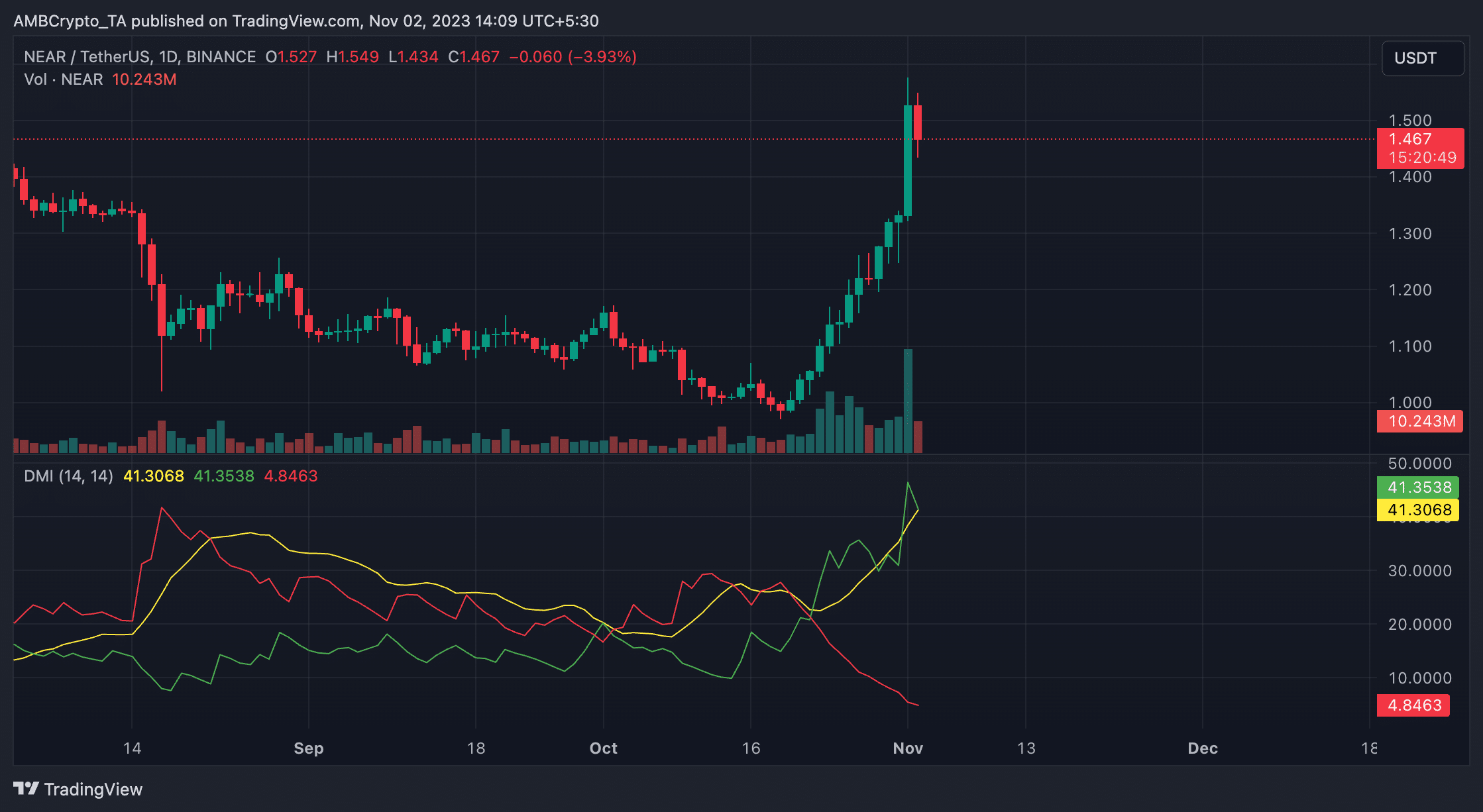

At press time, NEAR exchanged hands at $1.46, its highest price level since 3 June. In the last week, the token’s value has climbed by almost 25%. However, readings from its price action on a daily chart suggested that the altcoin might be due for a price correction.

Firstly, the token’s price trades above the upper band of its Bollinger Bands indicator. Typically, when an asset’s price rests above the upper band of this indicator, the market is considered overbought. Price reversals and corrections are common at these levels.

Also, key momentum indicators rested at overbought highs at press time. NEAR’s Money Flow Index (MFI) was 100, while its Relative Strength Index (RSI) was 78.73. An MFI value of 100 suggests extreme buying pressure, while an RSI above 70 suggests a strong upward momentum.

Buyers’ exhaustion sets in at these highs, as the bulls find it challenging to initiate any further price growth. At these levels, most market participants are only interested in taking profit; hence, token distribution is common.

The bulls might not be easily displaced

While NEAR’s key momentum suggested that the alt was overbought at press time, other indicators confirmed that the bulls remained in control of the spot market.

How much are 1,10,100 NEARs worth today?

According to the token’s Directional Movement Index (DMI), the bulls’ strength (green) at 41.35 rested above that of the bears (red) at 4.84.

Also, the Average Directional Index (yellow) rested at 41.30. An ADX reading of 41.30 is considered relatively high, suggesting that there was a strong trend in the market at the time of writing.